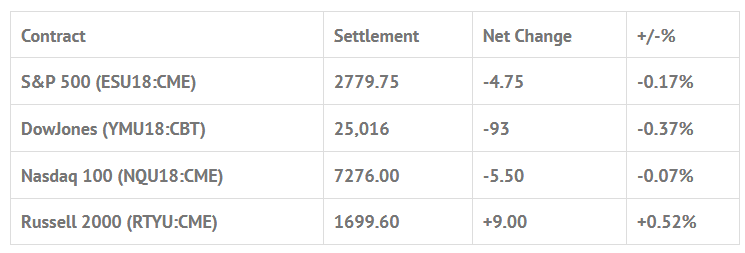

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed lower: Shanghai Comp -3.82%, Hang Seng -2.78%, Nikkei -1.77%

- In Europe 13 out of 13 markets are trading lower: CAC -1.32%, DAX -1.53%, FTSE -0.61%

- Fair Value: S&P +3.76, NASDAQ +25.98, Dow +10.41

- Total Volume: 993k ESU & 579 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the U.S. housing starts for May, out at 8:30 a.m. ET, and Redbook at 8:55 a.m. ET.

S&P 500 Futures: Are You Surprised The S&P Sold Off? You Shouldn’t Be

The S&P 500 futures that had seen weakness Sunday night, falling down to 2763.50, 21 handles lower from Friday’s close, opened the 8:30 regular session at 2766.50, down -18 handles, with just under 200k contracts traded. The futures immediately started to selloff down to a session low of 2761.25 in the opening minutes, pushing the benchmark index futures down -22.75 handles on the day.

After finding the early low was in the attention turned to upside buy stops that were building, and after the ESU printed 2769.00 before 9:00, it traded sideways until 9:30. Buy programs helped attack the buy stops as the ES rolled up to 2778.00 for the morning high just after 10:00 am. The late morning saw a grind lower into the euro close that continued into the early afternoon. The ES printed 2770.50 for the afternoon low before rallying back up to 2777.00 for the afternoon lower high.

The final part of the trading day saw the MiM open up to the buy side as the ES traveled up to the high of day at 2778.00, but as the MiM flipped to the sell side, the ES rally tapered off. The last hour saw the MiM going nowhere as the MOC came in at $100 million to sell. The ES printed a new high late in the session as buy programs came in at 2:45 pushing the ES up to a new high of day at 2780.00. On the 3:00 cash close the ES printed 2777.75 before settling the day at 2779.75, down -3.75 handles, or -0.17%, just a tick off the high of day, and 18 handles off the low of day.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.