As U.S. warships rained Tomahawk missiles onto a Syrian airbase Thursday night, currency traders began positioning themselves for safety.

It was not, however, the dollar that benefited. It was the yen.

It’s an odd turnabout. The yen, after all, represents the economy with the world’s greatest debt burden (in terms of debt to GDP). The yen, as well, is the sacrificial lamb in Japanese government’s plan to revitalize a long-moribund economy by continually printing currency.

And yet, the moment that global troubles bubble up, the world’s currency traders reflexively rush into the yen.

The question is why?

The answer to that question is tied why we believe that well diversified investors should have exposure to yen in the current environment – and by “current” we don’t just mean with missiles falling on Syria. We mean in the current global environment that has 1) the U.S. struggling under a new presidential administration that has yet to find any cohesion, and which has thrown out some challenging ideas related to global trade; 2) Europe still facing the after-effects of the Greek debt crisis and the additional burden of a migrant crisis that could spark hostilities; 3) North Korea rattling sabers and the possibility that President Trumps reacts aggressively; and 4) China trying to redefine its zone of influence in the Asia-Pacific region and the reactions that it stirs up.

In addition, there remains the possibility that the global financial crisis of a decade ago has not fully run its course. Central bankers across the West threw gobs of money at the crisis through Quantitative Easing programs and other campaigns to inject capital into the global economy. This strategy worked to reflate paper-asset prices and save a few large banks, but it did not vanquish the systemic disease – namely, the vast accumulation of debt in the West that has grown larger in the last decade and which could seriously hurt the globally economy.

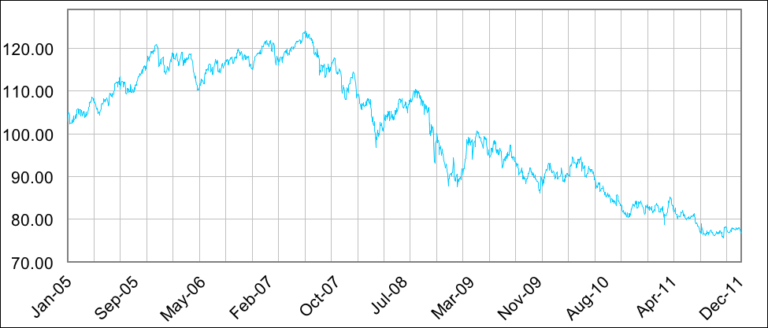

If an upset of some sort spreads fear through the global economy, the truly safe haven will be the Japanese yen – as it was during the global crisis, when it was the one notable asset to rise in value against the dollar as everything else crumbled. As this chart shows, the buck lost more than 47% against the yen from summer of 2007 (just before the crisis began) to early 2012. Or, another way to view this is that the yen gained more than 60% on the dollar.

The Dollar’s Slide Against the Yen

So Why the Yen: 2 Primary Reasons

Reason #1: Along with being the world’s most indebted nation, Japan, as a country reliant on exports, also holds title as the world’s largest creditor nation. The implication is that a lot of yen is floating around outside of Japan.

When a crisis erupts, the Japanese repatriate that money – they bring it back home. In that process, they’re selling assets in other currencies to buy yen. And at that point it’s a supply/demand issue. The supply of others currencies is rising as the Japanese pull out (those currencies fall in value) and demand for yen rises as the Japanese bring their money back home (the yen rises in value).

Reason #2: Japan offers some of the lowest interest rates in the world … -0.1%.

Because of that, the Japanese export their money overseas as part of the “carry trade.” They sell the yen (increased supply, downward prices) to buy other currencies with higher yields. In that process, they capture the spread between low yen yields and higher yields in currencies such as the U.S. dollar, as well as the Aussie and Kiwi dollars.

But, again, when crisis erupts, the Japanese (and other currency traders around the world playing the carry trade) close their positions and return to the yen … which gets back to supply and demand.

This is the reason the yen benefited from the bombing of Syria. Yet, the impact won’t be long-lived, most likely, because the Syrian issue will be fleeting. But the episode serves as evidence that the yen may well be a safe haven for diversified investors.

Grey swans have taken flight. If one lands, the yen may be a winner.

In Wealth & Prosperity,