Gold and silver hit fresh record prices on rate-cut hopes, geopolitics

The relentless, multi-year rally in the shares of Microsoft (NASDAQ:MSFT) continues to defy even the most bullish forecasters.

In 2021 alone, the software giant gained almost 55%, almost double the expansion of the benchmark NASDAQ 100 Index. MSFT also made history when it hit a market value of $2 trillion during the past summer, becoming the second US publicly-traded company to reach that milestone after Apple (NASDAQ:AAPL).

Microsoft’s cloud-computing business has been the major factor behind the stock’s 441% advance in the past five years—a period in which its CEO, Satya Nadella, branched out into new growth areas, mainly focusing on the cloud computing arena.

This unprecedented streak of gains, according to many analysts, has more room to run, making Microsoft one of the top picks from the elite group of mega-cap technology stocks in 2022. One of the major factors behind this optimism is the industry-wide transition toward cloud computing that has only just started.

Microsoft’s Azure unit, which rents computing power to startups and larger businesses, is in a position to thrive for years to come. According to Wedbush Securities, global cloud-services spending will approach $1 trillion over the next decade as businesses spend more on cloud computing.

A Unique Advantage

According to a recent report in Bloomberg, Microsoft has a unique advantage with which to attract more customers looking to transition into the cloud. Unlike its cloud competitors, MSFT sells traditional PC software and operating systems, and can provide better integration with its products, the report notes.

The report cited a Morgan Stanley survey of chief information officers that showed Microsoft would gain the biggest share of technology budgets over the next three years—above all other technology companies including Amazon (NASDAQ:AMZN).

These advantages should help Microsoft to continue to generate massive amounts of earnings and cash in the years ahead.

Source: InvestingPro

Based on InvestingPro analytics, Microsoft is expected to produce a 25% upside in EPS growth this quarter, a trend that's likely to continue into 2022.

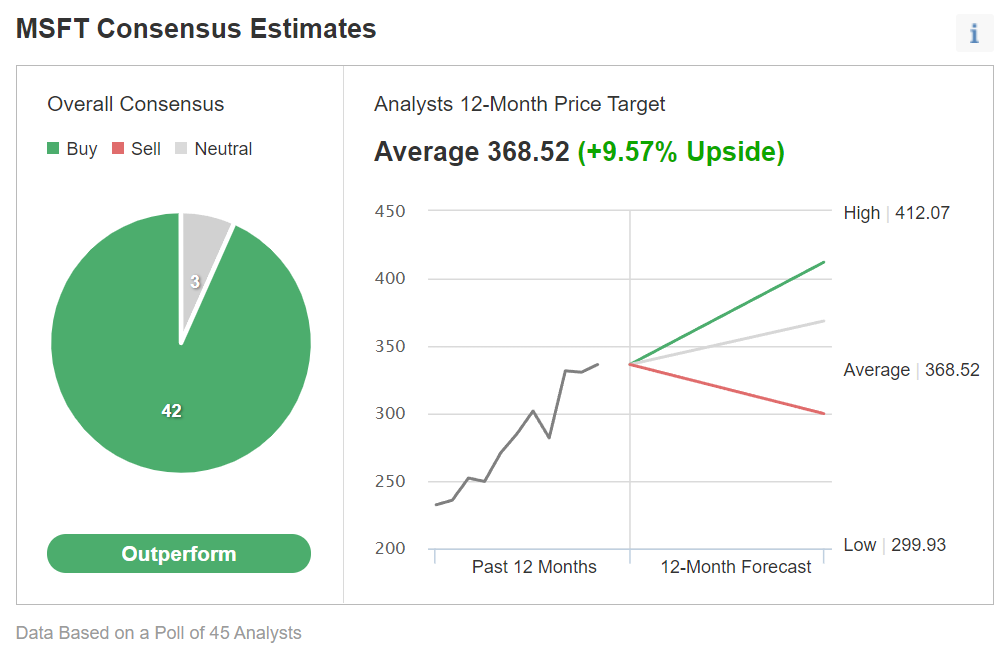

As well, among 45 analysts surveyed by Investing.com, an overwhelming percentage of those polled rated MSFT as 'Outperform."

Chart: Investing.com

The average 12 month upside target was $368.52, a gain of 9.57% from the stock's closing price on Friday of $336.32, with additional targets ranging from a low of $299.93 to a high of $412.07.

Credit Suisse, while setting a price target of $400 per share for the stock, said in a recent note that a big driver for Microsoft going forward will be Azure, which will continue to narrow the gap between MSFT and AMZN's Amazon Web Services, the leader in the cloud business commanding the largest market share. Its note added:

“For at least the next five years, we forecast Microsoft to deliver (1) mid-to-high teens revenue growth ... and (2) high-teens to +20% EPS and FCFPS growth—driven by scale (even with accelerating investments) and ongoing share repurchases. We believe these levels of sustained growth and profitability are still not properly reflected in consensus estimates or valuation.”

During his tenure, Nadella also diversified Microsoft's revenue stream by spending more than $45 billion on acquiring companies, including business social network LinkedIn, video game developers Mojang and ZeniMax, and the code-storage service GitHub.

The pandemic, too, has further accelerated MSFT growth. Millions of workers and students stuck at home have been using the company’s meeting software Teams to remain in touch and connected. As well, large corporate clients accelerated their shift to the cloud, while younger customers bought Xbox gaming subscriptions.

Highlighting these catalysts, Wells Fargo said in a recent note to clients:

“Even after having become one of the largest companies on the planet ... we still see a bright future ahead for Microsoft, driven by continued growth prospects in huge categories of IT spend ... ability to further monetize strong positioning in multiple end markets ... and a financial profile that continues to exhibit durable growth and margin expansion.”

Bottom Line

Microsoft continues to expand its market share into new areas of the digital economy, like cloud computing and artificial intelligence, while maintaining its leading position with legacy software products such as Windows and Office.

This durable advantage will help the company achieve sustained double-digit growth in revenue, earnings per share and free cash flow, making it one of the safest bets among the group of mega-cap stocks in 2022.