Halliburton Company (NYSE:HAL) has years of experience in providing products and services related to exploration, well construction, completion, production, and abandonment of an oilfield. With headquarters in Houston, this oil & gas service provider stands well-positioned to benefit from the strengthening demand and prices of oil and natural gas in the United States, making the stock an attractive investment option for long-term investors.

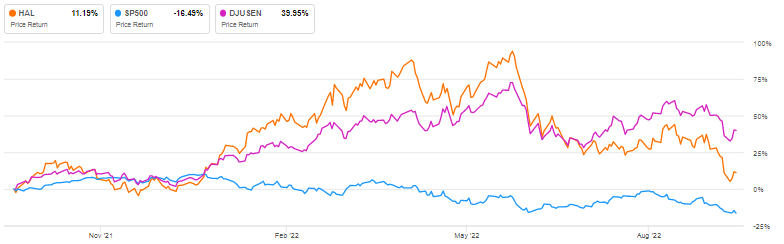

Shares of this $22.4-billion company have increased 11.2% in the past year. The Dow Jones Oil & Gas index grew 40% in the past year, depicting the strong momentum in the industry fueled by high demand and restricted supply. However, the S&P 500 decreased 16.5% in the past year.

Solid Industry Prospects A Boon For Halliburton

According to the U.S. Energy Information Administration (EIA), WTI crude oil increased 74.1% year-over-year in 2021 and is expected to grow 43.8% in 2022. Likewise, natural gas advanced by 14% in 2021 and is forecast to expand by 25.5% in 2022.

Also, the federal agency anticipates an average annual increase of 3.1% and 1.8% in WTI crude oil and natural gas prices, respectively, from 2021 to 2050. It also predicts a 0.4% increase in petroleum, other liquids, and natural gas consumption during this time.

High demand and prices are a great incentive for oil and natural gas companies to expand their production capabilities, requiring full support from oilfield service providers.

Diversity And Lower Capital Intensity Underpins Halliburton’s Success

A well-diversified business structure raises Halliburton’s investment appeal. Exiting 2021, the company operated in at least 70 countries and had a talented workforce of more than 40,000 globally. Of its total revenue, roughly 60% was generated outside the United States in 2021. Interestingly, the company has taken multiple initiatives to expand its international footprint.

In September 2022, Halliburton and the Saudi Data and Artificial Intelligence Authority decided to make applications and solutions for use in the energy sector. In May 2022, the company and Aker BP (OL:AKRBP) joined hands to make planning software for next-generation field development.

Notably, Akber BP is an oil and gas exploration and production company based in Norway. In March, the company opened the Halliburton Chemical Reaction Plant in Saudi Arabia. This chemical manufacturing plant would serve the region's oil & gas, refineries, industrial, and petrochemical industries.

In July 2022, Halliburton’s Chairman, President, and CEO, Jeff Miller, opined that the company’s “international markets will experience multiple years of growth” on the back of “a leading technology portfolio, the right geographic presence, and new service line opportunities.”

Also, the company provides various products and services, including iCruise, EarthStar, FlexRite, specialty chemicals, and artificial lifts. Solid demand for these offerings is beneficial for Halliburton. Its contract wins, too, have been advantageous.

In March 2022, the company was selected to study the carbon storage potential in the Greece-based Prinos basin. Also, it was selected to provide a cloud solution, iEnergy Stack, to Petrobel in the same month.

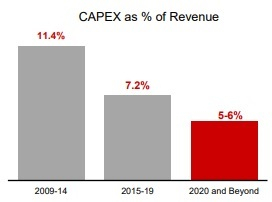

Also, using its technological expertise, new materials, and equipment designs, Halliburton has significantly lowered its capital intensity over the years. A chart depicting the same is provided below.

Halliburton’s Top-Line Trends

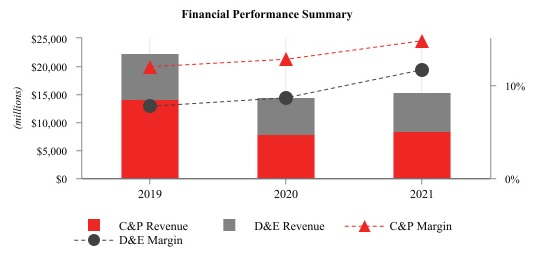

The company generates revenues under two segments — Completion and Production (C&P) and Drilling and Evaluation (D&E). The financial performance of these segments is shown in the chart below.

In the first half of 2022, revenues of Halliburton’s C&P segment increased 34.4% year-over-year to $5,264 million. This segment represented 56.3% of the company’s revenues in the first half of 2022. The D&E revenues of $4,094 million increased 26.4% from the year-ago tally and represented 43.7% of the company’s first-half revenues.

The consensus revenue estimate is anticipated to be $5.34 billion for the third quarter of 2022, while it is expected to be $20.26 billion for 2022 and $23.28 billion for 2023.

Halliburton’s Bottom-Line Strength

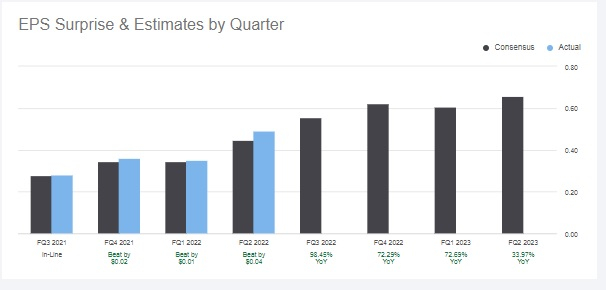

Halliburton’s adjusted earnings increased 40% year-over-year to $0.49 per share in the second quarter of 2022. The bottom line surpassed the consensus estimate of $0.45 per share by 8.9%. A chart showing the company’s earnings performance over the past few quarters is given below.

The consensus estimate for Halliburton’s adjusted earnings is $0.56 per share for the third quarter of 2022, $2.01 per share for 2022, and $2.79 per share for 2023. In the next 3 to 5 years, the company’s earnings are predicted to grow by 51.15% (CAGR).

Concluding Remarks

Halliburton has all the ingredients that could be of interest to long-term investors seeking exposure to the oil & gas industry of the United States.

Despite its high valuation (forward P/E of 12.28 versus the sector median of 6.58), its solid growth opportunities and shareholders-friendly policies (dividend payments grew 171.3% year-over-year in the first half of 2022) is appealing.