In my last investment post I applied the key concepts to a range of investment ideas. If you missed it, take a look. We have been on target so far with what to avoid.

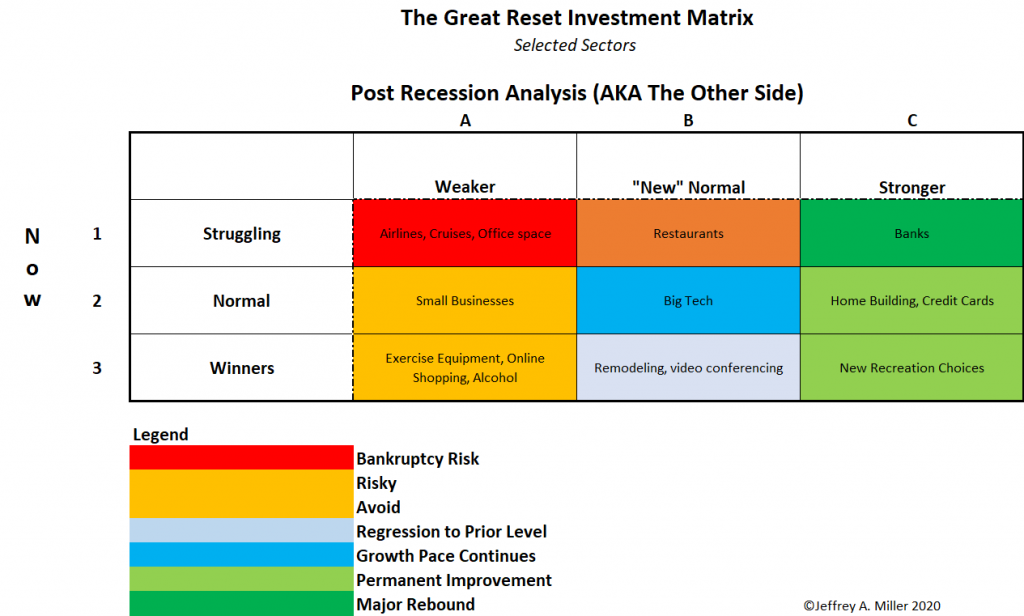

For now, and for as long as the pandemic weighs on the market, that is the necessary context for each stock idea. To provide a starting point, I created The Great Reset Matrix. Helped by readers' suggestions, I have made some improvements.

The Matrix is a conceptual guide, which I use in evaluating every new stock idea. The current version draws upon results from the Great Reset Project, where readers have joined in to help with my Wisdom of Crowds approach. The results may seem like common sense. Good! Comments from industry experts and analysts are often quite different. This is one way we will find edge. You can see past research or become a part of the project without for free. I will continue to disseminate results in posts like this one, and you can help.

Today’s matrix version looks at sectors, not individual stocks. Many sectors are not yet listed. You may disagree with the placement of others. If so, the matrix is doing its job – encouraging us to think about what is most important.

This Week’s Ideas

Each idea I include comes from a respected source. I frequently cite them and often use their ideas. What am I bringing to the party? I am including some comments about each idea and how I might use it in client portfolios. I also assign a matrix classification. Please join me in a discussion of the classification as well as contributing to other ideas. I hope that authors will soon include some of the matrix thinking in their work. That is starting to happen, although no one is giving any credit as yet. Many are writing about the “other side” but with no real analysis about how long it will take. Here are some examples.

In Stocks That Could Thrive in a Post-Pandemic World author Conrad de Aenlle explores ideas from several prominent managers. These emphasize companies that are doing well right now – catering to stay at home and do it yourself. His first source is Nathan Brown, co-manager of the Ivy Midcap Income Opportunities fund.

Companies that he expects to benefit include Tractor Supply (NASDAQ:TSCO), RPM International (NYSE:RPM), Trex and ScottsMiracle-Gro. These stocks and all the others Mr. Brown mentioned are held in Ivy portfolios.

He warned, though, that this trend may ebb sometime next year as companies like these “lose wallet share as other areas open for spending, and individuals spend less time at home.”

[Jeff] It Is easy to find stocks that are currently doing well. The challenge is figuring out if they can maintain the success. These are all 3A or 3B ideas.

Next, he turns to David Eiswert, lead manager of the T. Rowe Price Global Stock fund. He sees a “digital transformation portfolio” that includes some current winners like Netflix (NASDAQ:NFLX) and Amazon (NASDAQ:AMZN). Other ideas mentioned are Shopify (NYSE:SHOP), Square, and Trainline. He is also high on tests for pets.

Humans may continue avoiding others of our species, but many people have been getting quite cozy with four-legged creatures. Mr. Eiswert noted that animal shelters have been emptied by people looking for companionship.

“Those pets are going to live for 10 or 15 years, and they’ll need medicines and diagnostic tests,” he said.

Two companies in his fund that produce them are Idexx Laboratories (NASDAQ:IDXX) and Zoetis (NYSE:ZTS).

[Jeff] This is closer to our target. The ideas are still current winners, but there is a cogent argument for continued success. My tentative placement is 3B for all of these.

Another source emphasizes the lasting changes at conventional workplaces, despite increased work-from-home. Sarah Ketterer, chief executive of Causeway Capital Management has ideas about global supply chain failure leading to a demand for supplies from closer to home.

That, in turn, will raise demand for equipment, tools and gizmos that help bring about industrial automation.

“We expect that manufacturers globally will demand the best smart assets on a factory floor, such as robots, sensors and monitors,” she said. The German conglomerate Siemens “has what it takes to dominate automation in the next cycle,” in her view, because it has superior hardware and the software that makes it go. “No one U.S. competitor has that set of capabilities,” she added.

After the pandemic, just as during it, businesses will prize access to capital, something that tends to be in short supply during tough times. Bank stocks could show strength, she said, especially if the banks’ balance sheets are strong.

One winner could be the ING Group (NYSE:ING), a Dutch company whose stock recently was cheaper than it was during the global financial crisis, despite having three times the capital it had then, Ms. Ketterer noted.

[Jeff] This is what we seek. These are ideas for solid companies that we can expect to be even stronger post-recession. 2C is my provisional rating, and that is a good cell to include in our shopping list.

Peleton Interactive is a big pandemic success story, making it a key example for Row C. It is an expensive alternative to the fitness center. (Barron’s).

Peloton’s bike starts at $2,245, while its treadmill, Tread, begins at $4,295. A rower “over time, could be interesting,” Woodworth said, though that market is smaller than the bike’s, and “much, much smaller than Tread and bootcamp.”

Peloton (NASDAQ:PTON) generates subscription revenue from an app, which costs $12.99 a month, and its $39 monthly membership. Is there a risk the app could draw users from membership? The app, she said, was originally intended as a companion for traveling members, but gained traction after Peloton released the Tread and expanded digital offerings.

[Jeff] This is an interesting idea to follow, but there is no need to rush. There is no reason to guess about the needed change in the business model. Many investors are making the mistake of looking backward and buying because of the recent success.

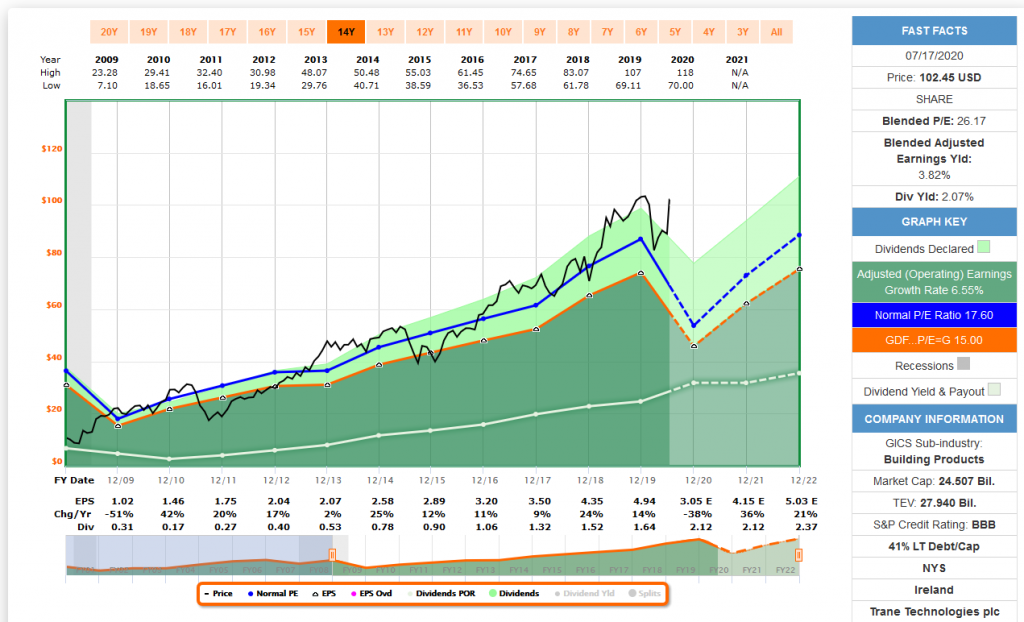

Barron’s mid-year roundtable is usually a good source of ideas. This year most of the panelists seem rooted in the current market without much vision or concern for valuations. Abby Joseph Cohen, for example, likes HVAC company Trane Technologies (NYSE:TT). This concept is supported by an emphasis on improved filtration and climate change. Here is the problem:

[Jeff] The stock seems to be ahead of the expected growth – way ahead! This might be a stock for cell 3B.

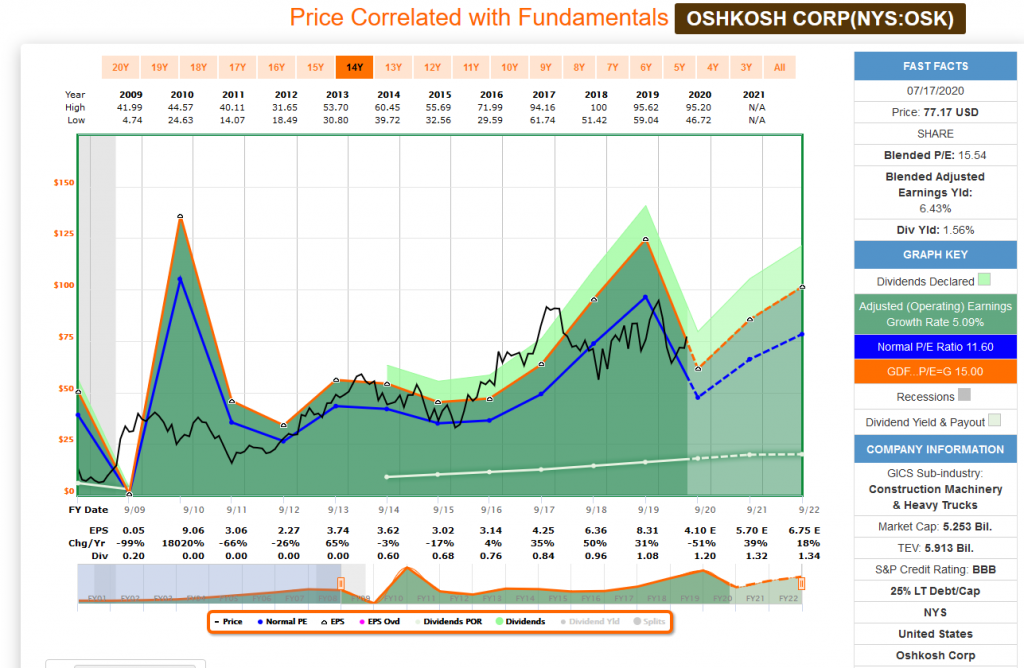

Her choice of Oshkosh (NYSE:OSK) is a cyclical company with a good business, including 25% defense and specialized construction. The valuation chart is typical of many that I am seeing.

[Jeff] This is a good stock for the watch list, but it depends on the rebound in activity and earnings expectations. It looks like cell 1C or maybe 2C.

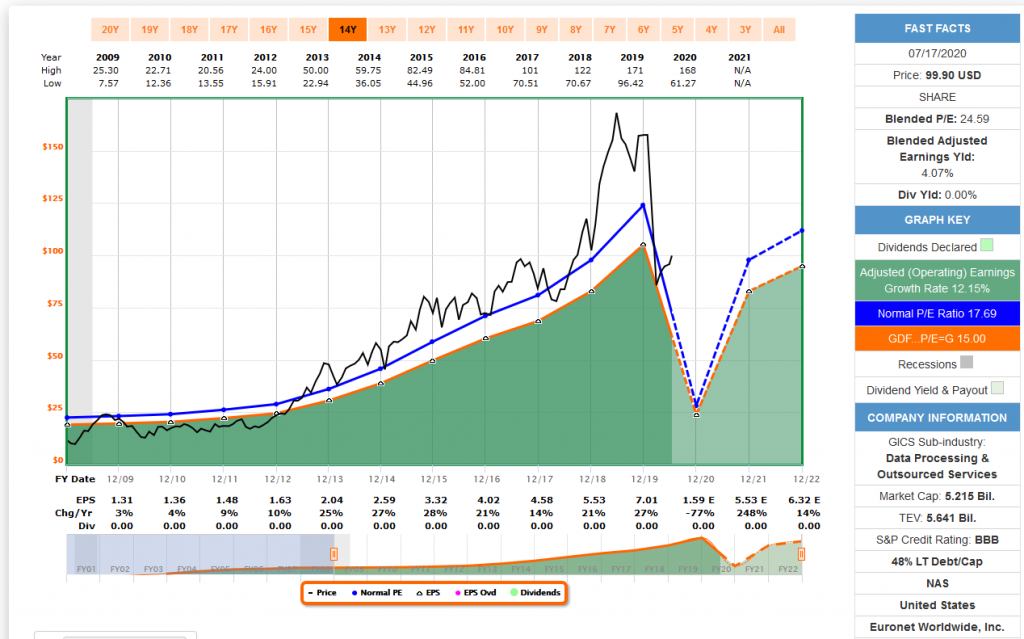

Meryl Witmer has a good story for Euronet Worldwide (NASDAQ:EEFT).

It is trading at about $100 a share, down from a high of $171. Euronet is a financial-payments technology company operating in three segments. Electronic Fund Transfer is an ATM business outside the U.S.; a recent U.S. acquisition, epay, provides mobile and digital payment cards; and the Money Transfer segment competes with Western Union (NYSE:WU) [WU] and MoneyGram International [MGI]. If you don’t think travel and tourism are coming back, this isn’t the stock for you. Euronet’s ATMs are located predominantly in eastern and southern Europe, with an emphasis on tourist attractions. We think travel and tourism will be back on a pretty good track within two years, and possibly within a year.

Euronet has a strong balance sheet, with $1.2 billion of cash. We are comfortable with its staying power and expect it to benefit as some competitors go out of business, allowing the company to garner more and better locations.

[Jeff] The FASTGraph chart fits the story. It is an example of cell 1B. Do not be trapped by looking at the past high as a rebound target.

The contribution of Rupal J. Bhansali made a lot of sense. She is a value investor who likes platform companies rather than product companies.

I believe there is a strong likelihood of a regime change in the markets. There are early signs of a reversal in many of the market’s underpinnings, from lower inflation and tax rates to productivity gains, population growth, and global trade. Many longstanding positives could unwind in coming years and decades. On the political front, populism and nationalism are on the rise, and they don’t tend to play out well for stock markets. Eventually, the stock market will reflect these things.

[Jeff] She is negative on some of the popular names. Her argument is well worth reading.

Alphabet (NASDAQ:GOOGL) (GOOG) and Facebook (NASDAQ:FB) as value stocks? Really? They meet Bill Nygren’s definition. (The Acquirer’s Multiple).

Many strategists now claim that “value looks cheap compared to growth.” Though I understand what they mean, and even agree with it, the phrase bothers me. To them, “value” is a euphemism for inferior businesses. But “value” and “growth” aren’t opposites.

When we say we are value investors, it doesn’t mean that we limit our investments to below-average businesses. It simply means that we estimate what each business is worth based on its own unique fundamentals and buy only those that are priced well below that estimate.

It’s just logical that the value we ascribe to rapid growth businesses is more than we ascribe to slow growth—or declining—businesses. Using our definition of “value,” rapidly growing companies, like Alphabet and Facebook, are “cheap” today, despite having trailing P/E ratios that are higher than the average stock. And slower growth companies, like banks such as Citigroup (NYSE:C) and Capital One with trailing P/E ratios that are a small fraction of the average stock, also look cheap.

To us, “value stocks” are always cheap because, by our definition, they are the stocks priced at the largest discounts to our estimates of business value, regardless of their P/Es and growth rates

[Jeff] That is also my definition of value.

Featured Advice

If you were to read a single investment article this week, I recommend When the Facts Change, We Change Our Minds (Anatomy of a Sale) by Vitaliy Katsenelson. I reviewed one of his books, read all of his work, and enjoy his music suggestions. This article provides some especially good investment advice. He begins with a discussion of airlines and the recession.

Flying is at one extreme in the spectrum of social distancing. It requires finding your way through airports packed with people and then getting on a plane that, even after the middle seats are removed will still have a higher density than a packed bar on Friday night in Manhattan. Thus flying will require a great many little, incremental, marginal decisions before we overcome the fear of boarding a plane.

Vaccine availability would instantly vanquish fear, and our behavior would come back to normal. Well, almost. There will be scar tissue on the economy – trillions in government debt and persistently high unemployment – that will take time to clear up. People are not flying today because we are in lockdown; they’ll be flying less than they used to after lockdown is over because they are still afraid; and after their fear is gone they’ll still be flying less because they cannot afford the flights.

[Jeff] As you would expect, I enthusiastically endorse his insistence on looking beyond the immediate effects on airlines. He does not see “cheap stocks” but rather a prolonged challenge which not all will survive.

As with most of my “best of the week” selections, Vitaliy looks beyond the current example to consider the broader lessons. In this case, it is the importance of changing your mind with the circumstances.

…we wanted to point out Buffett’s ability to change his mind. Interestingly, Buffett, who was already the largest shareholder of US airlines, bought more airline stocks a few weeks before he sold them. We did something similar this quarter, too: We increased our position in Melrose Industries, just to sell the full position two weeks later. (More about Melrose to follow).

And

Melrose is a very strong player in two industries that have been impacted tremendously: the airlines space (it makes parts that go into planes and engines) and car parts (it is one of the largest makers of transmissions for cars). We talked to the company. It has credit lines and cash to give it immediate liquidity, but we are not sure if it will be enough.

We had applied the traditional recession mental model to our analysis, and we were wrong. Given the world we are looking at now, we should have sold it sooner.

[Jeff] Not only is this a great example of constantly reviewing positions to reflect changing facts, it shows the importance of accepting mistakes and moving on before things get worse.

Watch Out For

Movie theater stocks. There are several specific challenges, writes Steven Zeitchik (Washington Post).

“You don’t want to make all the health stuff too obvious,” said Johnson, the chief executive of Classic Cinemas, which operates 120 screens at 15 theaters. “Because if it feels like they’re checking in for a flight, they aren’t going to come. But you have to let them know somehow. So it’s really hard.”

Movie theaters are encountering a slew of challenges as they lurch toward reopening after a three-month shutdown, including well-documented obstacles such as a lack of new movies and capacity legally capped as low as 25 percent.

Conclusion

My mission is to encourage both investors and professional stock pickers to look beyond the recession. Do not just rely upon current data.

Thinking about the matrix should be the most important step in your analysis. You will soon discover that there is no reason to reach for marginal choices. The best opportunities will come soon enough.