Inflation vs. deflation – while headlines get filled with “inflation” concerns, historical data shows “deflation” remains a threat.

The Financial Times recently had a great piece on Central Bankers and their stance that inflationary pressures remain transient. However, as FT concluded:

“For the first time in many decades, there is the possibility that a significant turning point has arrived, that price rises will be more than a flash in the pan and something more difficult to control.”

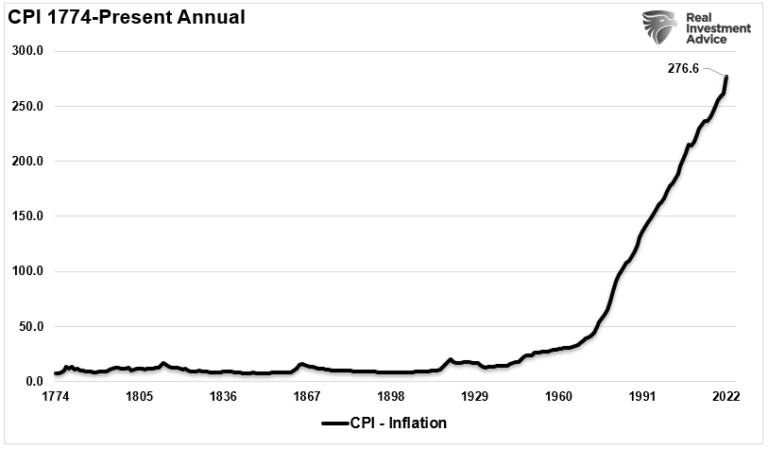

It is interesting to hear statements such as the above because inflation has been rising steadily since 1974. The chart below shows the long-term history of inflation going back to 1774.

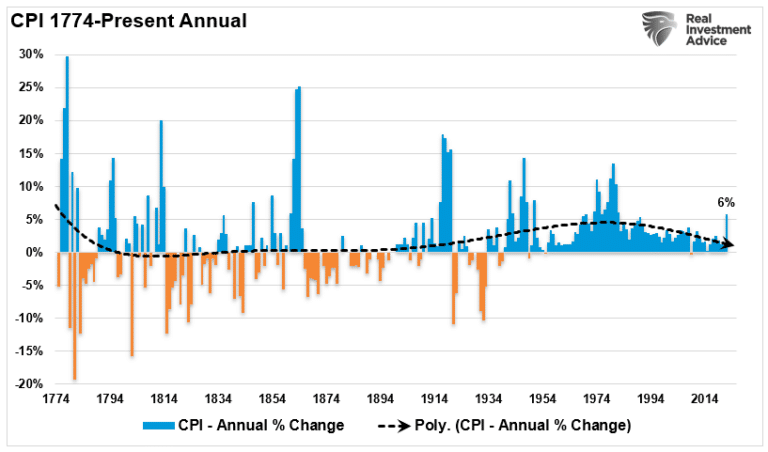

What the chart shows is that in 1954 the trajectory of inflation changed. However, the annual rate of change indicates the long-term deflationary trend.

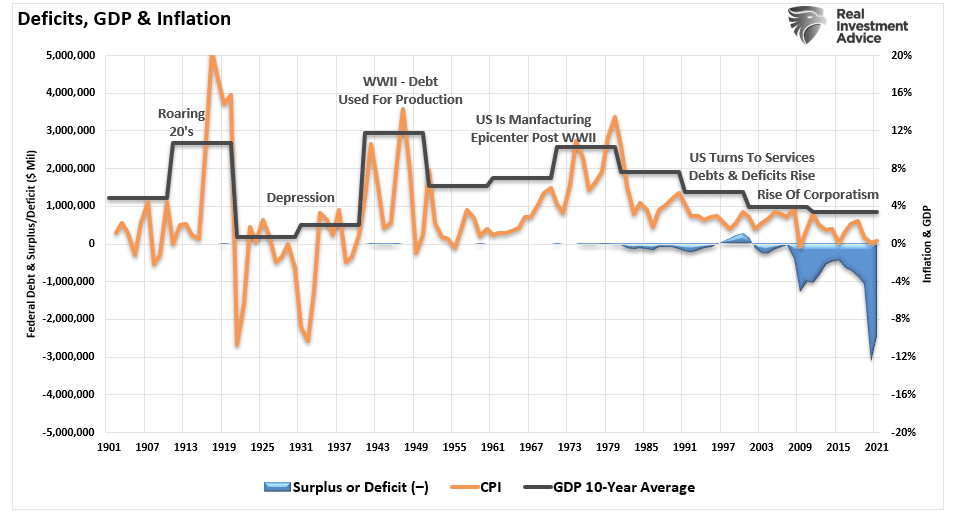

Notably, before 1920 the economy was primarily agriculturally based with a dramatically smaller population. Such gave rise to more variability in economic growth. However, the shift to manufacturing and industrialization minimized the big deflationary swings before WWII.

Unfortunately, beginning in 1980, the economy made a shift to financialization and services. While service jobs have a low multiplier effect economically, economic financialization led to a debt explosion. As a result, the combination of debt and lower economic output remains a consistent deflationary pressure.

The Inflation vs. Deflation Conundrum

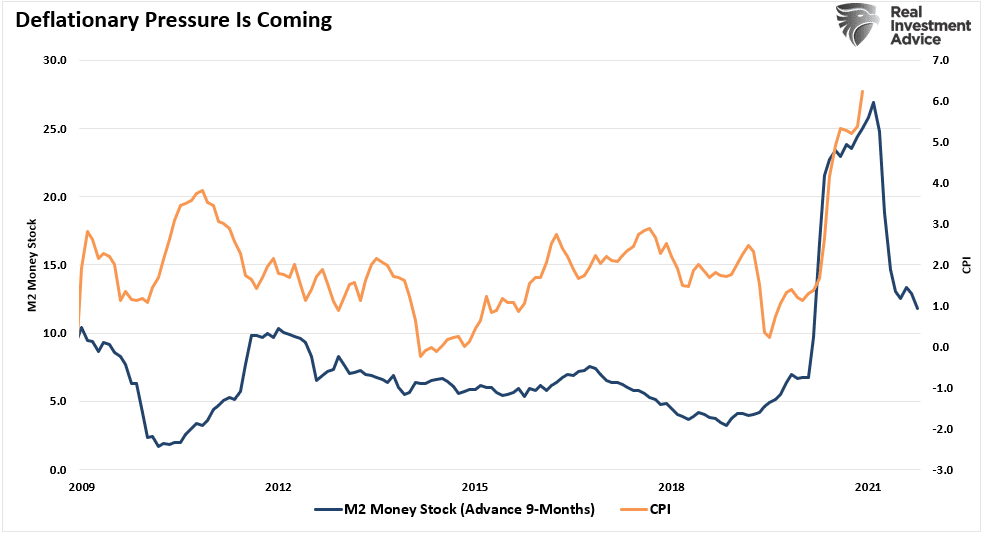

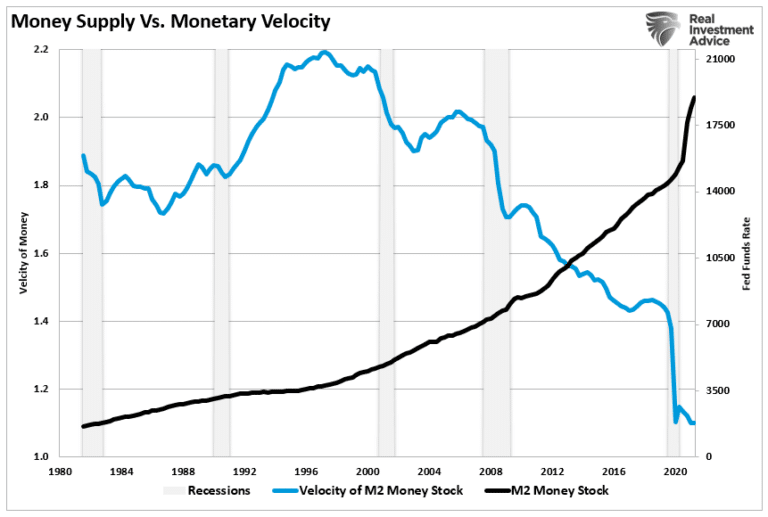

Currently, the mainstream consensus has latched on the sharp increase in the money supply because a permanent shift to higher inflation is coming. Such was a point we discussed in “Is Hyperinflation A Threat?”

“The measure of money in the system, known as M2, is skyrocketing, which certainly supports that concern. Now, with the Biden administration adding another $1.9 trillion into the economy, those concerns have risen.”

Furthermore, in a previous Bloomberg interview, Larry Summers stated:

“There is a chance that macroeconomic stimulus on a scale closer to World War II levels will set off inflationary pressures of a kind not seen in a generation. I worry that containing an inflationary outbreak without triggering a recession could be even more difficult now than in the past.”

The chart below suggests those points are correct. Given it takes about 9-months for increases in money supply to hit the economy, we see the inflationary spike.

The sharp decline in money supply suggests deflationary impulses in the economy will become visible around the middle of 2022. Which is roughly when the Federal Reserve plans to hike interest rates. This is significant in the debate of inflation vs. deflation.

However, there are still significant headwinds to inflation over the next decade outside of money supply changes.

The 3-Ds

Here are the 3-Ds of inflation vs. deflation. Over the coming decades, three primary factors are supporting deflationary pressures.

- Debt

- Demographics

- Deflation

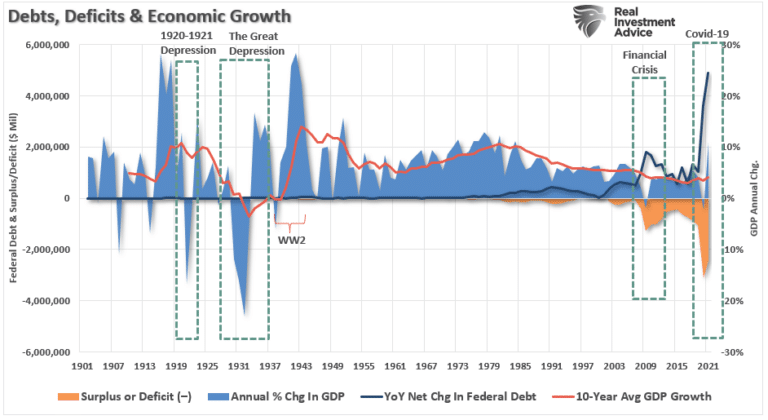

These issues are not new. But have been plaguing economic growth for the last 40-years. Given the baby-boomer generation has reached retirement age, they will leave the workforce at an increasing rate, drawing on their accumulated financial assets. As a result, the debts and deficits rose to levels that detracted from economic growth rather than contributed to it.

As shown, the surge in debt and deficits coincides with a peak in the 10-year average economic growth rate.

The decline in economic prosperity keeps a deflationary pressure on the economy as the government expands its deficit spending to sustain the demands on the welfare system.

The negative impact on the economy is clear. There is a significant negative correlation between the size of the government and economic growth. Rather, debt is the problem, not the solution.

“Excessive indebtedness acts as a tax on future growth and it is also consistent with Hyman Minsky’s concept of “Ponzi finance,” which is that the size and type of debt being added cannot generate a cash flow to repay principal and interest. While the debt has not resulted in the sustained instability in financial markets envisioned by Minsky, the slow reduction in economic growth and the standard of living is more insidious.” – Dr. Lacy Hunt

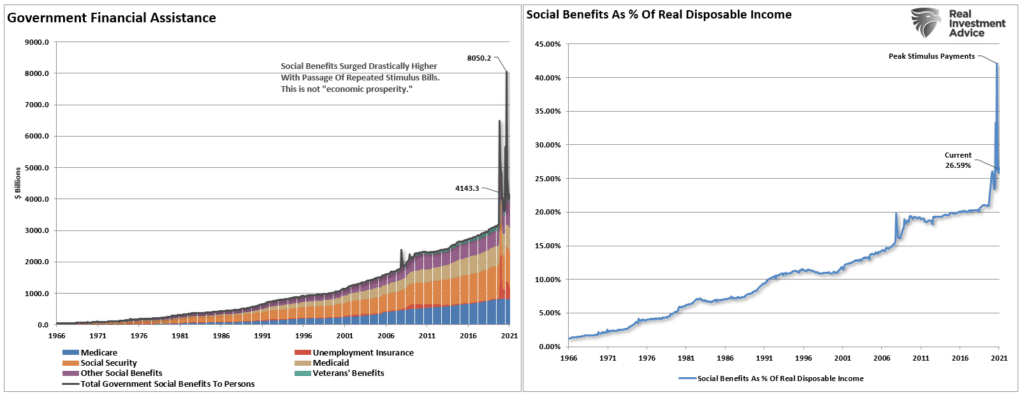

The most direct evidence of the decline of economic prosperity is the rise in social welfare as a percentage of disposable incomes. Recycling tax dollars is a zero-sum game and increases the deflationary pressures on the economy from debt required to fund it.

Debt-Driven Deflation Will Cap Inflation

Furthermore, a recent report from the Mercatus Center at George Mason University studied the effective “multiplier” of government spending.

“The evidence suggests government purchases reduces the size of the private sector and increases the size of the government sector. On net, incomes grow, but privately produced incomes shrink.

There are no realistic scenarios where the short-term benefit of stimulus is so large that government spending pays for itself. In fact, even when government spending crowds in some private-sector activity, the positive impact is small. It is likely much smaller than economic textbooks suggest.”

With households dependent on governmental assistance, the deflationary “psychology” is difficult to break.

“In addition to the psychological drivers, there are structural underpinnings of deflation as well. A financial system’s ability to sustain increasing levels of credit rests upon a vibrant economy.

A high-debt situation becomes unsustainable when the rate of economic growth falls beneath the prevailing rate of interest owed. As such the slowing economy reduces borrowers’ ability to pay what they owe.

In turn, creditors may refuse to underwrite interest payments on the existing debt by extending even more credit. When the burden becomes too great for the economy to support, defaults rise. Moreover, fear of defaults prompts creditors to reduce lending even further.”

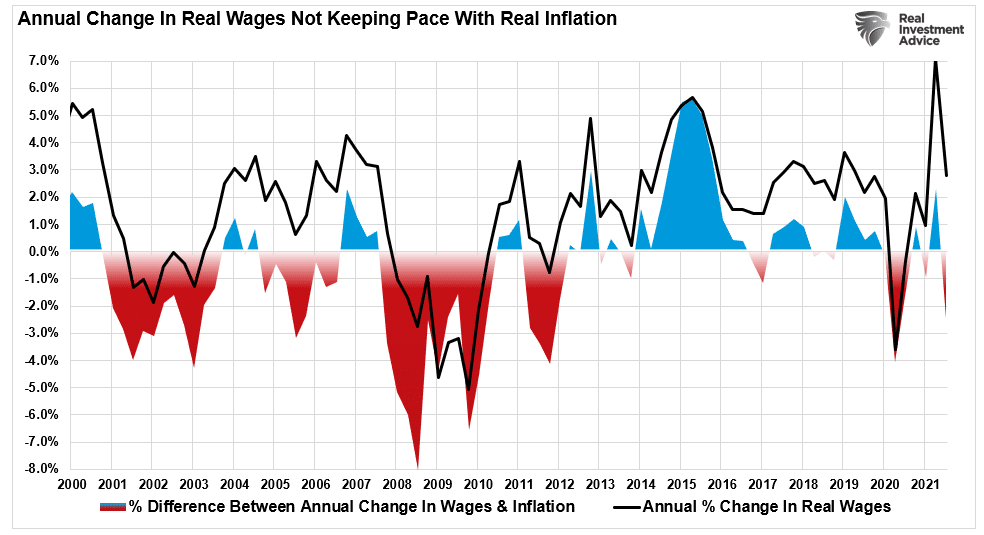

Consider the role of wages in the inflation vs. deflation question. When wages fail to keep up with inflation, consumption will contract, contributing to the deflationary bias.

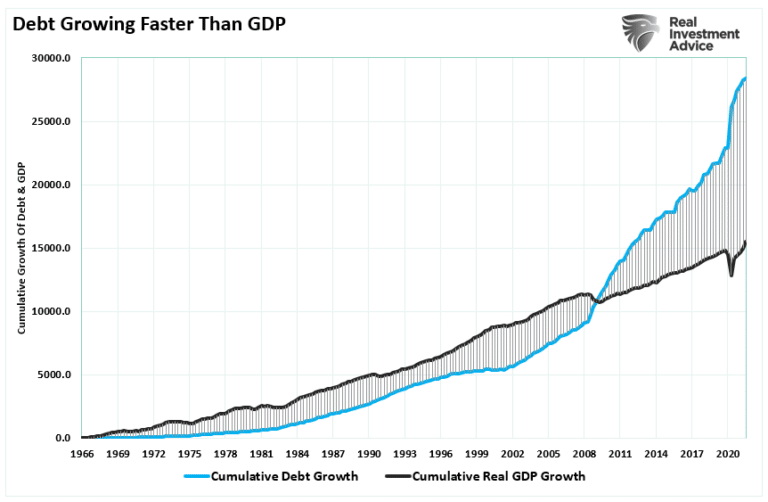

For the last four decades, when the Fed took action to achieve their goal of “full employment and stable prices,” it led to an economic slowdown, or worse. The relevance of debt versus economic growth is all too evident, requiring an ever-increasing amount of debt to generate $1 of economic growth.

In other words, without debt, there is little to no, organic economic growth.

Don’t Forget The Demographics

The most considerable deflationary pressure will come from the changing demographics. As baby boomers retire and leave the productive workforce, they will cut back on spending and withdraw assets from the financial markets.

MostCentral Banks are increasingly convinced high inflation rates might not be so transient after all. Such is why the tightening cycle has now begun. Secular demographics will reach maximum deflationary pressures in the decade ahead.

Such is in stark contrast to the 1970s when demographic trends underpinned the then inflationary surge.

But amid the current inflation panic, Eric Basmajian of @EPBResearch reminds us that the demographic headwinds facing the major economies are intensifying (especially with people dropping out of the workforce).

In the long-term, demographics will be a big shock to Central Banks hopes of higher inflation rates.” – Albert Edwards

“Demography is destiny.” – Auguste Comte

The Fed’s Liquidity Trap Is Deflationary

“When injections of cash into the private banking system by a central bank fail to lower interest rates or stimulate economic growth. A liquidity trap occurs when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war.

Signature characteristics of a liquidity trap are short-term interest rates remain near zero. Furthermore, fluctuations in the monetary base fail to translate into fluctuations in general price levels.”

Pay particular attention to the last sentence. Every aspect of a liquidity-trap is in place:

- Lower interest rates fail to stimulate economic growth

- People hoard cash because they expect an adverse event.

- Short-term interest rates near zero.

- Fluctuations in the monetary base fail to translate into general price levels.

Notably, the issue of monetary velocity and saving rates is critical to defining a “liquidity trap.”

While many today continue to compare the economic environment to the 1970’s inflationary spike, the impact of demographics and debt are vastly different.

The issue of inflation vs. deflation is likely to continue next year. Will the economy experience a short-term inflationary spike as the stimulus runs through the system? Of course. However, once the “Sugar Rush” wears off, the deflationary pressures will quickly reassert themselves.

The problem for the Fed is they may well make another policy mistake as they hike interest rates at precisely the wrong time. The 3-Ds continue to suggest that inflation will give way to deflation, economic strength will weaken, and over-zealous investors will once again get left holding the bag.