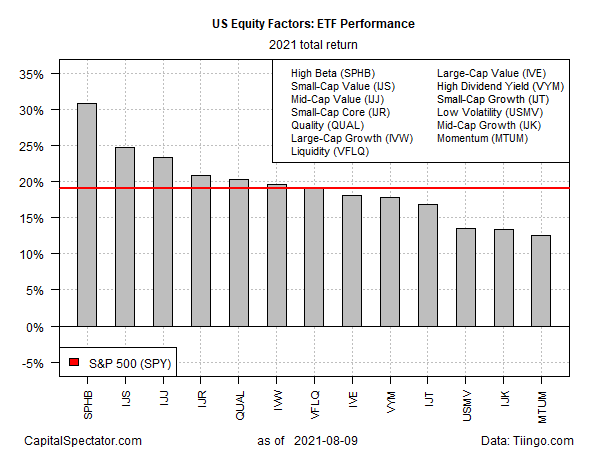

The strategy of holding stocks with the highest beta risk have stumbled recently, but remain comfortably in the lead year-to-date for US equity factors, based on a set of exchange traded funds.

Invesco S&P 500® High Beta ETF (NYSE:SPHB) is up 30.9% so far this year through yesterday’s close (Aug. 9). That’s well ahead of the second-best factor performance via iShares S&P Small-Cap 600 Value ETF (NYSE:IJS), which is ahead 24.7% in 2021.

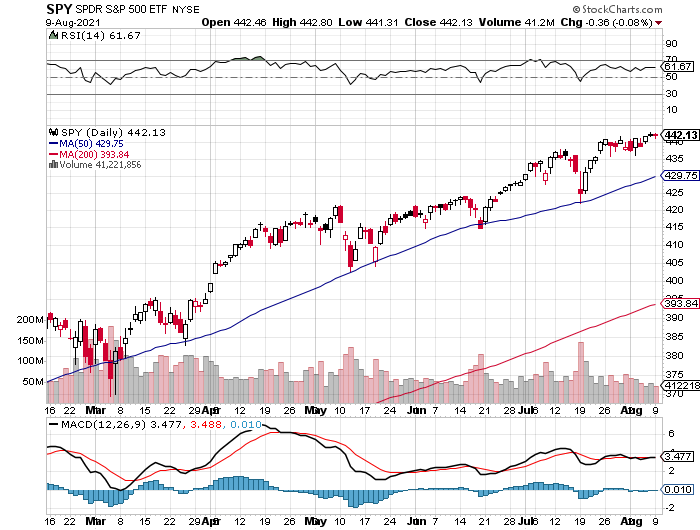

SPHB’s performance edge is even stronger vs. the standard equities benchmark: SPDR® S&P 500 (NYSE:SPY) is up 19.0% year-to-date.

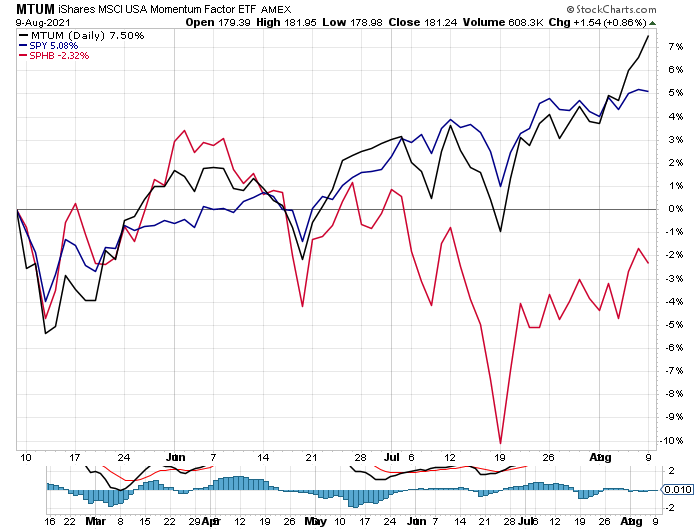

SPHB’s recent trading behavior, however, looks shaky compared with the market overall. The high-flying ETF began to stumble in June and has been trending lower even since. For much of the past month, SPHB has traded below its 50-day moving average, a possible warning sign for the fund’s near-term outlook.

SPY, by contrast, continues to trend up with relatively stable persistence.

In a sign of the times, all the factor funds on our list continue to post gains. The weakest performer: iShares MSCI USA Momentum Factor ETF (NYSE:MTUM), which is up a relatively moderate 12.5% year-to-date.

Note, however, that MTUM appears to be regaining its upside mojo and has outperformed SPHB and SPY lately. MTUM’s recent bounce is especially conspicuous over the trailing three months: the fund is up 7.5%, slightly outperforming the US equities benchmark (SPY) while crushing SPHB, which has lost 2.3% since May 9.