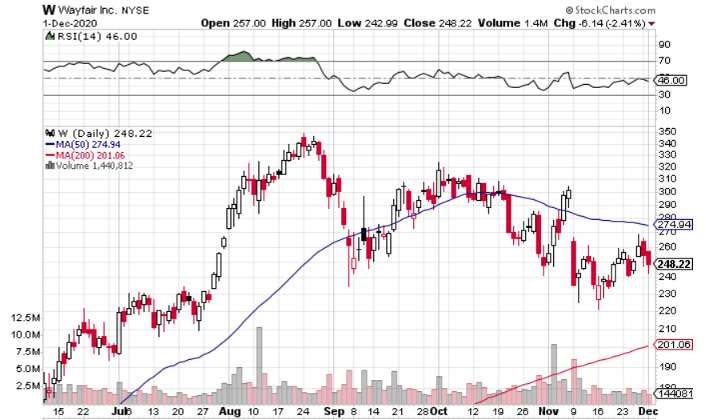

Wayfair (NYSE:W), an e-commerce company that sells furniture and home-goods, has been one of the most prominent pandemic winners, surging from lows of $21.70 in March all the way up to highs of almost $350 in August. Wayfair shares overheated, however, and spent September through early November between around $234 and $324.

There was reason to believe that after shares digested the massive gains, they would resume their uptrend in earnest. But then the vaccine news came on Nov. 9. Investors, fearing Wayfair’s performance in a post-vaccine world, rushed to the exits; Wayfair closed the session down more than 21%.

The pandemic was a huge tailwind for Wayfair, and some type of selloff was justified in the wake of the vaccine news. But the question is: Has this correction run its course or is it just getting started?

The Good

Around a month ago, Wayfair reported its Q3 2020 earnings. Revenue was up 66.5% yoy to $3.8 billion, beating Wall Street estimates of $3.65 billion. Earnings blew away expectations, coming in at $2.30 per share on a non-GAAP basis, vs. estimates of 80 cents per share. Shares surged more than 7% on the news, indicating that investors were fixated on the earnings number – not always the case for a high-flying growth stock.

As great as the numbers were, they represented a slowdown from Q2 2020, when revenue grew 83.7% yoy to $4.3 billion and earnings came in at $3.13 per share.

The growth rates are impressive, but is Wayfair getting close to its ceiling? Not if you look at the home furnishings market as a whole. Wayfair recorded $9.1 billion in revenue in 2019, but home furnishings stores accounted for nearly $120 billion in sales last year.

Besides having plenty of opportunities to acquire new customers, Wayfair has historically done an excellent job of retaining its existing customers. In Q3, its repeat order growth was up 84.5% yoy.

And even though many people will return to the office post-pandemic, work-at-home, in some capacity, is here to stay. Work-at-home won’t be as much of a tailwind for Wayfair in 2021 and beyond, but it will continue to boost sales for years to come.

The Bad

Wayfair is going to face TOUGH comps next year. Forget about Wayfair growing at Q2 & Q3 2020 rates; the company may struggle to eke out any growth.

Two of the main reasons why Wayfair has thrived in 2020 are that people have been nervous about shopping in person and they’ve been stuck at home. This has been a perfect recipe to get people to buy furniture online.

Like many others, I do believe that the long-term shift to online shopping will continue post-pandemic. That said, I think a lot of people are going to start buying furniture in-person again. Wayfair will be better off than it was pre-pandemic, but by how much? Shares still trade at more than double their January 2020 highs.

Next, we have the “pull-forward effect.” Most people who were planning on buying furniture sometime in the next couple of years probably took 2020 as an opportunity to do so. If not in 2020, then when? If this happened on a large enough scale, it could put a serious dent in Wayfair’s 2021 numbers.

Then, there’s the competition – Wayfair faces a lot of it. Amazon (NASDAQ:AMZN, Target (NYSE:TGT), and Walmart (NYSE:WMT) see what Wayfair is doing, and have the deep pockets and the know-how to cut into Wayfair’s market share.

Wayfair may be faring well in the customer retention department, but there aren’t really any switching costs for customers that move to a competitor. An economic moat is ideal in a competitive industry – Wayfair doesn’t really have one.

The Verdict

I might sound extremely bearish about Wayfair’s long-term prospects – think 2022 and beyond – but it’s more so that I’m concerned about 2021. I want to see how Wayfair handles the post-pandemic environment and the increasing competition.

Wayfair is trading at 1.7x forward sales and 54.9x forward earnings, which is too lofty of a valuation when you consider all of the unanswered questions. You’re best off taking a wait-and-see approach with Wayfair. If the company does have a rough 2021, it’s easy to see the market falling victim to shiny object syndrome and selling Wayfair off to nonsensical levels. That could be a buying opportunity if it comes to fruition.