Mining stocks would likely suffer when the general stock market slides, and it seems that we won’t have to wait too long for that.

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

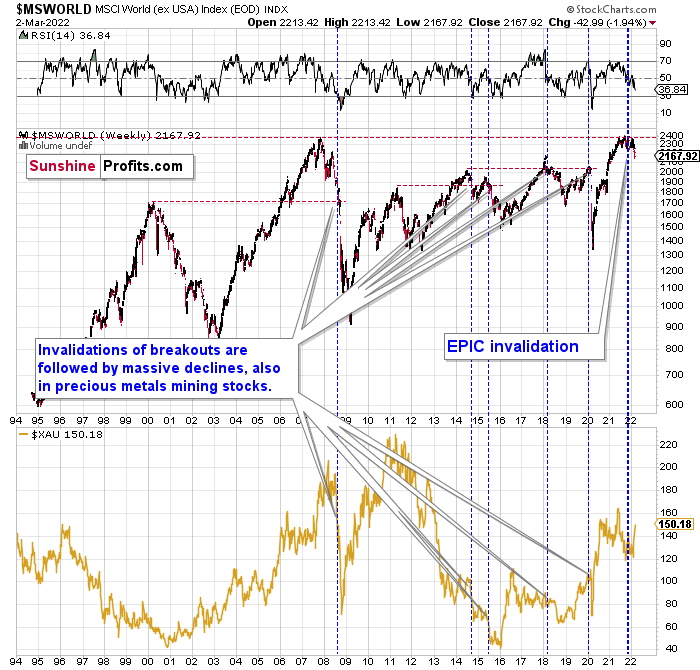

"Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

"It's a strong sell signal for the medium- and quite possibly for the long term.

"From our—precious metals investors’ and traders’ —point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in the mining stocks (represented by the XAU Index).

"Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

"Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

"What does it mean? It means that it is time when being out of the short position in mining stocks to get a few extra dollars from immediate-term trades might be risky. The possibility that the Omicron variant of COVID makes vaccination ineffective is too big to be ignored as well. If that happens, we might see 2020 all over again—to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside…You have been warned."

Here's how the situation currently looks from the U.S. point of view. The chart below features the S&P 500 futures.

The key thing about the above chart is that what we’ve seen this year is the biggest decline since 2020, and the size of the recent slide is comparable to what we saw as the initial wave down in 2020. If these moves are analogous, the current rebound is normal—there was one in early 2020 too. This also means that a much bigger decline is likely in the cards in the coming weeks.

The thing that we see with regard to the short term is that stocks moved above their declining resistance line. However, this line was already "broken" in a similar way earlier this year. The fact is that this "breakout" actually resulted in its invalidation and another wave down.

If history is about to rhyme with regard to both short-term and the analogy to 2020, the next move lower might be much bigger.

This would be likely to have a very negative impact on the precious metals market, in particular on junior mining stocks (initially) and silver (a bit later).