The key “thrill of victory and agony of very temporary defeat” weekly gold chart.

Broadening patterns indicate a loss of control in markets. The wild Sunday night and Monday gold price action is “textbook” for the huge broadening pattern in play.

While Stochastics now has a crossover sell signal, RSI does not. The most likely scenario now is a pause for a week or two, and then another more significant rally to above the immense $2080 “line in the sand”.

Tactics? Gold stock enthusiasts who did some selling into the $2080 gold price area should now focus on buying at $2010, $1985, and $1928.

These key buy zones should also be the focus for long-term accumulators.

From the $2145 area high, a drop to support at $2010 is a $130/oz price sale. A drop to $1985 support is a $155/oz sale, and the $217/oz drop to $1928 support would be a truly epic price sale but this last one is unlikely to happen.

I’m not a big fan of sloping trendlines in the gold market, but they are helpful at times. Note the green trendlines defining the volatile uptrend.

A drop to the lower trendline would put gold at the big $2010-$1985 support area. It’s a “must buy” zone for most gold stock enthusiasts. I call it a golden stocking stuffer for Christmas 2023!

What about the dollar and rates? The DXY (dollar index) chart. There’s some minor inverse H&S action, and it’s in sync with the projected 1-2 week pause for gold.

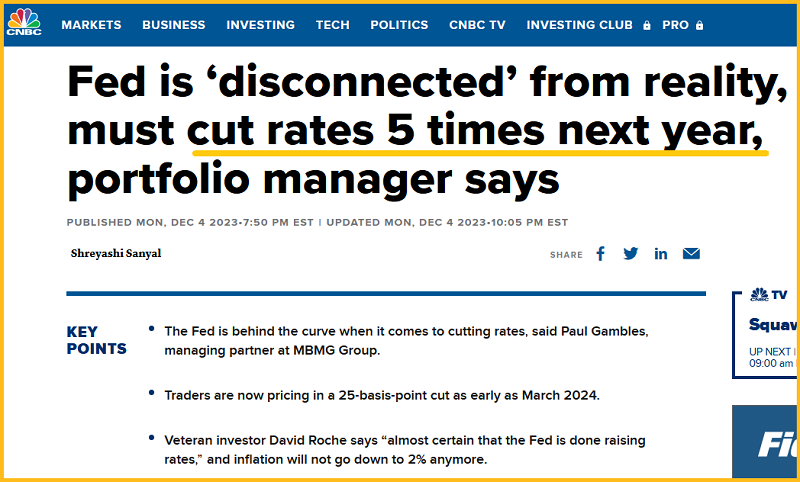

US rates aren’t confirming the action in the dollar. There’s a dead cat bounce, but the weekly chart suggests a much bigger dip in rates lies ahead.

The 5%-5.25% zone is major resistance. Rates need another huge bout of de-dollarization (it’s coming) and inflation (also coming) to move above there.

In the interim, as the US government bungles the final two years of this 2021-2025 war cycle (like they’ve bungled most of their wars) and the nation ships into recession

Rates could dip to as low as 2.5%.

The bottom line is that 2024 is likely to be a “golden year” for the metals, and rates may stay low until 2026 or 2027 before the US government creates the next massive wave of inflation with its drug-like addiction to fiat, meddling, spending, and debt.

From there, the Fed would start hiking again and gold would take an initial hit but it would happen from a much higher level than where it is now. How high? Probably $3000+, and at that point, most money managers would have a keen interest in the miners, a “here to stay” interest.

A consistent focus on the big picture is critical for gold and silver market investors. I cover that picture 5-6 times a week in updates just like this one, in my flagship

I use the one-week “January indicator”; if the market is up for the first week of trading in the new year, it’s usually a good indication that money managers are committed to consistent buying throughout the year.

If the market is down at the end of that first week, they tend to be non-committal and remain that way for the whole year.

A tumbling stock market would be more fuel for lower rates, even if the Fed doesn’t cut. That’s because panicked investors would rush to buy bonds, pushing bond prices up and interest rates down.

I always urge stock market investors to get out of the stock market on Aug 1, get back in later in October, and exit again in December. This is a time to book profits, stand back, and watch the first week of trading in January. It could get ugly, and fast!

I’ll dare to suggest that most mainstream money managers are more out of touch with reality than Fed chair Jay. Having said that, Jay should have hiked a lot more than he did, but targeted those aggressive hikes only at government debt, while offering relief and stimulus to debtors in the private sector. With the stock market at nosebleed valuation levels, rate cuts are not needed, but they are likely to happen if it tumbles.

With all of the above in mind, the stunning GDX chart. A textbook inverse H&S pattern (with breakout) is now the head of what could be a much bigger pattern. While the gold bullion market action is wild, GDX and most gold stocks look great! The right shoulder build could take GDX to just under $29, but it doesn’t need to go that low.

Friday is the next jobs report. That could mark the low of the pullback and put gold in the buy zone, somewhere between $2010 and $1985. If that’s not the low, it’s likely just days away from there. Both traders and accumulators should keep their fingers on the buy button, ready to usher in a new and very golden year!