- Gold delivers fizz-worthy $2,000 high for bulls; record peak will likely take longer

- Upside momentum intact despite a drop from Monday’s one-year highs

- Fed in play on Wednesday adds to the challenge of gold bulls

Gold bulls: Have the bubbly you rightly deserve, but keep another in the chiller as that record high you want may take a little while longer to happen.

After a year-long hiatus, gold prices finally reached in Monday’s session, the nirvana long aspired by longs in the game — $2,000 an ounce.

But hanging on to that perch, growing comfortable with it, and stamping a new record high there might require further patience.

With the U.S.-to-Europe banking crisis already firing safe-haven buying on all cylinders, gold has upward momentum on its side.

For Comex futures to reach a new record high beyond $2,078.80 and spot gold to rewrite its all-time peak of $2,072.90, the yellow metal might have to retrace some of the huge gains from the past few sessions to make another strong push forward, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

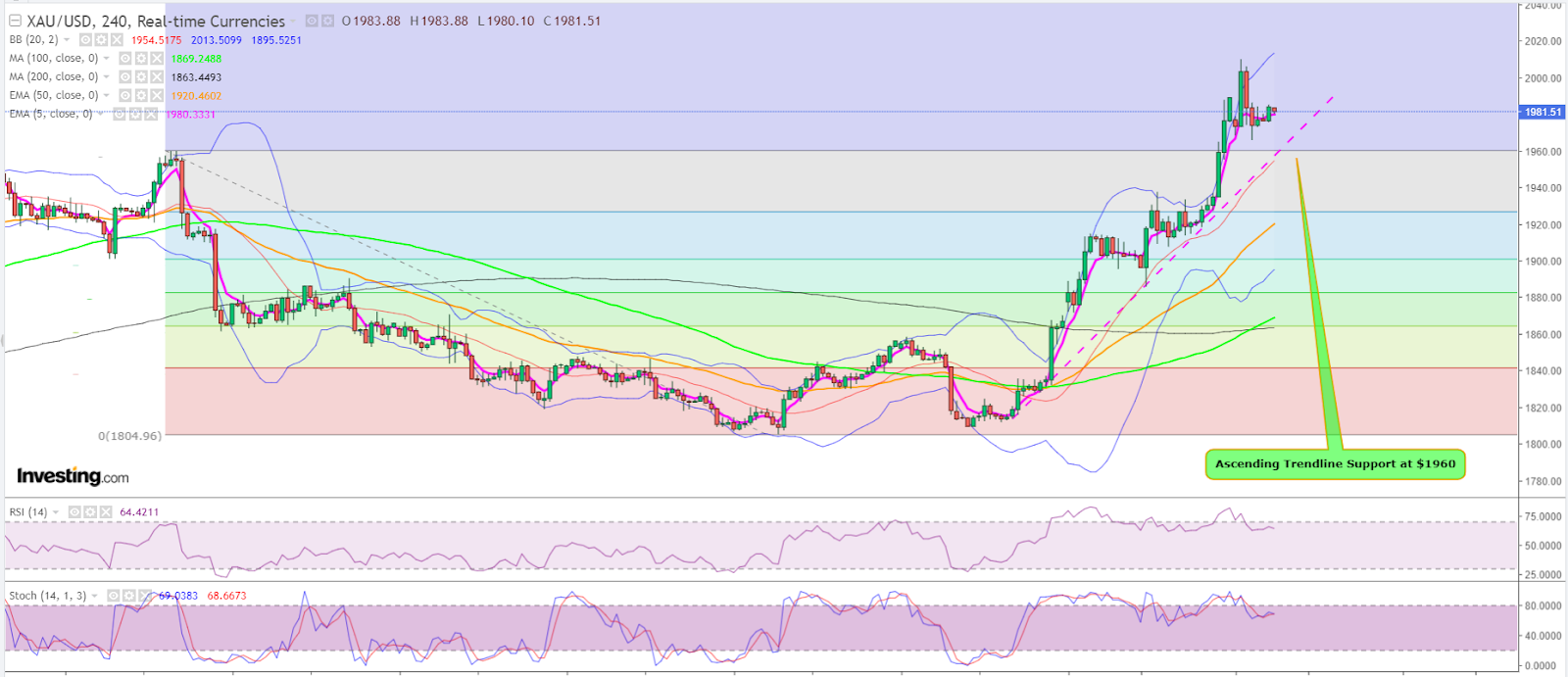

Charts by SKCharting.com, with data powered by Investing.com

A lot will also matter on what the Federal Reserve agrees to in the next 24 hours — and in the coming months — for its monthly rate decision.

Gold prices have been on a tear since the U.S. banking crisis erupted just over a week ago with the takeover of two mid-sized lenders — Silicon Valley Bank and Signature Bank — by the Federal Deposit Insurance Corp as depositors yanked billions of dollars from them after fearing about their solvency. Silicon Valley later filed for bankruptcy protection. A third bank, First Republic (NYSE:FRC), also waded into trouble despite receiving a $30 billion cash infusion from a consortium of U.S. banks.

Elsewhere, the banking crisis has spread to Europe, with Credit Suisse (NYSE:CS), one of the preeminent names in global investment banking, having to seek help from Switzerland’s central bank and put itself up for sale.

Some of the investor stampede towards safe havens cooled on Monday after Swiss investment bank UBS (NYSE:UBS) said it would buy its beleaguered peer Credit Suisse. Top U.S. banking group JPMorgan (NYSE:JPM) also appeared to make progress in the rescue plan for First Republic.

That calm saw the front-month April gold futures contract on Comex hover at $1,985 an ounce by 01:00 ET (05:00 GMT), ahead of Tuesday’s official open in New York. That was nearly $30 below the previous session’s one-year high of $2,014.90.

The spot price of gold, more closely followed than futures by some traders, hovered at $1,982 versus Monday’s peak of $2,009.84.

Dixit noted that both the futures and spot prices hit session lows on Monday that were about $40 to $45 below the day’s peak, describing those as “healthy corrections”.

On a four-hour time frame, spot gold’s Middle Bollinger Band of $1,955 remains positioned well above the 50 Exponential Moving Average of $1,920.

Spot gold is also above the bullish confluence of the Daily Middle Bollinger Band and the 50-Day Exponential Moving Average, both standing at $1,870, Dixit said, adding:

“Gold hasn’t really lost its bullish momentum despite the $45 drop from Monday’s intraday highs, as prices show a calculated resilience. The pullback we’ve had from the peaks is very healthy and gold longs may need a little more patience for a new record, though not too much.

The possibility of a further drop to $1,960-$1,950 remains intact, but buyers are very likely to resurface taking the metal higher for a retest of $2010, above which gold’s first target of $2040 is stationed. Next in sight would be $2,056 and most probably a new record high.”

On the flip side, Dixit said the recoil from Monday’s one-year highs has put a “pin bar formation” on spot gold, which may limit gains temporarily.

If bullion fails to gain momentum to break and sustain above $1,990, then an initial drop to $1965-$1960 is likely, before that extends to $1,955.

“If selling intensifies below $1,955, we can see gold plunge into the $1,932-$1,928 support areas. It will take a while for us to retrace all the gains made in the $1,900 territory. That’s what I meant by the market being in a broadly bullish pattern. The path of least resistance is higher.”

Also testing the mettle of gold bulls this week will be the Fed's rate decision.

Also testing the mettle of gold bulls this week will be the Fed's rate decision.

Traders across markets — not just in gold — will be dissecting with surgical precision Fed Chair Jerome Powell’s news conference after Wednesday’s rate decision for key takeaways on inflation, the U.S. economy and future rates.

The Fed is expected to approve another 25-basis point hike at its March 22 meeting, bringing U.S. interest rates to a peak of 5%, and advocate further increases that will help it catch up with inflation, which grew at an annual rate of 6% in February.

The Fed intends to bring inflation back to its long-term target of 2% per annum and has said it will rely as much as possible on rate hikes to do that, having already raised 450 basis points over the last year.

The banking crisis is, however, weighing on the Fed’s plans as many on Wall Street are blaming that on the central bank’s rate increases instead of what appears to be reckless risk-taking by the executives of the banks that went under. There is pressure now on the Fed not to do any more rate increases. So far, Powell has shown no signs of capitulating to such emotional blackmail.

Craig Erlam, analyst at online trading platform OANDA, said:

“The next test of [gold’s] bullishness may come Wednesday and perhaps not from the rate decision itself but what Powell and his colleague have to say on the path forward.”

***

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.