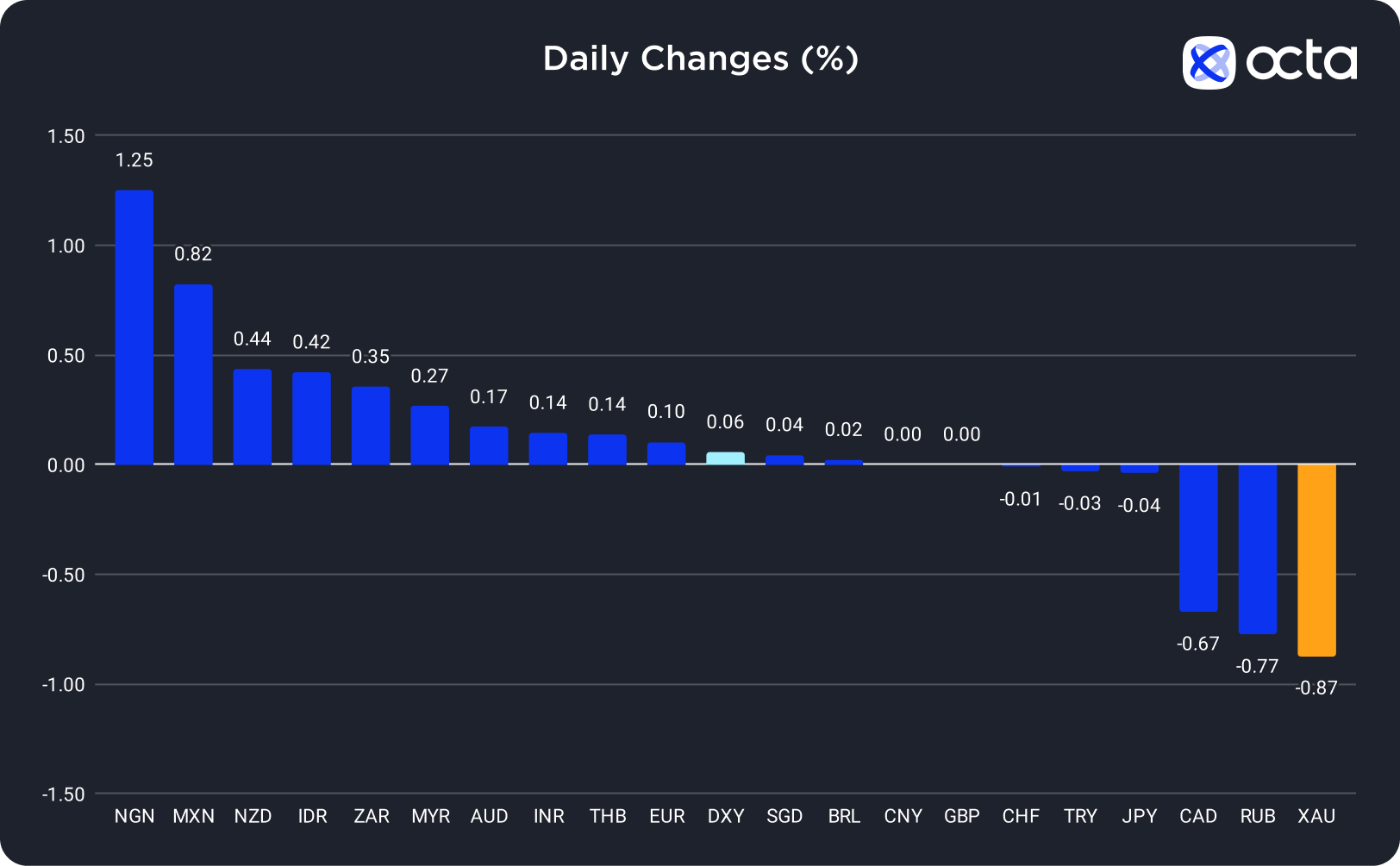

On Friday, the Nigerian naira (NGN) was the best-performing currency among the 20 global currencies we track, while the Russian rouble (RUB) showed the weakest results. The New Zealand dollar (NZD) was the leader among majors, while the Canadian dollar (CAD) underperformed.

Gold Has Been Falling for Six Consecutive Days as the Fed Is Expected to Remain Hawkish

Gold (XAU) price lost 0.87% on Friday despite a smaller-than-expected increase in the core Personal Consumption Expenditure (PCE) Index.

"Gold's outlook, fortunately, or unfortunately, has a lot to do with the underlying interest rate environment moving forward," said David Meger, director of metals trading at High Ridge Futures.

Indeed, expectations that the Federal Reserve (Fed) may keep interest rates higher for longer continue to increase. The market currently prices a 30.8% chance of a rate hike in November and a 45.1% chance of it in December. In fact, should macroeconomic data continue to come out better than expected, the market may begin to price in additional rate hikes later this year. Higher rates should exert downward pressure on precious metals. At the same time, gold remains a powerful safe-haven bet for many investors.

"Demand for gold as a hedge against a soft-landing failure is unlikely to go away as the outlook for the U.S. economic outlook in the months ahead looks increasingly challenged," Ole Hansen, head of commodity strategy at Saxo Bank, wrote in a note.

XAU/USD was declining during the Asian and early European sessions. Today, traders will have the opportunity to get more clues on the health of the U.S. economy. There are two events to watch. First, the Institute of Supply Management will publish its Manufacturing Purchasing Managers Index (PMI) at 2 p.m. UTC. If the figures come out higher than expected, the selloff in gold may accelerate. Second, Jerome Powell, the Fed Chair, will give a speech at 3 p.m. UTC. He might provide important details on the future path of U.S. interest rates.

The Australian Dollar Continues to Trade Below 0.65000. The Spotlight Is on the RBA Decision.

The Australian dollar (AUD) initially rallied on Friday, but failed to break above the important 0.65000 level and lost most of the gains. Still, it managed to finish the day on a positive note, rising by 0.17%.

AUD/USD has been trading in a rather tight range for more than a month as the pair lacks a strong fundamental impetus for a decisive breakout. The interest rate decision by The Reserve Bank of Australia (RBA) may provide such an impetus. RBA is set to meet on Tuesday, with prevailing expectations suggesting that it will maintain the principal interest rate at 4.10%, with a prospective increase to 4.35% in the next quarter, according to a poll of economists by Reuters. The inflation data for the country in August aligned with predictions, marking a 5.2% rise year-to-August, largely fueled by a spike in the cost of fuel. Consequently, economists anticipate another rate increment before the year concludes.

AUD/USD was declining during the Asian and early European sessions. Traders await the RBA interest rate decision at 3:30 a.m. UTC on Tuesday. Although the actual policy decision is unlikely to surprise the market, the RBA may add new details to its post-meeting statement, potentially triggering extra volatility. Any hawkish comments may be enough to push AUD/USD above 0.65000.