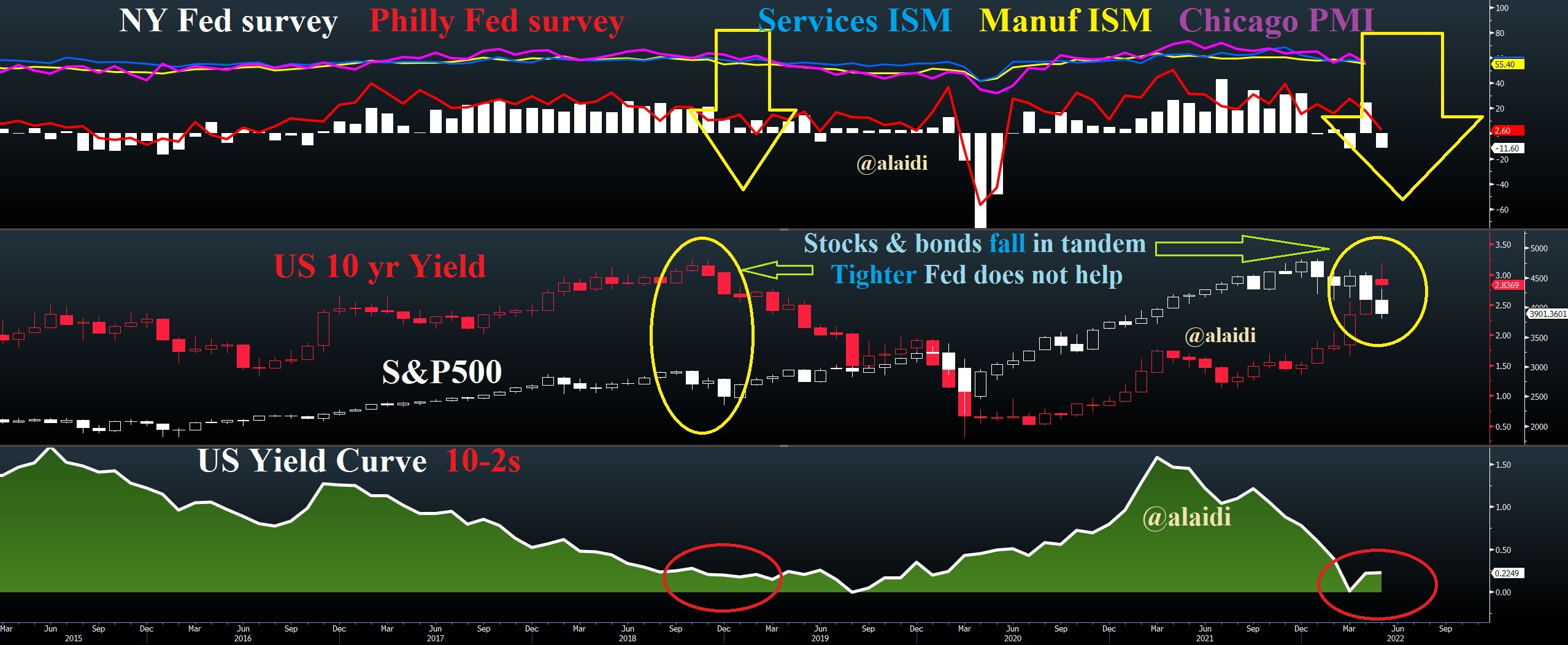

Here are charts capturing the weakness in asset portfolios, business surveys, and consumer sentiment alike. The simultaneous decline in various Fed and non-Fed business surveys (top panel), falling stocks and bond prices sustaining a loss of over $23 trillion (middle panel) and flattening yield curve (bottom panel).

The latter illustrates that even bond vigilantes are growing skeptical of the Fed's latest policy shift. Don't be taken by the fancy charts and ask instead, “how do I trade these ideas?” and “what is the realistic timeframe?” Let's see.

The uninterrupted slowdown in the Philly Fed survey, Chicago PMI, Manufacturing ISM is worthy of notice, but no recession concern is serious enough until the services ISM joins its manufacturing counterpart to two straight months below 50 to signal a contraction of conditions.

The time-lag problem with this requirement is that by the time we get to sub-50, conditions will have turned dire enough, that you don't wait for a monthly stat.

The "market" response to the above deterioration is reflected in the simultaneous bear market in stocks and bonds…the first of its kind since the early 1980s. Such loss in institutional portfolios may be somewhat subsided of the high levels of cash allocation.

Next Monday is the Memorial Day holiday in the US. But later that week will have the release of both ISM surveys and the jobs report for May. It is too early for such reports to reverse, or halt the inflation-fighting focus of the Fed.

Yet, we must continue watching USD and bond yields. FX traders are already giving more weight to the idea of narrowing US yield advantage (see USD's limited bounce during last week's stocks turmoil).

Bond bulls may be further enthused by more pullback in yields—such as a break below 2.60% in the 10-year. Bond bears will need a proper close above 3.0% to get them confident again. No fireworks are expected as long as yields remain inside this range.

FX, however, is already ahead of the curve, as we have gained from EUR/USD, AUD/USD and XAU/USD these past 2 weeks.