Market Update: Volatility creeping back into the market, here are some key markets to watch.

It’s been a while since I’ve written a market update, so with the recent interesting market action I figured I’d get back in the groove and highlight some key markets I’m watching for the rest of 2015.

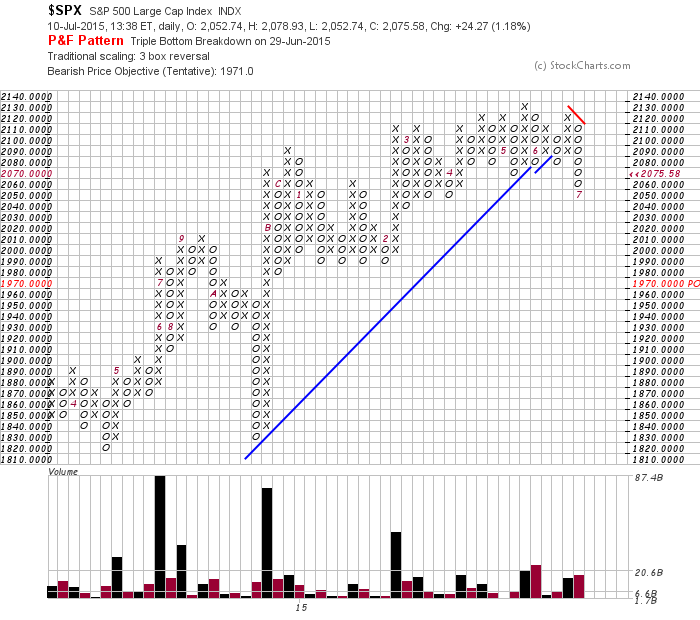

Equities: The S&P 500 is testing critical long term support levels at the 200 day moving average currently around ~2055, and the past few days have seen closes below that level for the first time since last October’s downside shakeout. What is different this time is the S&P 500 is breaking below the bullish support line on the longer term point and figure chart, with a downside target of 1970 now in place. We are getting a nice relief bounce today to end the week so maybe this is another shakeout, but I am getting much more cautious on equities with a “sell in May” high in place and a weak end to the 2nd quarter in June. I think the 2100 level will cap any rallies near term, and with more room down to the 1970 level the risk reward is leaning in favor of shorting the S&P 500 at current levels, and 2050 needs to hold for the weekly close. Breaking that level I would get defensive quickly.

Currencies: The headlines have been all about the Greek crisis and what that means for the euro. After being bearish on the euro for quite a while, it looks to me like the currency is basing and looks like a better risk reward buy around the 1.10 level. I like how it is rallying on “bad” news, and it should be able to move higher back up to the 200 day resistance levels around 1.15. The US dollar has gone into consolidation mode this year, and could also easily pull back into 200 day moving average support. For now I think the short term trend has shifted lower for the US dollar so I would trade accordingly.

Rates: The headlines also have been consistently discussing when the Fed will be raising rates, and the bond market has been all over the place this year with flights to safety shooting rates lower coupled with rate spikes on worries the Fed will move rates higher sooner. My opinion doesn’t matter, but I’m not sure the economy is strong enough to handle the leverage unwind that could be caused from higher rates. Ultimately I know rates will need to go higher, but for the short term I think bonds should find support at current levels. The 125 level on the 10 year bond futures price seems like a decent support zone that should hold near term pullbacks (10 year rates should have resistance @ 2.5%)

Commodities: In general most commodities remain challenged, especially energy and metals, although some of the metals are reaching pretty interesting fundamental support levels like palladium and platinum, but the charts still look like trying to catch a falling knife so it’s probably too early to buy. However, several of the agricultural markets are starting to awaken from a long slumber, and look like they should be good buys on pullbacks to support. For example, look at the new yearly highs in corn. That’s a pretty nice breakout off low levels, and I would be interested in buying any pullback into the 4 levels. Keep an eye on the agricultural markets, because it looks to me like they could be setting up for some huge rallies in the back half of 2015.

Full disclosure: No conflicts of interest with current positions.