If Mary Shelly were around today, she might have a cause of action against the Federal Reserve for copyright infringement. The Fed has stolen the storyline Shelly’s 1818 gothic novel, Frankenstein, The Modern Prometheus. The case against the Fed’s criminal usurpation of intellectual property is strong; any schoolboy would see the obvious plagiarism, including the plot, the central characters, and even some of the dialog of the original science fiction horror story. Here is a summary of the plaintiff’s brief of the case:

A prominent alchemist living in the Washington DC area, Dr. Alan Greenspan, frustrated by his inability to turn lead into gold, turns to economics to find fame and for-tune. Economists have a much easier task than metallurgists or other scientists that must deal with laws of physics. Greenspan reasoned, “Economists can just make up their “laws” out of whole cloth; intuition and whimsy are much easier to document than any scientific experiment. I’ll just have to mumble, to make it difficult for others to truly understand what I am saying.”

So, to reach his altruistic goal of prosperity for all US citizens, Dr. Greenspan decided to create a benevolent protégé, The Modern Prometheus, out of a sleepy quasi-government agency, The Federal Reserve. By cobbling together a few cast-off, and defunct economic policies, many taken verbatim from an ancient tome written by J. M Keynes, the eccentric Dr. G. patches together a snip of low interest rate, a massive chunk of long term bonds, marinated in a special sauce which he called “ Phillips Curve Elixir and Healing Tonic”. At the critical moment, Dr. Greenkenstein pulls the lever sending a massive electrical charge through his ”creature”, that twitches, then opens his yellow eyes, causing the Dr. to shout “It’s alive!” The creature grows taller and more massive when Dr. G. feeds it billions of long term bonds each month, eventually reaching $4 Trillion in the weighty, long term assets.

But the creature suddenly turns on his creator, escapes into the countryside and wreaks havoc in the banking system, destroying the yield curve and striking fear into hearts of investors and speculators alike. The scourge of “Irrational Exuberance” runs rampant in the markets. Dr. Greenkenstein ultimately retires, but not until his malignant monster nearly destroys the world financial system with “sub-prime loans”, related “MBS’s”, “credit default swaps”, and other toxic assets. The inscrutable Dr. G was succeeded by Dr. Ben Bernanke, and more recently by Dr. Janet Yellen, both eager and loyal disciples of the evil economic Wizard of Washington.

This case might not be so scary, except for the fact that it is not a work of fiction, as was Shelly’s original novel; it is based on a true story. The facts are plain for anyone to discover. The Fed is a Frankenstein monster, created by well-meaning but misguided politocrats who jealously guard their elitist, statist power and control over virtually every aspect of the political economy.

The problem is, this concentration of power is un-American, contrary and repugnant to the Constitution. Although the Federal Reserve impacts every aspect of economic activity in the United states, and has major influence in global economics, there is no check or balance on the Federal Reserve in our Republic. It was not without good reason that Jefferson and Madison opposed the first United States central bank. Creation of such an institution is not among the Enumerated Powers, and to this day, it could be argued that its very existence is un-Constitutional. In addition, the Federal Reserve and those non-elected bankocrats have likely committed crimes against persons, crimes against property, felony theft, extortion, foreign corruption, constructive fraud and conspiracy to commit felonies, among other crimes. The Federal Reserve could be judged to be a criminal enterprise. Every citizen who respects the Constitution and the Rule of Law should act to bring this federal Frankenstein monster and its accessories to justice.

Recently, former FOMC member, Jeremy Stein, called for the Fed to tighten now, well ahead of schedule, in order to unwind the “Fed Put”. In an interview with a reporter from the New York Tines this week, Stein said “Markets seem to sense an element of a Fed put, and that complacency can be a source of risk in itself, so you have to push back on that a bit.” Whenever the Fed decides to tighten, the markets will sell off. In fact, traders may hit the sell button with just a hint the Fed may raise interest rates.

The fundamental problem with the Fed (aside from its illegitimacy) is the Fed has caused, and is causing, more harm to the US (and global) economy than good. That’s a direct consequence of its intervention in the credit markets. The Fed has a history of doing precisely the wrong thing in response to economic crises. In the 1930’s the Fed contracted the money supply when they should have expanded (if they had any legitimate authority to act at all). The wrongheaded move actually extended to Great Depression (Freidman and Schwartz). Complicit in this injury was FDR and his socialist minions whose massive federal programs transformed the country into a quasi-socialist state. (Social Security,WPA, and other collective redistribution schemes).

In the last decades, the “Masters of the Universe” at the Fed have caused the Great Recession (along with the Congress who legislated “moral hazard” into the housing market), and are now creating a huge bubble in the equity markets by artificially suppressing interest rates. This is the classic case of what von Mises called “malinvestment”; the consequence of government intervention in the credit markets that masks the true price of assets (including interest, a measure of the demand for money). Such statist manipulation always ends badly.

About two weeks ago, Fed Chair Yellen delivered the Keynote at the Jackson Hole economic summit. The night before her speech, she sat down at the rustic bar at the Blue Heron, which is equipped with a gilded Ouija Board. The Queen of the Doves inquired, “Can I stay longer at the Ball?” Observers of the Invitation-Only event may yet reveal some lively discussion at the closed door meeting. Yellen’s prepared remarks could be interpreted in almost any way; this Fed chief has leaned to obfuscate in classic Greenspan fashion.

In the weeks following the economic summit, traders have confirmed the Fed Put is alive and well. The S&P 500 Index has closed over 2000 for the first time.Gold is hovering near the 1260 after clinging to the 1300 support level for several weeks.

While stocks have soared on the Yellen Put, gold is moved more sideways than up as the Fed has tapered its Quantitative Easing (QE). We can see on the monthly chart that spot gold is trading near the .236 Fibonacci retracement level, and has traded at key Fib retracement levels since the high of October 2012.

The Ichimoku indicators are mixed with a bearish bias for spot gold on the weekly basis chart. Price action over the last four months has formed a weak symmetric triangle pattern, which may signal the development of a new trend if the price of gold breaks above or below the trend lines, with confirming volume) that form the triangle pattern. The separate MACD oscillator is neutral, which is another indication that gold is trading in a sideways manner.

Which way will gold move in the near term? Well, gold is likely to trade lower, along with the Euro, as a result of imminent economic policy changes in the EU. Mario Draghi might be ready to throw in the towel on its monetary policy, which has failed to jump start the European economy, despite massive Quantitative Easing by the ECB. Instead, he might turn to responsible fiscal policy (mon Dieu!). Recall that socialist Francois Hollande was swept into office on his promise to drop Austerity in favor of welfare state overspending.

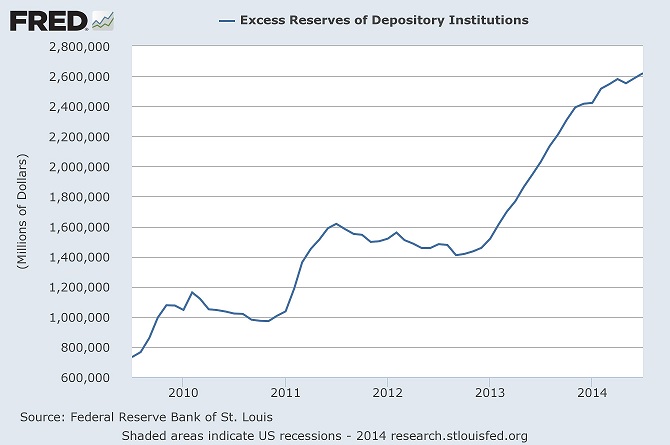

Whichever path Mario Draghi decides to take, in the longer run, gold is likely to climb. That’s because inflation will become more evident to everyone, and will take center stage in the professional debate on economic policy. Consumers know better than to believe government reports about low inflation, or GDP growth for that matter. The Federal government has been “managing” all measures of the economy for political reasons since 2008. More importantly, the Fed has created a massive store of liquidity, $2.6 Trillion of which is held by Fed member banks as “excess reserves”.

When the banks start lending again, they will flood the economy with new fiat money at the same time output (GDP) is sluggish. Prices will rise for consumers and producers alike, which will reduce the purchasing power of the Dollar because average wages have declined each year for the last six years. Rising inflation will further dampen consumer demand, which will continue to slow economic activity, in a slow spiraling decent into recession.

Savvy investors can anticipate the oncoming flood of inflation by owning real money. Real money holds its value while fiat money shrinks in value due to Fed-induced inflation. The Fed created a monster that eats away at your wealth, and it is lurking in your neighborhood. Stay safe by owning gold.

Responsible citizens and prudent investors protect themselves and their wealth against the ambitions of over-reaching government authority and debasement of the currency by owning gold. Gold is honest money. Investors from around the world benefit from timely market analysis on gold and silver and portfolio recommendations contained in The Gold Speculatorinvestment newsletter, which is based on the principles of free markets, private property, sound money and Austrian School economics.

The question for you to consider is how are you going to protect yourself from the vagaries of the fiat money and economic uncertainty? We publish The Gold Speculator to help people make better decisions about their money. Our Model Conservative Portfolio has outperformed the DJIA and the S&P 500 by more than 3:1 over the last several years.