Micron surges after one of the biggest beats in U.S. semis history

In the first installment of kicking the tires on alternatives to the standard 60/40 US stock/bond asset allocation, I reviewed three relatively tame possibilities. The results, based on adding various flavors of foreign equities and fixed income, were less than impressive, albeit in part because US markets have been on a tear in recent years. Let’s take another dive into the possibilities with a more radical approach with a volatility ETF.

For the uninitiated, vol ETFs are funds that target stock market volatility as an asset class. The standard approach is holding VIX futures contracts. The basic idea is that these futures, which are proxies for market vol (i.e., risk), tend to be negatively correlated with S&P 500 returns and so a sharp market correction will be offset with a sharp gain in VIX futures. As such, holding vol is a potent counterbalance to market corrections.

Let’s note up front that there are significant hazards to consider with vol ETFs, particularly in a buy-and-hold context. Given the tendency for the stock market to rise over time, VIX ETFs are destined to lose money. The longer you hold these funds, the deeper the loss (assuming a buy-and-hold strategy). Rather, the intent (at least according to some traders) is to use VIX ETFs on a tactical, rather than strategic, basis.

Let’s dispense with that advice in this test. Why would we do that? The short answer was outlined recently by a risk manager on the value of a dedicated “convexity strategy” through time. David Dredge, CIO of Singapore-based Convex Strategies, discusses the details in a podcast at Macro Hive, explaining that the standard 60/40 stock/bond mix is a crude tool for managing market risk. Instead, he recommends allocating some portion of a risk portfolio to long vol strategies.

To be clear, Dredge doesn’t recommend vol ETFs per se and so the following in no way reflects how his firm manages vol for clients. Note, too, that there are many alternatives to vol ETFs, including options, futures and other derivatives. Suffice it to say, Dredge’s strategies are more sophisticated than what’s presented below.

That said, the goal here is to look for some perspective on how adding a vol allocation to a 60/40 portfolio changes the risk/return profile. In practice, you’d almost certainly use something other than vol ETFs for a dedicated long allocation à la the ideas discussed by Dredge and other risk managers. But as a first approximation of how these strategies can work, it’s easy to test the idea with vol ETFs.

With that in mind, consider how a standard 60/40 portfolio stacks up against shifting various amounts of the bond allocation to ProShares VIX Mid-Term Futures ETF (NYSE:VIXM).

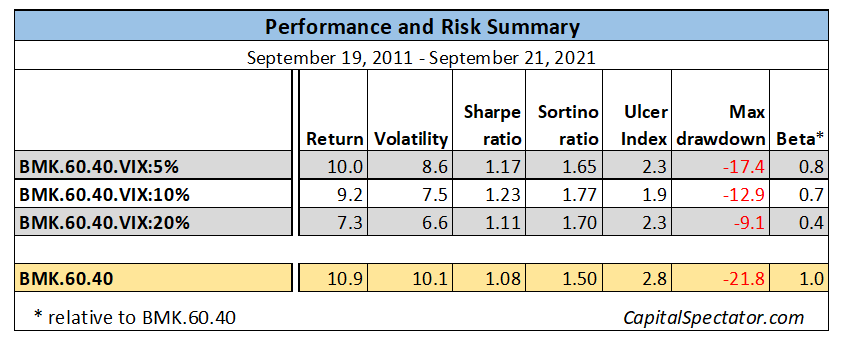

For the benchmark stock and bond allocation, I’m using Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) and 40% in Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), with a start date a decade ago (Sept. 19, 2011). For the vol allocations, varying degrees of the bond (BND) allocation are moved to VIXM. Specifically, there are three portfolios of 5%, 10% and 20% in VIXM (with corresponding reductions in BND). In all cases, US stocks (VTI) remain at a 60% target weight. Note, too, that all portfolios are rebalanced to target weights at the end of each calendar year.

Here’s how the wealth indexes stack up via return and some basic risk metrics:

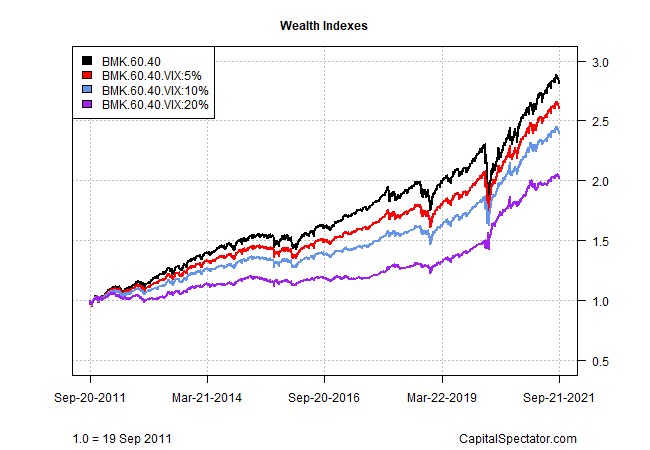

Next, consider a visual review of performance over the ten-year window:

Although the standard 60/40 portfolio (BMK.60.40) outperforms, the risk-management benefits of adding VIXM to the strategy isn’t trivial. Notably, Sharpe and Sortino ratios are higher in all three alternative portfolios and the maximum drawdowns are substantially softer. In other words, the reduction in return is arguably more than offset with lesser risk. Not too shabby when you consider that these alternative strategies require no forecasting or timing skills.

In the real world, these results can be further enhanced with greater efficiency in derivatives products, in part by reducing costs—Morningstar reports that VIXM charges a hefty 0.87% expense ratio. Caveats aside, this toy example suggests that a dedicated allocation to volatility can deliver satisfactory results in the search for an alternative to the standard 60/40 strategy. All the more so if the easy winnings in US stocks and bonds over the past decade transition to a higher-risk environment and lesser performance, as some analysts predict.