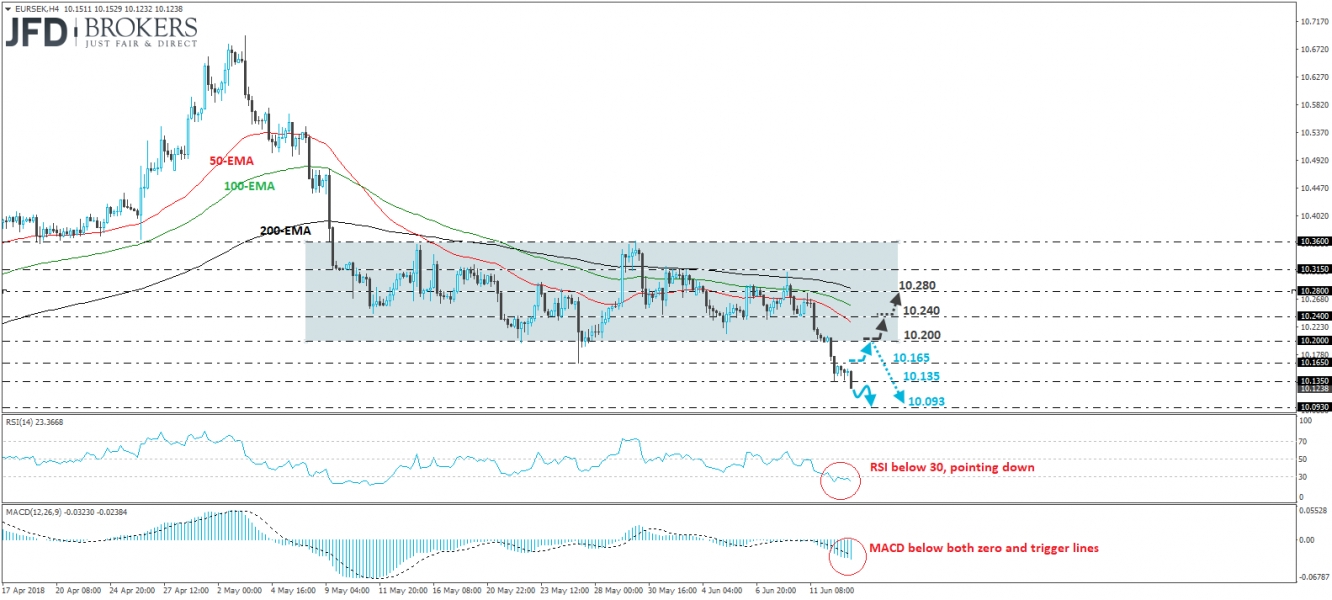

EUR/SEK traded lower during the European morning Wednesday, breaking below the support (now turned into resistance) hurdle of 10.135. Yesterday, the rate dipped below 10.200, the lower bound of a sideways range that had been containing the price action since the 9th of May. Therefore, we would consider the short-term outlook to have turned negative.

We believe that the break below 10.135 may have opened the way for our next support zone of 10.093, marked by the low of the 22nd of March. If that level fails to prevent the price from falling further, then we may see extensions towards our next key support zone of 10.055.

Our short-term momentum indicators detect strong downside speed and corroborate our view. The RSI stands within its below-30 zone and is pointing down, while the MACD lies below both its zero and trigger lines, pointing south as well.

On the upside, a move back above the 10.165 hurdle may push the rate to test 10.200, the lower end of the aforementioned range, as a resistance this time. However, even if this is the case, the near-term outlook would stay negative in our view. We would still see a decent chance for the bears to jump in near 10.200 and drive the battle lower.

We prefer to wait for a move back above 10.200 before we change our view to flat. Such a move would bring the rate back within the range and could initially aim for the 10.240 level. Another break above 10.240 could target our next resistance of 10.280.