- · Tumbling inflation erodes euro’s gains as dollar perks up despite rate cut bets

· Wall Street loses some steam but stocks still set for best month of the year

· Oil prices climb cautiously as OPEC+ output decision awaited

Euro falls victim to rate cut frenzy

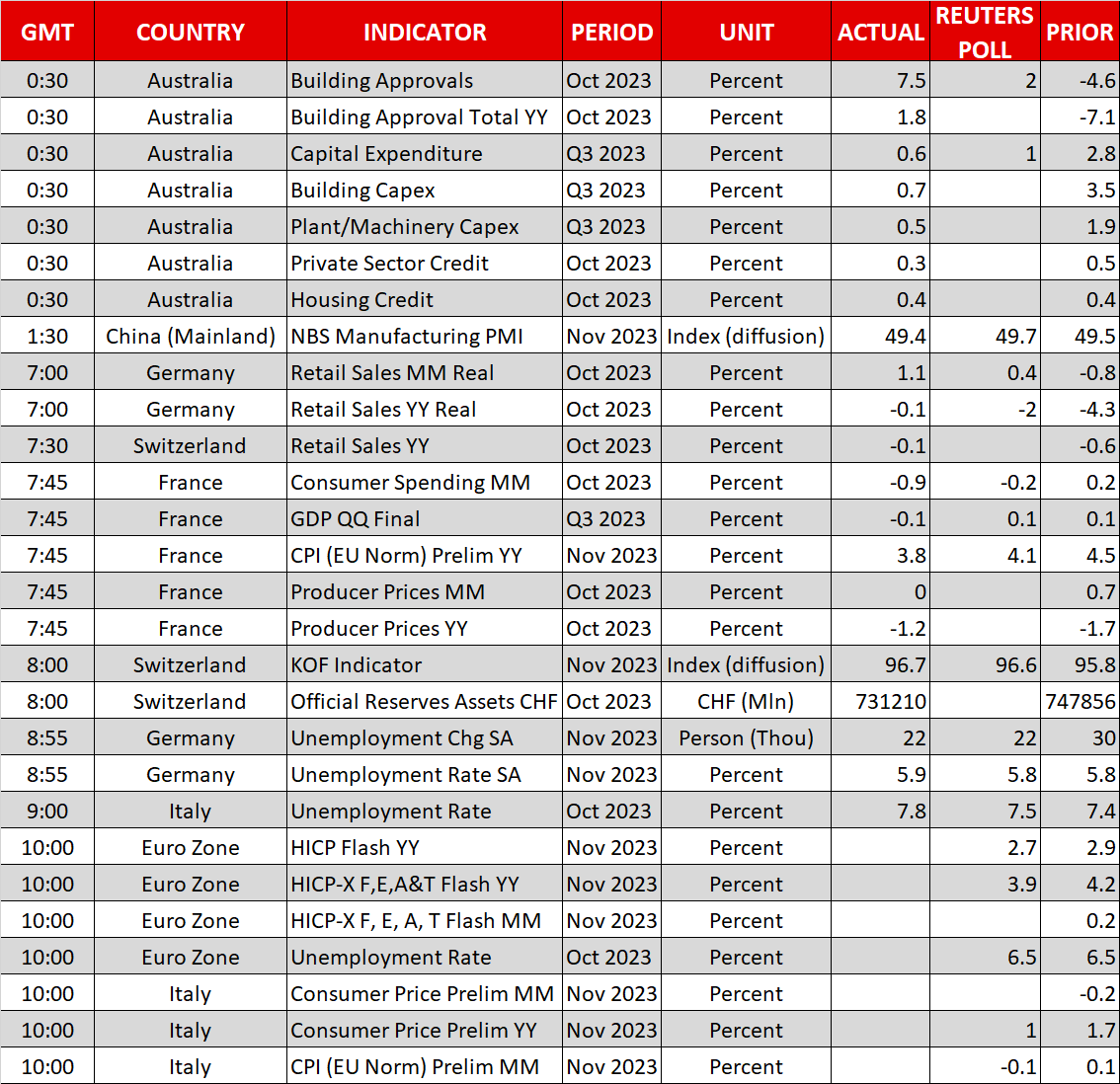

The euro took a dive on Thursday, retreating from three-and-a-half month highs against the US dollar, as weaker-than-expected CPI numbers out of the Eurozone pressured the single currency. Inflation in the euro area plunged to 2.4% y/y according to the flash estimate for November – the lowest since July 2021.

The core measure that excludes all volatile items also declined by more than forecast, slipping to 3.6%, which was the first reading below 4.0% since June 2022.

The data boosted expectations that the European Central Bank will begin slashing rates sooner rather than later, with the latest market pricing suggesting that the Europeans may beat the Fed with the first rate cut of the cycle.

Investors have fully priced in a 25-basis-point rate reduction for the ECB by April, while the first fully priced cut for the Fed is not anticipated before May.

Although the ECB is unlikely to make a dovish pivot before core inflation is a lot closer to its 2% target, it can be argued that the much weaker economic backdrop in the euro area combined with lower energy prices build a stronger case for looser policy in Europe than in America.

Even if the Fed were to start cutting rates around the same time as the ECB, the much tighter labour market in the US will probably reduce the scope for very aggressive easing. The same cannot be said for the ECB and this raises question marks about the euro’s latest uptrend against the greenback.

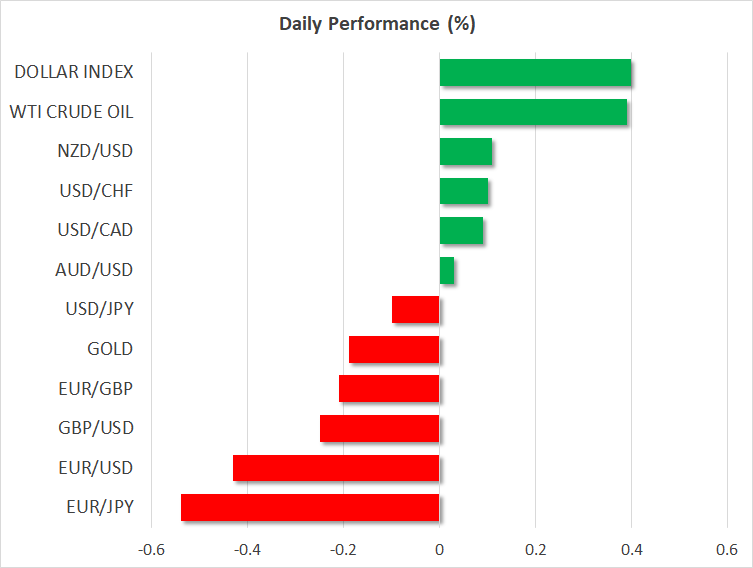

The euro came just shy of cracking the $1.10 level yesterday but has since fallen back to around $1.0920.

Dollar extends rebound from 3½-month low

The US dollar edged higher on Thursday, extending its recovery against a basket of currencies for a second day after hitting the lowest since mid-August. The turnaround comes even as rate cut expectations for the Fed remain elevated and Treasury yields dipped further on Wednesday, brushing fresh lows.

The surprise rebound in the US currency is probably down to several factors. Expectations that the ECB will be among the first of the major central banks to cut rates has taken the steam out of the euro’s upswing, while speculation that the Bank of Japan is stepping closer to exiting negative rates has bolstered the yen lately.

In addition, the upward revision to US GDP growth for the third quarter to an astonishing 5.2% annualized rate likely served as a reminder of just how strong the American economy has been.

Core PCE and Powell comments eyed

Still, it’s just as possible that this is simply an overdue technical correction for the greenback after the past month’s sharp selloff. The downtrend may resume if today’s data underscore the view of a slowing economy and receding inflationary pressures.

The all-important core PCE price index is due at 13:30 GMT alongside the personal spending and consumption prints for October.

Investors are also waiting for Fed Chair Powell’s remarks tomorrow to see if his views are more closely aligned to those of Waller, who struck an unexpectedly dovish tone on Tuesday, or to those like Barkin who are still keeping the door open to another rate hike.

With financial conditions loosening lately amid the rally in equities and the slide in Treasury yields, it will be interesting to see whether Powell is ready to start talking about rate cuts.

Stocks remain buoyant, oil up ahead of OPEC+ decision

Any pushback against market expectations could hurt stocks, though for the time being, the positive momentum on Wall Street appears to be holding despite a modest pullback yesterday, which mainly affected the Big Tech.

The S&P 500 closed marginally in the red on Wednesday, but futures are in positive territory today, on track to finish the month almost 9% higher.

Shares in Asia are also maintaining an upbeat mood, shrugging off disappointing PMI numbers out of China earlier in the session.

In commodities, oil prices were heading higher for a third day in anticipation of fresh efforts by OPEC+ countries to restrict supply.

It’s unclear if any decision by OPEC+ to reduce production will go far enough amid disagreements within the alliance on the scale of the cuts. If OPEC+ fails to reach a decision today, that would send a strong signal that the differences are very wide.

For now, though, the expectation that some sort of an agreement is on the cards is helping oil futures to climb to three-week highs.