World equity indices traded higher yesterday and today in Asia, with the Japanese yen being the main loser among the major currencies. With no clear catalyst behind the improvement in risk appetite, we believe it may be due to some ongoing developments being already priced in.

Market Sentiment Improves With Yen Staying In a Free-Fall Mode

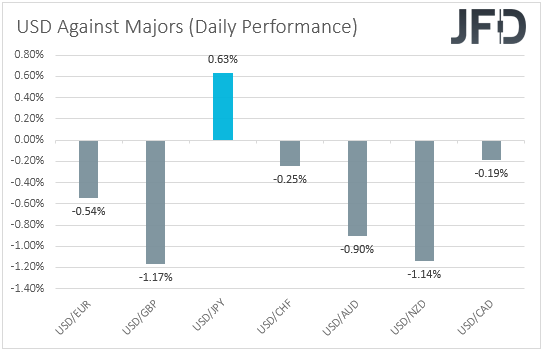

The US dollar pulled back against all the other major currencies on Tuesday and during the Asian session Wednesday, except the Japanese yen. The greenback lost the most ground versus GBP, NZD, and AUD in that order.

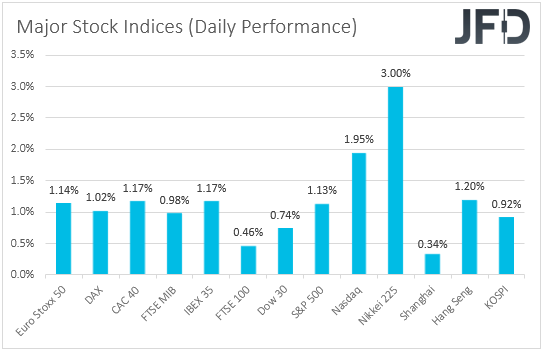

The weakening of the US dollar and the Japanese yen, combined with the strengthening of the pound, the Aussie and the Kiwi, clearly suggests that markets traded in a risk-on manner yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU and US indices were a sea of green, with the positive morale rolling into the Asian session today.

With no clear catalyst behind the improvement in risk appetite, we will say that this adds credence to our view for some further advances, although we are still reluctant to call for a long-lasting recovery. The reasons we believe that further advances may be looming amid a still-raging war in Ukraine are two.

Firstly, as we explained yesterday, nowadays, the setbacks on negative headlines are lesser than the advances we get when there is a glimpse of hope. Maybe most participants remain optimistic that some progress could still be made in talks between Russia and Ukraine. Maybe they believe that no other nation will need to get involved militarily and that a two-nations level conflict has already been priced in.

The second one has to do with monetary policy. Yes, Fed Chair Powell appeared overly hawkish on Monday, raising speculation that he and his colleagues may need to lift rates by 50 bps at the upcoming gathering. According to the CME FedWatch Tool, there is a 66% chance for such an action.

However, investors have been aggressively hawkish even before the Fed released its new dot plot, which pointed to 6 more quarter-point hikes by the end of the year. Thus, a very aggressive Fed may also be priced in, to a large extent, and that’s probably why we see equities keep climbing higher.

As for why we are reluctant to call for long-lasting recovery, it is because of the war in Ukraine. Anything pointing to this escalating to something even worse could hurt risk appetite again. And what do we mean by something worse? An example is more nations getting directly and militarily involved in the conflict.

Now, as for the currencies, the yen has been in a free-fall mode lately, and besides the improvement in risk appetite, another important reason for that may be the fact that other major central banks, like the Fed and the BoE, are raising rates at a time when the BoJ is maintaining an extra-loose policy. Therefore, the widening monetary policy between the BoJ and the rest of the world is likely to continue weighing against the yen for a while more.

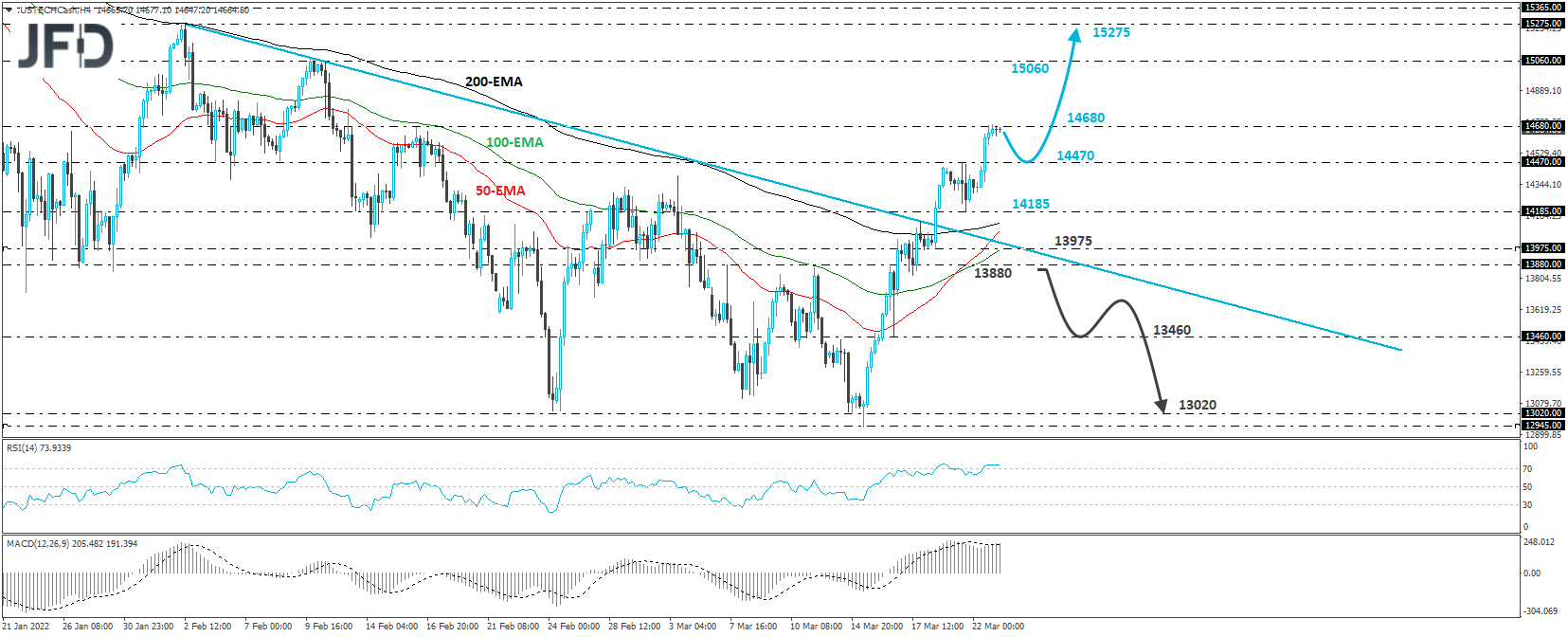

NASDAQ 100 – Technical Outlook

The NASDAQ 100 cash index traded higher yesterday, breaking above Monday’s high of 14470, thereby confirming a forthcoming higher high on the 4-hour chart. This, combined with the fact that the index continues to trade above the downside resistance line drawn from the peak of Feb. 2, keeps the short-term picture positive.

Even if we see a small retreat after testing the 14680 zone, marked by the high of Feb. 16, we see decent chances for the bulls to retake charge soon and perhaps push the index higher. If they manage to overcome the 14680 territory this time around, we may see them pushing towards the 15060 zone, marked by the high of Feb. 10, where another break could see scope for extensions towards the high of Feb. 2 15275.

To abandon the upside case and start examining whether the bears have gained the upper hand, we would like to see a break below the 13880 zone, marked by the inside swing high of Mar. 11. This could also mean the return of the index back below the aforementioned downside line, and thus, we could experience extensions towards the 13460 zone, marked by the low of Mar. 16.

Another break below that barrier could pave the way towards the 13020 barrier, marked by the low of Mar. 14, or the 12945 zone, marked by the low of the day after.

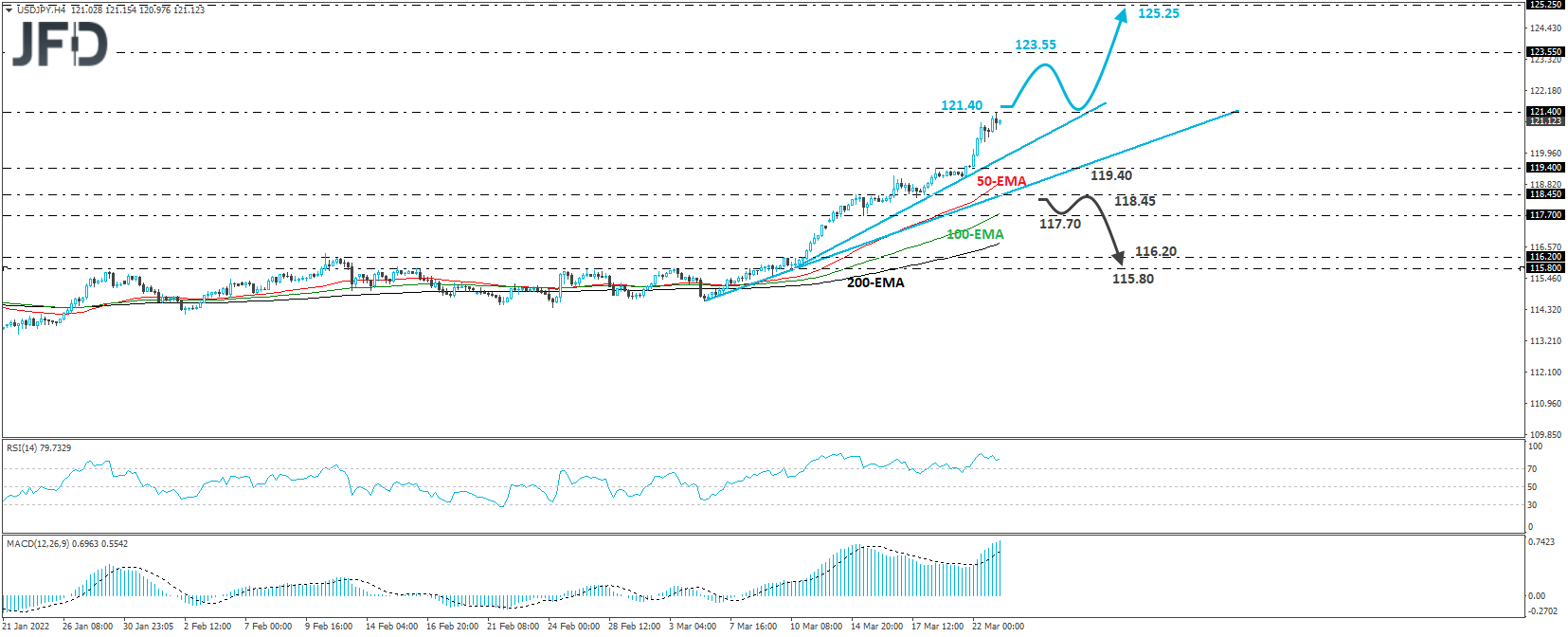

USD/JPY – Technical Outlook

USD/JPY continued trading in a rally mode yesterday, breaking above the 119.40 barrier, marked by Friday’s high. Although the rally was paused near the 121.40 level, the rate remains above the upside support line drawn from the low of Mar. 10 and well above another line, taken from the low of Mar. 4. Having that in mind, we will consider the short-term picture to be positive.

We believe a break above 121.40 could encourage more bulls to join the action and perhaps drive the rate towards the 123.55 zone, which provided strong resistance between Nov. 6 and Dec. 18, 2015. If the bulls are not willing to stop there this time, they could aim for the peak of Aug. 11, 2015, at 125.25.

We will start examining a bearish trend reversal upon a break below the 118.45 level, marked by the low of Mar. 18. The rate will be below both the aforementioned upside lines. It may initially target the 117.70 barrier, marked by the low of Mar. 15, the break of which could carry larger bearish implications, perhaps opening the path towards the 116.20 zone, marked by the inside swing high of Mar. 10.

As for Today’s Events

During the early European morning, we already got the UK CPIs for February, with both the headline and core rates rising by more than the forecasts suggested. At last week’s meeting, BoE officials decided to hike interest rates by another 25 bps via an 8-1 voting, with the dissenter calling for no increase at all.

Remember that officials lifted rates by 25 bps at the February gathering, but the vote was 5-4, with the dissenters calling for a 50 bps increase. Last week’s decision revealed a more cautious approach by policymakers and raised questions as to whether they will proceed as aggressively as the market has been pricing in heading into the gathering.

Nonetheless, accelerating inflation above the bank’s target of 2% may have revived some expectations that the bank may need to act more quickly. Later in the day, UK Chancellor Rishi Sunak made his Spring Budget Statement, where he could announce more measures to help households and small businesses amid surging fuel and other prices.

As for the data, in the US, we have new home sales for February, with the forecast pointing to a slight increase compared to January. Besides UK Chancellor Sunak, we have a few more speakers on the agenda, including Fed Chair Powell again and BoE Governor Bailey.