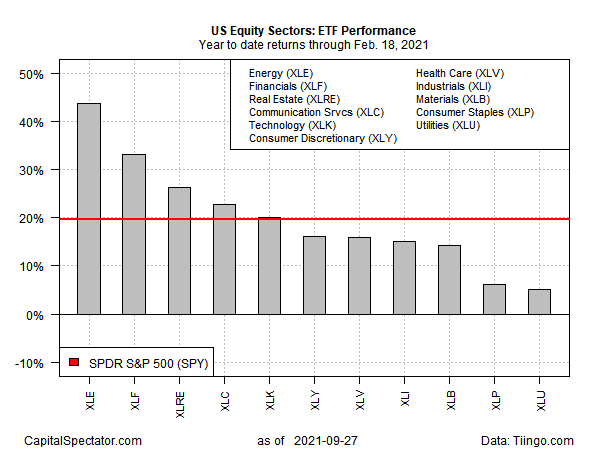

As oil and gas prices soar, energy shares are back on top for year-to-date performance for US equity sectors through Sep. 27, based on a set of exchange traded funds.

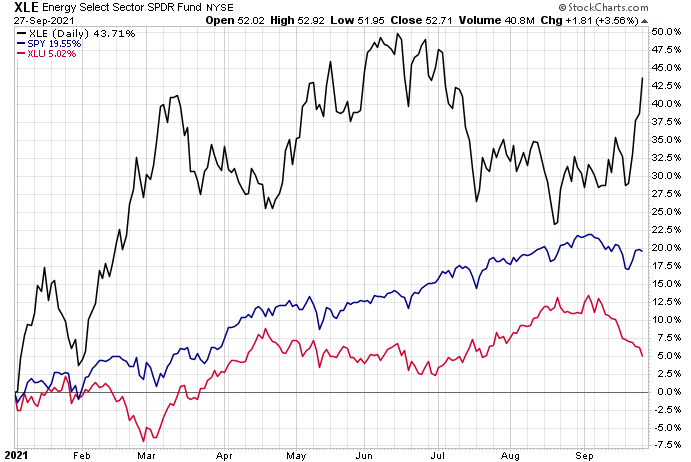

Energy Select Sector SPDR Fund (NYSE:XLE is up nearly 44% so far this year, marking a dramatic rebound after a summer of weakness.

Analysts are pointing to supply shortages as the catalyst for the recent runup in energy prices, a bounce that’s driving stocks in this sector higher.

“While we have long held a bullish oil view, the current global oil supply-demand deficit is larger than we expected,” advise Goldman Sachs strategists in a note to clients.

Highlighting the shift in expectations: Brent crude oil, the international benchmark, topped $80 a barrel on Tuesday – the highest since 2018. “In oil we’re over $80 a barrel this morning on a Brent basis and we look at the rig counts in the U.S. and other parts of the world, they’re showing you that, hey, $80 a barrel is simply not enough,” says Jeff Currie, who heads up commodities research at Goldman Sachs (NYSE:GS).

Financials and real estate are distant second- and third-place sector performers this year, respectively. All the US equity sectors are posting year-to-date gains, although the laggards are far behind. The softest gain this year is in utilities via Utilities Select Sector SPDR® Fund (NYSE:XLU), which is up a modest 5.0%.

The broad stock market is up 19.6% year to date, based on SPDR® S&P 500 (NYSE:SPY).

Comparing the strongest and weakest sector performers year to date currently shows an astonishing 39 percentage-point spread by way of surging energy stocks (XLE) vs. sinking prices for utilities (XLU).