July 29th was the last time the major U.S. indices all closed at new highs. Why do the markets continue going higher? Its called ‘quantitative easing’, and you know what? It’s far from over, and going to take a lot of time to unwind the last 10 years of it.

Last quarter the Russell 2000 outperformed the S&P by 4.16%, its largest monthly beat since November of last year. According to FactSet, despite the geopolitical risks, the S&P rose 4% in the 3rd quarter, its 8th consecutive quarter of gains. Factset said, ‘stocks have more room to advance’, with an unusually high number of S&P 500 companies issuing positive revenue guidance for the third quarter.

There was another repeat of the overnight price action Sunday night into Monday morning; buy the Globex weakness. The low overnight was 2517.00, and the high came in at 2523.50, with total volume of 155,000 futures traded. The first print on Mondays open came in at 2518.50, and then the futures ran up to 2525.75. After the high was made, the ES pulled back to down below the vwap at 2520.00, and then rallied back up to 2522.75, before pulling back down to 2520.25, one tick above the previous pull back. From there, the ES rallied back up to 2522.00, and then sold off down to 2519.00 as the Nasdaq 100 futures (NQZ17:CME) sold off down 5985.75. After the NQ bottomed, the ES traded back up to 2524.75. Throughout the decline, financial stock were firm, and kept going up.

It was another long trading day. After the initial selloff from the early high, the ES grinded higher, but there was almost no movement. Even when the NQ downticked the ES held tough. I know there are a lot of traders that wanted to sell the ES if it got to 2525, but I do not think the 6 handle drop down to 2519 was the selloff people were looking for. The dilemma for trades is plain and simple; the ES is up too high to buy, and too firm to sell.

After 2:00 pm CT, the MiM started to show anywhere from $274 million to $111 million to buy, and as it did, the ES went ‘bid’ trading up to a new daily high of 2528.00 going into the 3:15 futures close. The overall price action was one of very small dips, followed by new highs. There was no let up, but there was a lack of trade.

In the end the S&P 500 futures (ESZ17:CME) settled at 2526.25, up +10.25 handles, or +0.40%; the Dow Jones futures (YMZ17:CBT) settled at 22507, up +161 points, or +0.71%; the Nasdaq 100 futures (NQZ17:CME) settled at 5980.50, down -2.00 points, or -0.03%; and the Russell 2000 (RTYZ17:CME) settled at 1512.50, up +19.60 points or +1.29% on the day.

While You Were Sleeping

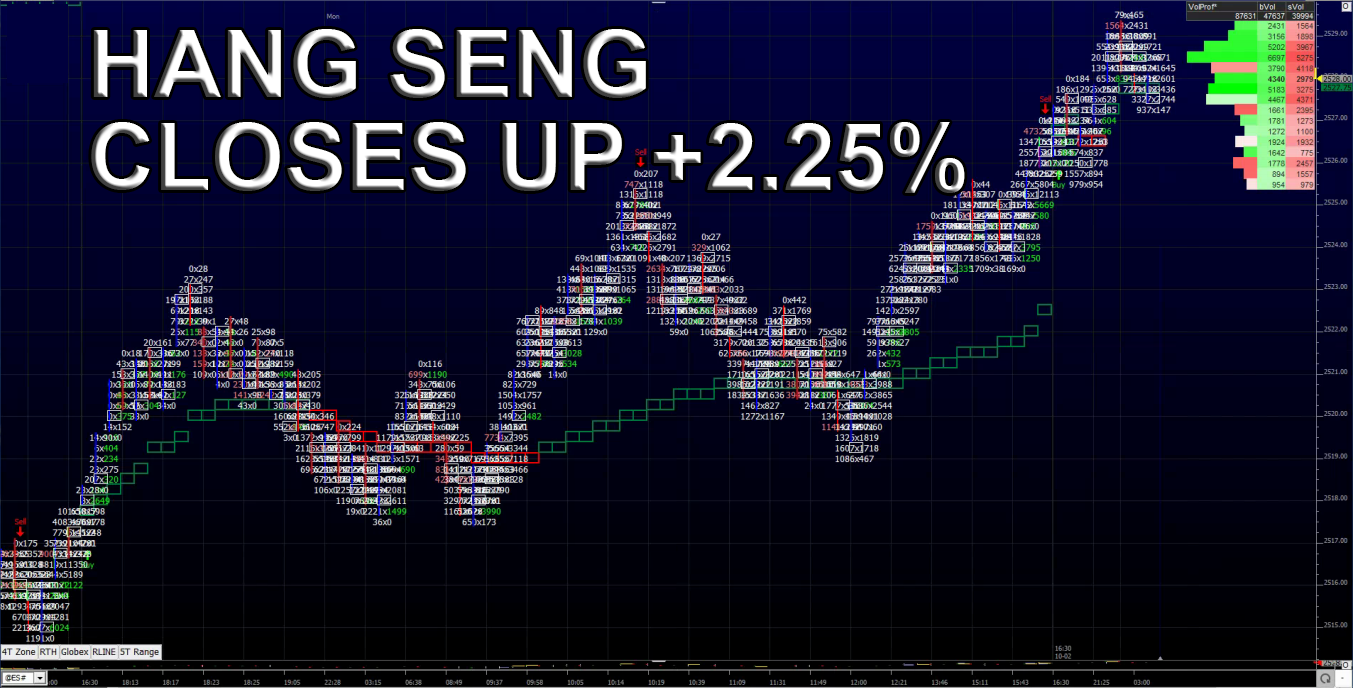

Overnight, equity markets in Asia traded mostly higher, and were led by the Hang Seng Index, which closed up a whopping +2.25%. Meanwhile, in Europe, stocks are also trading higher, with the OMX Helsinki Index leading the charge at +0.50% this morning.

In the U.S., the S&P 500 futures opened last night’s globex session at 2527.25, and were held to just a 4 handle range overnight. It was another low volume/low volatility night for the S&P 500 futures. As of 7:00am CT, the last print in the ES is 2528.00, up +2.00 handles, with 80k contracts traded.

In Asia, 9 out of 11 markets closed higher (Shanghai +0.29%), and in Europe 9 out of 12 markets are trading higher this morning (FTSE +0.10%).

Today’s economic includes Tuesday: Data — Motor Vehicle Sales, Gallup US ECI (8:30 a.m. ET), Redbook (8:55 a.m. ET); Fedspeak — Jerome Powell Speaks (8:30 a.m. ET); Earnings — Lennar (NYSE:LEN) (6:00 a.m. ET).

Our View

Another Globex session, and another all time high. While we are not trying to call tops, it just feels too high to buy higher. There was end of the month money working on Friday, and first of the month money on “Mutual fund Monday”. What we are left with is a “too high to buy and too firm to sell” market.

We think with Yellen speaking tomorrow, and the unemployment number coming up on Friday, that this rally may turn into ‘back and fill’ for now. A pullback down to the top of last week’s range and yesterday’s low of 2517.75 would be a good opportunity for buyers, but even a 20 handle pullback from the 2529.50 high into the heart of last week’s range would likely be a gift.