The title of this article indicates the extreme risks from which the proposed strategies aim to profit; of course, they may also serve as hedges within portfolios. Therefore, this update of the here-linked December 2, 2019 report may assist in fine-tuning one’s timing.

That 2020’s top-to-bottom swing in the Dow could be 10,000 points, while silver’s trough-to-peak move could be $10 suggest that timing is key for those who seek to leverage their investments by being prudent with regard to entry prices. So, the encapsulated technical analysis hereunder is concerned with timing. As for other factors, valuations are at extremes and politics are merely headlines to be ignored.

Reiterating, the first ever impeachment of a U.S. president remains a possibility, since those triggering the event would be the decision makers who would be strategically seeking lower asset prices in key industries (i.e. – telecommunications, banking, etc.); the political diversion could be blamed for a sharp drop.

Of course, war would fail in that regard, as military events are almost always followed by market advances, notwithstanding any brief pullbacks. On the other hand, however, an event that triggers memories of 2001, as opposed to a military incident (i.e. – Iran) could trigger a deeper and more sustained decline.

NEVER forget, however, that the true reasons for market declines (and even precious metal lift-offs) relate only to valuations and fundamentals and nothing else. This is important for knowing to NOT be fooled by hysterical media reporting.

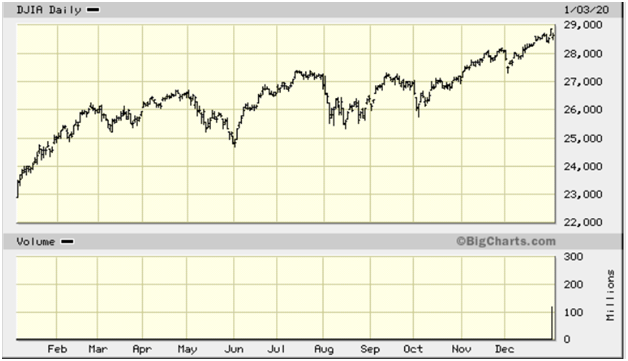

Dow Jones 30: As previously reported, trading is expected to be bound by the upper trend-line which connects the tops from December 2017 – July 2019. The recent new all-time high was again contained by that trend-line, though a blow-off could temporarily spike above it (see Dow chart below).

As for the ideal target for that blow-off, note the following excerpt from the December 2, 2019 report:

“WARNING: At major cycle peaks, I have cautioned that blow-offs occur to nice round headline-grabbing numbers. In this case, 30,000 is such a number, just as 40,000 was the Nikkei’s number to watch 30 years ago. Included in the warning, note that a fancy number serves as a “magnet” that is front-run by smart money.

“Just as the Nikkei’s summit was just over 39,000 on the first day of 1990, could the Dow peak at a level somewhere between 29,000 - 30,000 during the first week of 2020?”

Also worth noting as evidenced by these recent years’ declines, the degree of the index’s smashes have been steeper after each subsequent peak.

Major cyclical support is evident in the 18,000 – 20,000 area. I again suggest, however, that one employ strategies that do not require bearish trends for positive results (see STRATEGY/CONCLUSION, below).

Silver:

Throughout the years, I have written of silver’s time cycles and cautioned that the metal will often put in a price low a month before its time cycle bottom; the latter would mark the orthodox low, while the former would represent the unorthodox bottom. From the December 2, 2019 article:

“In the past, however, when I have written of that cycle, the metal’s unorthodox (Elliott terminology) bottom occurred a month early, as it occasionally does, thereby putting in a higher price low that coincides with the time cycle bottom.”

Indeed, as we see from the SLV chart immediately below, the lowest price of the post-September 2019 correction occurred early last month, and I would now complete one’s accumulation of silver-related investments at a higher low (see STRATEGY/CONCLUSION, below).

STRATEGY

Consistent with the forecasts implied by this article’s title, one may contemplate the following risk-defined strategies:

DOW: I strongly suggest being rid of non-precious metals-related equities and contemplate hedging strategies. Ideally, such strategies would offer substantial protection against sharp declines, while offering a positive return following bullish periods, including bear market corrections.

One must always bear in mind that most days are actually positive during several periods within any bear market.

To achieve such strategic ends, one’s strategy could involve the use of put option combinations, which include both long as well as short contracts.

SILVER:

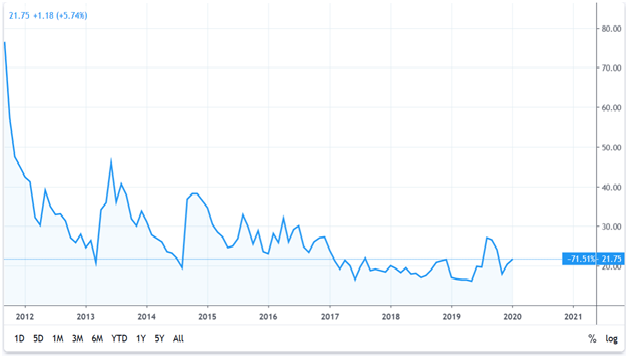

The chart of the VXSLV (SLV option time premiums) below dates back to 2011 and clearly illustrates the dramatic potential for the appreciation of volatility premiums. Even a move to 30 on the VXSLV level represents substantial profit.

If one has concerns about silver’s downside potential, one can at least note that the VXSLV really had nowhere to go but up, certainly if one believes that the VXSLV and the SLV will trend co-directionally, thereby providing a positive double-whammy for silver option speculators.

The short term charts of the VXSLV (not shown) show that a dip may be possible over the coming days, which would be consistent with a slight drop of 25-40 cents in the metal, owing to silver’s short term overbought condition.

Consistent with this section’s 2nd paragraph, and given silver options’ cheap premium levels, too much finagling looking for a better price would be illogical. Remember, this is the precious metals’ major underperformer. Gold, as always, is ahead of the curve, while others have actually put in all-time highs.

Reiterating last month’s recommended strategies one may look at 1 and 2-year call options. The historically low silver option premiums (see chart immediately below) offer speculators price levels that make longer term contracts competitively cheap when compared to shorter dated contracts; as the bull market ages, longer dated contracts will become more expensive when compared to short term contracts. This is the outcome of the market’s expectation of higher prices for the longer term.

The fact that this quantitative analysis aligns so well with the price action in the metal is a recipe for substantial profits, if managed correctly.

Also consistent with last month’s suggestions, after a break to new multi-month highs one could look to write options against the long position(s). The written (sold) position(s) would protect capital and potentially even increase the investment’s leverage, depending on how the written position(s) is/are subsequently managed.

The above was written on January 5, 2020.