- US dollar stabilizes after profit-taking pullback

- Investors agree with Fed’s ‘higher for longer’ view

- Wall Street rebounds as AI remains main driver

- Gold gains, but remains well off its record

Higher for even longer

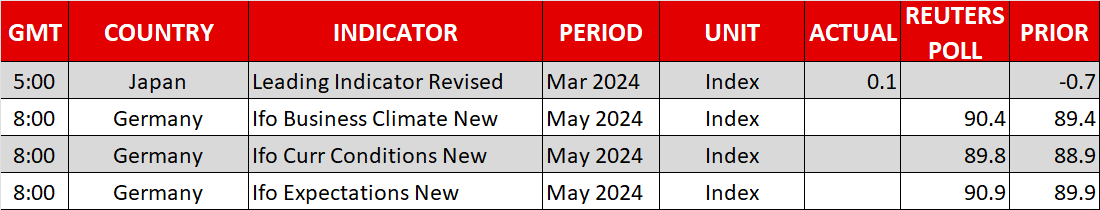

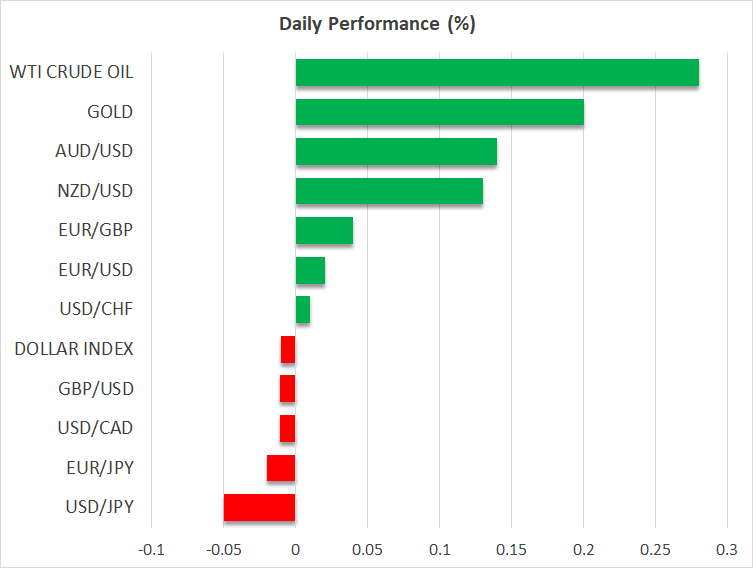

The US dollar pulled back on Friday against most of its major counterparts, perhaps as the slight dowward revisions to the UoM inflation expectations for May prompted traders to lock some profits on the long positions they initiated earlier in the week. The greenback is trading in narrow ranges against its peers today.

Despite Friday’s setback, the fundamental picture was not altered, and this is evident by the fact that Fed funds futures and Treasury yields continue to reflect the ‘higher for longer’ message reiterated by Fed officials. Investors ended the week penciling in only 34bps worth of rate cuts by the end of the year, with the probability of a September reduction dropping to 55%.

Apart from Fed policymakers, what may have also prompted market participants to scale back their rate cut bets were Thursday’s better-than-expected PMIs, which pointed to accelerating input and output costs.

With all that in mind, dollar traders are now likely to continue paying attention to remarks by Fed officials heading into Friday’s PCE inflation numbers. Today, the US markets will stay closed in observance of Memorial Day, but during the Asian session on Tuesday, the Fed chorus will start with Cleveland Fed President Loretta Mester, who will speak at a BoJ event.

AI euphoria poised to continue

The S&P 500 and the Nasdaq rebounded strongly on Friday, erasing a large portion of Thursday’s losses. The pullback in the US dollar may have helped, although investors seem to be embracing the Fed’s ‘higher for longer’ view. Perhaps the fact that Nvidia (NASDAQ:NVDA) announced stronger-than-expected revenue forecasts encouraged them to continue pricing in future growth opportunities relating to artificial intelligence (AI).

As long as this is the case, anticipating a bearish reversal on Wall Street solely due to the Fed’s repricing seems to be an unwise choice. After all, there has been a massive repricing since the beginning of the year, when the market was expecting around six quarter-point rate reductions, and yet, Wall Street stayed in uptrend mode, stretching into uncharted territories.

What’s more, the horizons of equity investors are longer than those of forex traders, thus delayed rate cuts may not be as much of a concern. As long as rate hikes are not a part of the equation, equity-market participants may be cheering the prospect of lower borrowing costs at some point in the not-too-distant future.

Is the downside correction in gold over?

Gold is trading in the green today, extending the mild recovery it started on Friday. However, it remains well off its record high posted on May 20, after which it was sold off on the Fed’s ‘higher for longer’ messages.

Overall, though, the main driver of the precious metal this year was not expectations surrounding the Fed’s future course of action, but rather, the elevated central bank purchases, especially by the People's Bank of China (PBoC), as well as safe-haven flows amid tensions in the Middle East.

With Israel attacking the southern Gaza Strip city of Rafah over the weekend, safe haven flows are likely to remain elevated, and as far as central bank purchases are concerned, China may ramp up its operations in the next few months leading up to the US elections, as a Trump victory implies the risk of worsening US-China relations. Thus, gold may eventually resume its broader uptrend, albeit at a slower pace.