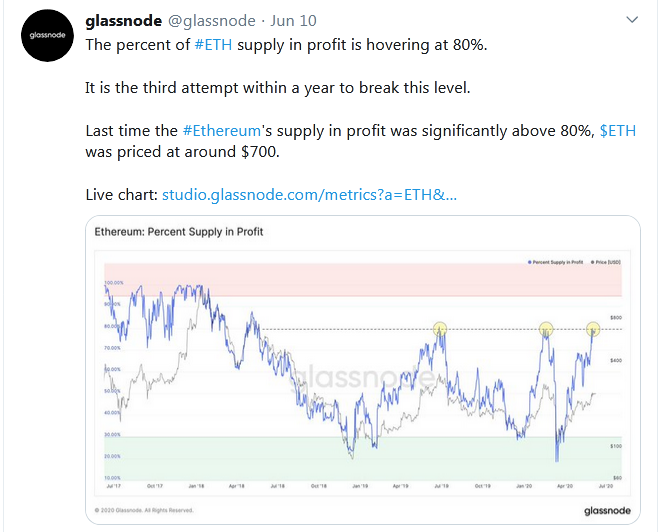

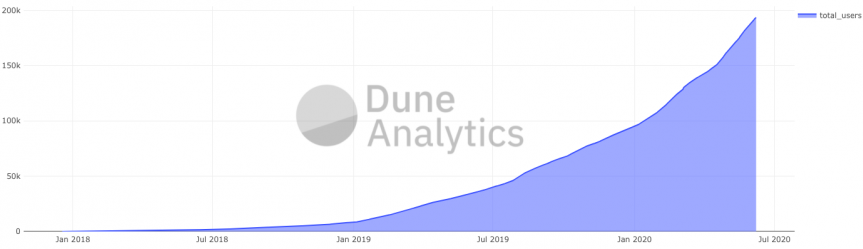

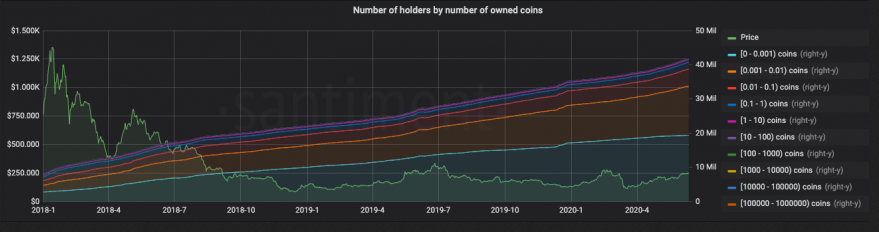

ETH investors are overcome with profits. A correction could be due. Altcoins have been the focal point of the post-March 2020 rally, as ETH investors and LINK holders have outperformed BTC by 15% and 70%, respectively. Now that over 80% of ETH’s supply is in profitable positions, are altcoins overdue for a correction? Glassnode data shows the recent rally to $250 put ETH investors firmly in the green. With over 80% of ETH supply held at a profit, investors have been accumulating the number two crypto at an unprecedented rate. This data was calculated for EOA addresses, meaning it only accounts for individual addresses and not wallet contracts. This increase in profitability is the result of increased demand from ETH investors, which is, in turn, driven by several factors. ETH is the primary currency of the Ethereum blockchain as all transaction fees, including ERC-20 token transactions, are paid in the native asset. Users must hold ETH to pay transaction fees and access the booming DeFi space too. Rising gas prices over the last few weeks and a surge in DeFi users have contributed to increasing demand for ETH. But investors as a whole are at the forefront of this rally, accumulating large quantities of ETH to sell for a profit at a later date. The data provided by Glassnode confirms that these investors were vital to ETH’s rally thus far, adding to demand but not supply (i.e., not selling). The number of holders has consistently increased since the 2018 top, but the adoption curve has grown a notch steeper this year. In 2020, seven million new ETH investors came on board as the metric rose by 20%, from 35 million to 42 million. This means more unique addresses are accumulating ETH. It could also signal that a retail burst fueling Bitcoin and altcoin rallies are beginning. Despite overwhelming positive sentiment from ETH investors, 80% of positions in profit is not sustainable over the long-term. That’s how markets work, unfortunately. Just looking at this chart, one can see that reversals often occur when a majority of ETH’s supply is deep in profit. Give investors a sense of calm before unleashing chaos in the market. Compare ETH’s 80% of supply in profit metric to BTC’s 40-45%, and the story becomes much clearer. ETH investors have led this rally ever since the Black Thursday flash crash. And they could continue to lead the crypto market by being the first the correct from these highs. This doesn’t mean a new low is in order, but rather that order must be restored to the market as coin holders are overcome with profits. Of course, the market could continue to climb higher as historical data doesn’t always predict the future. It’s worth noting that these are unrealized profits i.e., profits that have not yet been taken. A substantial correction could cause this ratio to decrease, forcing weak hands to capitulate.Key Takeaways

Altcoins Take Flight

Bearish Perspective

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Data Shows 80% Of ETH Investments Are In Profit

Published 06/11/2020, 07:41 AM

Data Shows 80% Of ETH Investments Are In Profit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.