The ongoing rally in crude oil is relentless.

Despite concerns about subdued demand as Omicron spreads across the globe like wildfire and a surging US Dollar in the wake of the hawkish FOMC meeting, so-called 'black gold' is extending its gains for a third consecutive day and appears well on its way to rising for the sixth consecutive week.

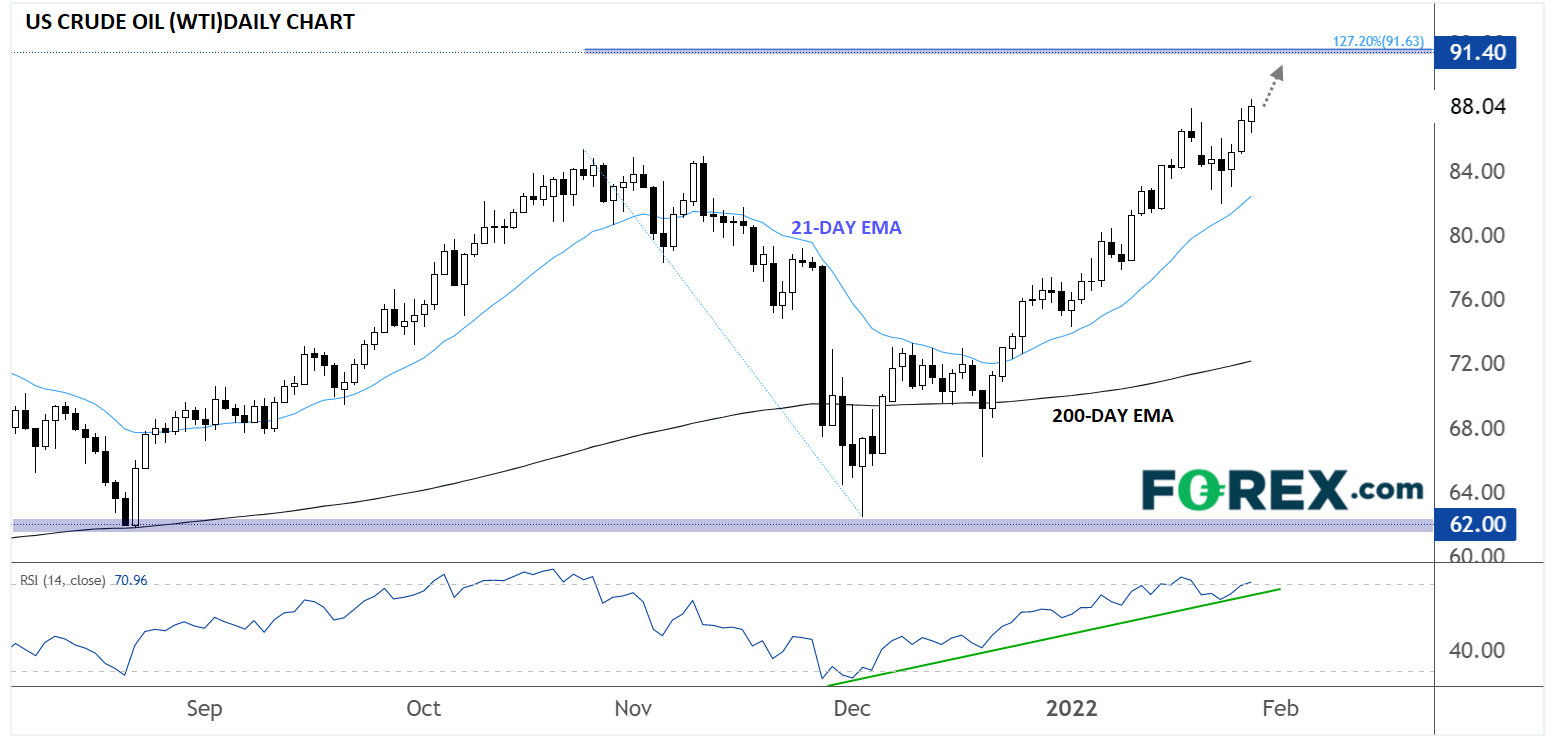

More to the point for traders, US crude oil has broken out to its highest level in over seven years above last week’s high near $88.00 and looking at the chart, there’s little in the way of meaningful resistance until above $90.00:

Source: StoneX, TradingView

As the chart above shows, the next level of resistance to watch will be in the mid-$91.00s, where the 127.2% Fibonacci extension of the Q4 pull back and previous-support-turned-resistance from back in 2014 converge. Above that level, WTI could quickly stretch into the mid-$90.00s or even make a run at $100 before stalling.

For now, technical traders will be watching short-term trend measures like the 21-day EMA and the uptrend line on the 14-day RSI indicator for any signs that the near-term bullish trend may be weakening.

Of course, we would be remiss if we didn’t highlight the fundamental factors driving oil itself. An OPEC+ source attributed the recent buying to the geopolitical tensions between Russia and Ukraine, and that theme shows no signs of fading any time soon.

Against that backdrop, OPEC+ will conducts its regular policy meeting next week, with most observers expecting the cartel to stick to its plan and ratify a small production increase of about 400,000 bpd in March. More than the supply/demand balance in the global market, many OPEC members have struggled to increase production due to local capacity constraints, so a larger increase seems unlikely any time soon.

With both technical and fundamentals seemingly pointing to continued strength in the oil market, bulls clearly have the upper hand for now.