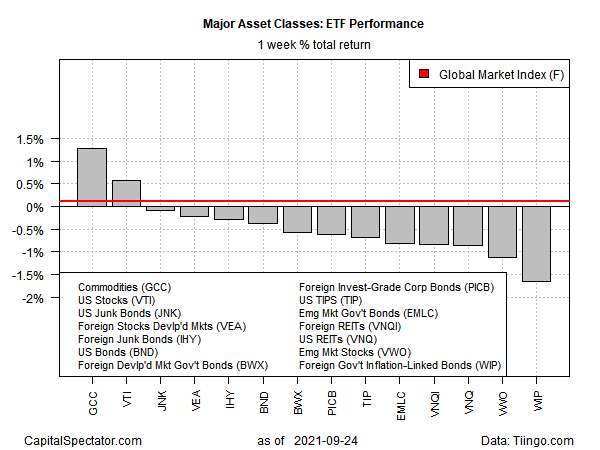

In a week of mostly lower prices for the major asset classes, a broad measure of commodities bucked the trend with a solid gain, based on a set of ETFs for the trading week ended Friday, Sep. 24.

The equal-weighted WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 1.3% last week. Despite the latest gain, GCC continues to trade in a range and the latest pop doesn’t alter the outlook for more of the same in the near term.

US stocks also rose last week. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) gained 0.6%. The advance marked the first weekly increase in the past three weeks.

US bonds, by contrast, remained on the defensive as interest rates rose last week. Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) dropped 0.4%, leaving the fund at its lowest close in over a month.

The rest of the major asset classes retreated. The biggest decline: foreign inflation-linked government fixed-income securities via SPDR FTSE International Government Inflation-Protected Bond ETF (NYSE:WIP), which slumped 1.7% — the fund’s third straight weekly loss.

Despite the widespread losses, a benchmark portfolio that holds all the major asset classes via ETFs was flat last week. The Global Market Index (GMI.F), an unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights via ETF proxies, held steady after two straight weeks of decline.

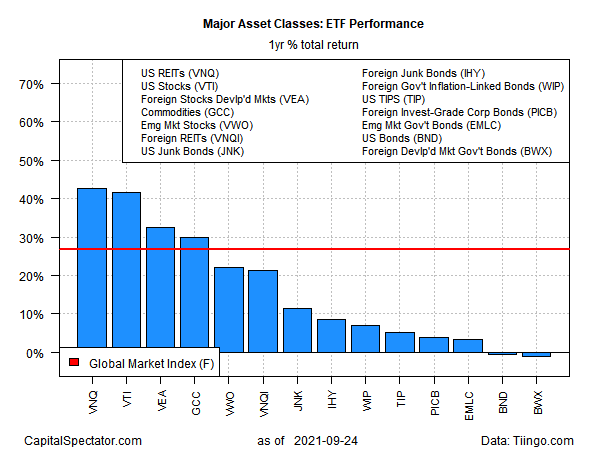

For the one-year trend, US real estate investment trusts (REITs) are narrowly in the lead. Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) is up 42.6% over the past year. That’s slightly ahead of the second-best one-year performer for the major asset classes: US shares via VTI, which is up 41.7% for the trailing one-year period.

The weakest performance for the major asset classes on a one-year basis: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond ETF (NYSE:BWX) is down 1.2% for the past 12 months.

GMI.F’s one-year return: a strong 26.7% gain.

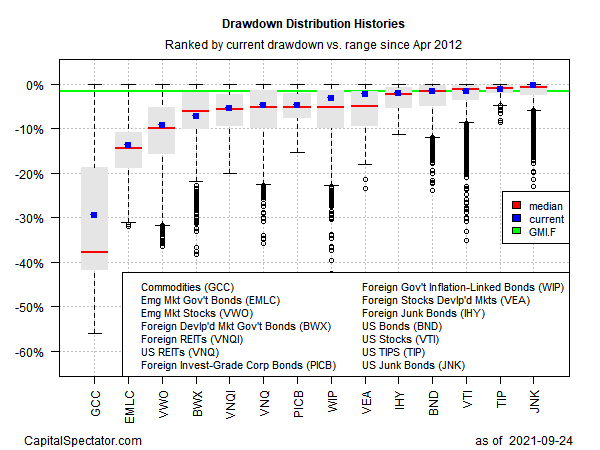

Profiling the major asset classes in terms of current drawdown still shows most markets with low to nil declines relative to their previous peaks. The biggest downside exceptions: commodities (GCC) and stocks and bonds in emerging markets (EMLC and VWO, respectively).

GMI.F’s current drawdown, by contrast, is a modest -1.8% as of last week’s close.