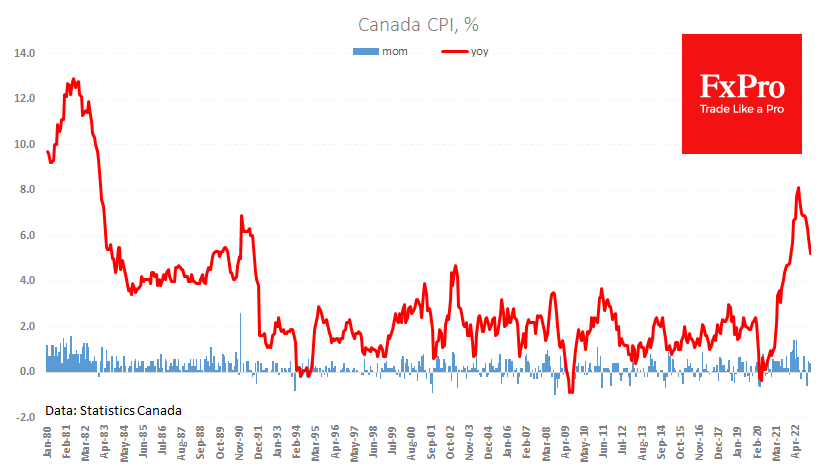

Canadian consumer prices rose 0.4% in February, with annual inflation slowing to 5.2% from 5.9%. Both figures were below expectations of 0.5% and 5.4%, respectively, reflecting a faster return to normality than economists had expected.

Consumer inflation excluding fuel and food, slowed to 4.7% year-on-year, the lowest since January last year, although the monthly increase was 0.5%.

The slowdown in the annual inflation rate can be explained by a high base effect, as prices rose by 1% per month in the first half of 2012. However, to avoid falling into the trap of an imaginary improvement, it is better to look at the monthly rate of increase.

It remained above the 0.17% needed in February to reach an annual inflation rate of 2%. Thus, inflationary pressures in Canada remain elevated, requiring the regulator to maintain a tight monetary policy stance.

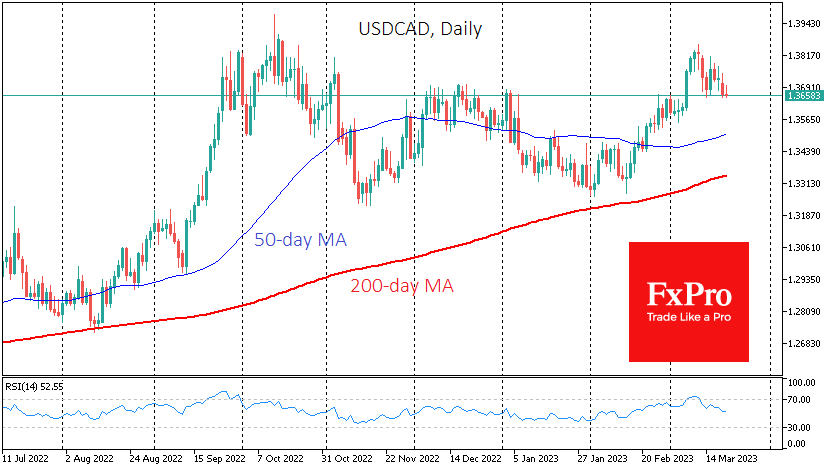

In response to the weaker-than-expected figures, the USD/CAD jumped ten pips but quickly pared the gains as high monthly price growth rates do not allow the Bank of Canada to consider its job done.

Earlier this month, the USD/CAD peaked at 1.3860 after the Bank of Canada kept rates and fears that the Fed would double its rate hike pace. However, since the 10th of March, the pair has been in a steady decline as the divergence in expected policy rates has diminished.

It will not be surprising if the Fed turns out to be more accommodative than the Bank of Canada, in line with the historical pattern. The pair's decline promises to continue in that case, with a potential medium-term target near 1.33.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Inflation Slows Due to High Base

Published 03/21/2023, 09:50 AM

Updated 03/21/2024, 07:45 AM

Canadian Inflation Slows Due to High Base

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.