According to Mish’s Economic Modern Family, the market remains mostly bullish with only the transportation sector, via iShares Transportation Average ETF (NYSE:IYT) and regional banking, via SPDR® S&P Regional Banking ETF (NYSE:KRE) sitting in cautionary phases under their 50-day moving average.

However, most of the Modern Family closed lower or flat on the day while, semiconductors ETF—VanEck Vectors Semiconductor ETF (NASDAQ:SMH)—made a large push to new highs ending +2.44% on the day.

The blatant move in tech could be showing us the next chapter of the market.

In hindsight, the tech industry was the first to recover from pandemic lows last year and is again showing strength compared to the other sectors.

Despite having been interrupted by supply chain issues, demand stayed strong in the tech space. Conversely, other sectors could be losing momentum.

With that said, one way to see if momentum is slowing or gaining is through MarkgetGauges proprietary Real Motion indicator.

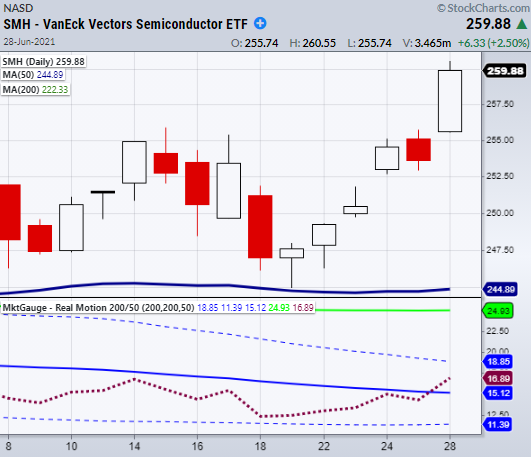

On the Semiconductors (SMH) chart, Real Motion has recently broken through its 50-period moving average.

This confirms that momentum is now following price, since the price is currently over its 50-DMA.

On the other hand, members such as Retail—SPDR® S&P Retail ETF (NYSE:XRT)—and the small cap Russell 2000 via iShares Russell 2000 ETF (NYSE:IWM) have a negative divergence with price over the 50-Day moving average and real motion under the 50-DMA.

With most of the Modern Family showing weakening or diverging momentum, will Semiconductors' break to new all-time highs drag the other indices higher, or will the rest of the family stay rangebound or begin to trend lower?

The Dow Jones Industrial Average was showing some stress.

ETF Summary

- S&P 500 (SPY) New highs.

- Russell 2000 (IWM) Struggling with resistance at 234.

- Dow (DIA) Confirmed a bullish phase with second close over the 50-DMA at 342.29, but looks weak.

- NASDAQ (QQQ) New highs.

- KRE (Regional Banks) 63.63 support. 68 choppy area.

- SMH (Semiconductors) New all-time highs.

- IYT (Transportation) 254.65 support.

- IBB (Biotechnology) 159 support area.

- XRT (Retail) 97 pivotal area.

- Junk Bonds (JNK) 109.65 now support.

- XLU (Utilities) 63.25 support. 64.50 resistance area.

- SLV (Silver) Inside day.

- VBK (Small Cap Growth ETF) 292.96 resistance level.

- TLT (iShares 20+ Year Treasuries) 140 support.

- USD (Dollar) 91.50 support.

- DBA (Agriculture) Needs to hold 18.21.

- GLD (Gold Trust) Inside day.