Key Points:

- Cable recently buoyed by negative greenback sentiment swing.

- Bank of England MPC decision likely to be the key event.

- Risks for the Cable are largely tilted to the upside.

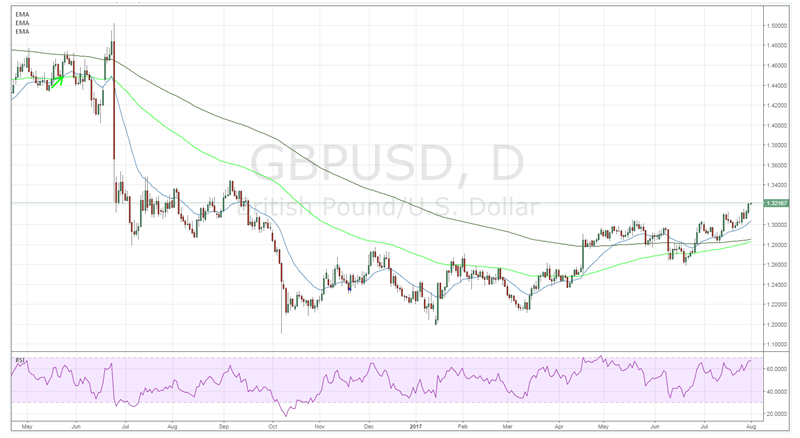

The Cable experienced another week in the green as the pair reacted to both the U.S. FOMC and UK GDP results. However, it was largely the FOMC’s lack of hawkishness that set off a broad sentiment swing against the greenback and saw the pair significantly buoyed. However, the focus will now shift to the Bank of England’s interest rate decision and it remains to be seen if the pair can retain its bullish intent.

Last week was a relatively positive one for the Cable as the pair was buoyed by both the U.S. FOMC and the UK GDP results. However, it was primarily Yellen’s speech following the FOMC vote which broadly skewed sentiment for the greenback and this led to a sharp rise for the Cable. In addition, the UK GDP figures proved on target at 0.3% q/q and added to the long slow bid that the pair received. UK output is likely to be on the upside in the coming months as increased consumer confidence continues to flow through to the broader economy. Price action did manage to break through the near term high but the momentum slowed quickly and the pair ended up finishing the week out around the 1.3134 mark.

Looking ahead, it’s set to be a highly busy day for the Cable as a slew of UK economic data is due for release in the coming days. In particular, the Bank of England is due to meet to determine their near term interest rate policy as well as release their inflation report. The market is largely expecting the central bank to hold rates steady at 0.25% but watch for any potentially hawkish statements as inflation is definitely accelerating in the UK. In addition, the U.S. Non-Farm Payroll figures are also due for release and could bring with it some volatility if the print varies from the estimate of 180k. Subsequently, there is plenty of economic releases which could impact the Cable’s valuations in the coming week.

However, there is also some dissent on the potential direction of the BOE at the coming meeting with Morgan Stanley taking the view that the Dove’s upon the MPC might just hold on in the coming meeting but that the decision could still go either way. Having said that, inflation is starting to roar and an August hike is still a strong possibility considering the vote could go either way. Regardless, the Cable is fundamentally predisposed to the upside and we should start to see some further gains as we move towards the critical meeting.

Ultimately, the Bank of England’s decision is likely to set the tone for the pair in the coming week and we could very well see a significant appreciation as the pair potentially reacts to the decision. Regardless, the upside is beckoning given the risk of the MPC meeting is completely stacked to the upside. Subsequently, keep a watch on the Cable because in all likelihood there will be plenty of volatility in the aftermath of the meeting.