- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BITQ ETF: A Safer Way To Dip Into The Volatile Cryptocurrency Market

This article was written exclusively for Investing.com

- Cryptos in an ugly trend since November 2021

- Buying on ugly corrections proven optimal approach

- Many investors uncomfortable with crypto wallets

- BITQ is a crypto stew

- BITQ should follow Bitcoin and crypto prices

Turning a five-cent investment into more than $31,500 in 12 years is astonishing in any market. If you had spent $1 on Bitcoin in 2010 and held on to it, you would have a cool $630,000 today. Returns like that are nothing to sneeze at. And at Bitcoin's high in November 2021, that $1 would have been worth $1.38 million.

While some high-profile devotees embrace cryptocurrencies as the means of exchange for the future, detractors call the asset class evil and worthless. Passions run high on both sides, contributing to the price volatility. Meanwhile, more and more analysts and financial advisors are recommending a small exposure to the asset class.

As investors and speculators look to move some percentage of their nest eggs into the burgeoning arena, there are alternatives to how to participate. The most direct route is to buy tokens, but there are more than 19,670 cryptocurrencies from which to choose. Plus, after purchasing crypto, the next issue is whether to keep it in a wallet in cyberspace or on an exchange that acts as a custodian.

Companies and ETF products trading on the stock market that move higher and lower with crypto values now provide an alternative. These products eliminate the custodial problems as they can sit in traditional portfolios.

I like to call the Bitwise Crypto Industry Innovators ETF (NYSE:BITQ) a Bitcoin stew, as it holds a variety of companies that have long-side exposure to the asset class.

Cryptos In An Ugly Trend Since November 2021

On Nov. 10, 2021, Bitcoin and Ethereum, the two cryptocurrencies that account for more than 60% of the market cap for the total asset class, reached all-time highs. The day they reached those highs, they closed the session below the previous day’s low, putting in bearish key reversal patterns on the daily charts—an ominous sign.

Source: Barchart

The chart shows Bitcoin’s pattern of lower highs and lower lows. As of May 31, the price was sitting not far from the most recent May 12 low.

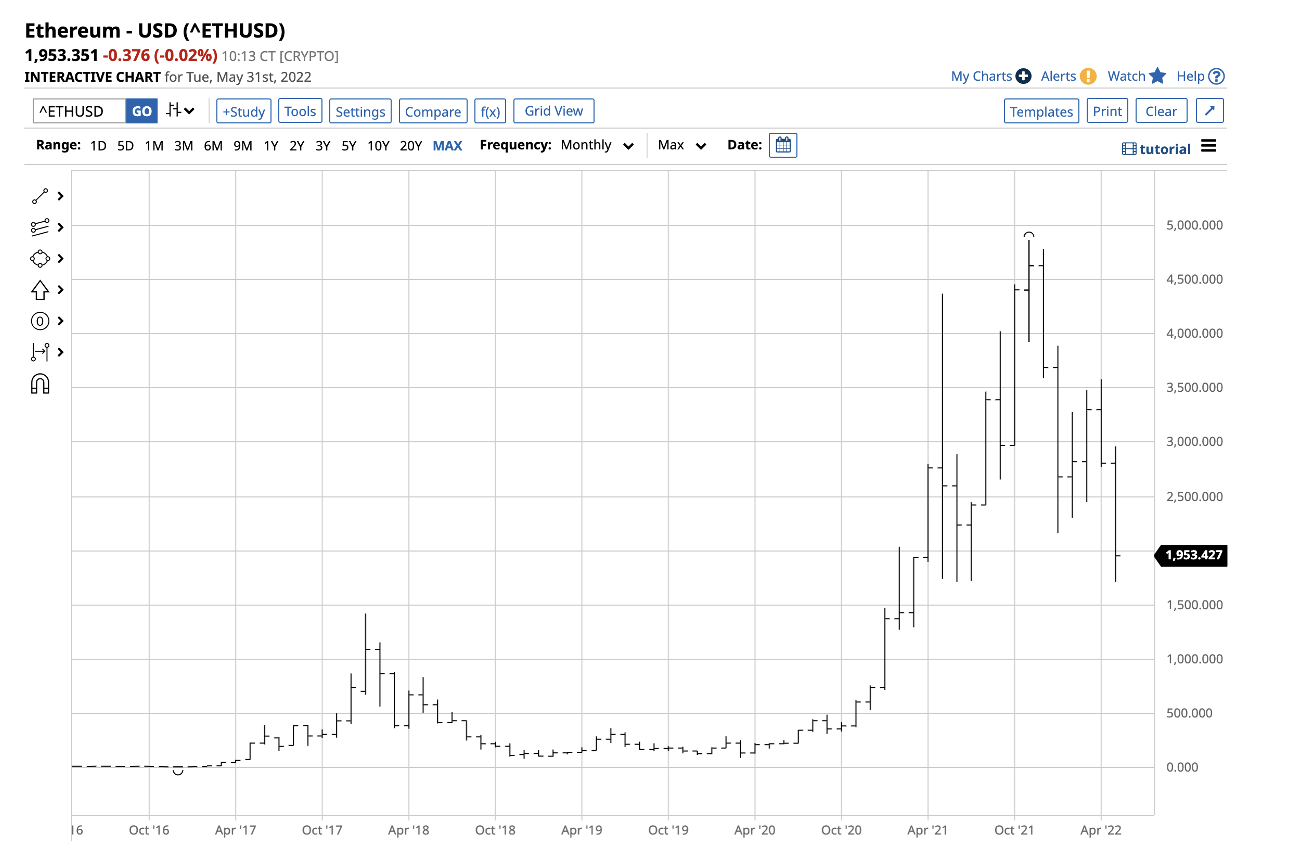

Source: Barchart

Ethereum has followed the same path but has declined even more than Bitcoin on a percentage basis since mid-November 2021. Ethereum made another lower low on May 27.

Buying On Ugly Corrections Has Been Optimal Approach

The long-term charts show that buying during periods of price carnage has been a profitable strategy over the past years.

Source: Barchart

The long-term Bitcoin chart shows the boom-and-bust price action in the leading cryptocurrency.

Source: Barchart

Ethereum has displayed a similar pattern of wide price variance over the past years.

Many Investors Uncomfortable With Crypto Wallets

One of the roadblocks for new entrants to the cryptocurrency arena is comfort with storing or holding tokens. Cryptocurrency wallets can store tokens, with owners gaining access through password keys. However, a drawback has been horror stories of lost password keys that caused millions in losses.

Block (NYSE:SQ), formerly called Square, is working on a crypto wallet they've dubbed the “rock” that may make future market participants more comfortable with the safekeeping procedures.

Meanwhile, many crypto investors and traders choose to leave their tokens with exchanges. Coinbase (NASDAQ:COIN) recently scared the pants off some customers when it disclosed that they could lose tokens if the exchange files for bankruptcy.

In short, custody and security continue to be roadblocks to expanding cryptocurrency’s addressable market.

BITQ Is A Crypto Stew

Many investors limit their activities to assets they can keep in traditional stock portfolios. The advent of ETF and ETN products expanded the addressable market for alternative investments over the past years.

The VanEck Gold Miners ETF (NYSE:GDX) is an example of a product that increased market participation in gold. Before GDX, investors and traders had to choose between physical metal, futures, or mining shares. GDX is a product that holds physical gold and correlates well with the ups and downs in the precious metal’s price.

The Bitwise Crypto Industry Innovators ETF (BITQ) product is a Bitcoin stew, holding shares in companies that move higher and lower with the cryptocurrency. Enterprise software analytics maker MicroStrategy (NASDAQ:MSTR) is the fund's largest holding, followed by Galaxy Digital Holdings (TSX:GLXY), Coinbase, Silvergate Capital (NYSE:SI) and crypto mining equipment maker Canaan (NASDAQ:CAN) which round out the top five positions.

Additional BITQ’s holdings include:

Source: Barchart

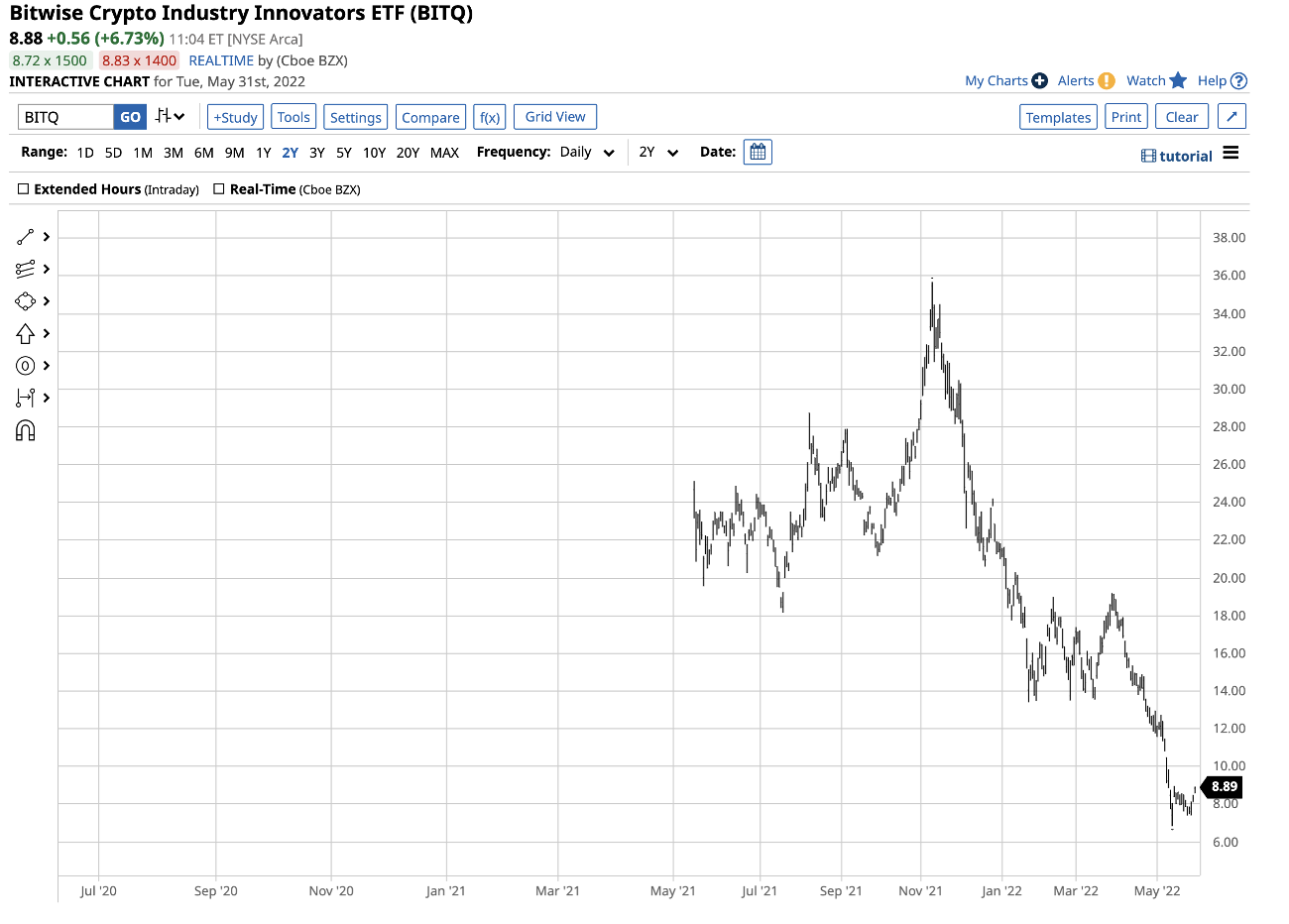

At $8.88 per share on May 31, BITQ had $60.663 million in assets under management. The ETF trades an average of 145,414 shares each day and charges a 0.85% management fee. The latest blended dividend was $0.65, translating to a 7.32% yield.

BITQ Should Follow Bitcoin, Crypto Prices

BITQ came to market on May 12, 2021, at $24.69 per share.

Source: Barchart

The chart shows a 64% decline to $8.88 on May 31. Over the same period, Bitcoin declined from $56,915.26 to $31,600 or 44.5%. BITQ underperformed the leading cryptocurrency as speculative interest has declined. A rally in Bitcoin and other cryptos would likely cause BITQ to follow. Time will tell if the underperformance during bearish periods translates to outperformance during bullish trends.

BITQ is an option for market participants looking for upside exposure to the cryptocurrency asset class. BITQ holds a diversified portfolio of crypto-related companies that trade on the stock exchange, making it a Bitcoin stew.

Related Articles

Last week, the ADP Employment report showed that US private companies added around 152,000 workers, lower than expected and lower compared to a revised 188,000 from the previous...

Bitcoin has started June on a positive note. Lower-than-expected labor market data fueled rate-cut speculation, boosting Bitcoin. In case of a weak NFP report today, Bitcoin...

BlackRock (NYSE:BLK) CEO Larry Fink predicts that the market for Real World Assets will grow to $10 trillion over the coming years. Chainlink is at the forefront of this hype, yet...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.