Tuesday, the NASDAQ 100 Invesco QQQ Trust (NASDAQ:QQQ), Russell 2000 iShares Russell 2000 ETF (NYSE:IWM), and S&P 500 SPDR® S&P 500 (NYSE:SPY) all gapped lower on Tuesday, followed by a rally.

One of the most important indices to gap lower was the teach heavy index QQQ.

This is important because big tech companies were the first to lead the rally created from the pandemic back in March of last year. With tech leading the charge higher, it is also a cause for worry if it were to weaken.

If so, it could be signaling that overall market strength is lessening or fear from other things like inflation is gaining weight.

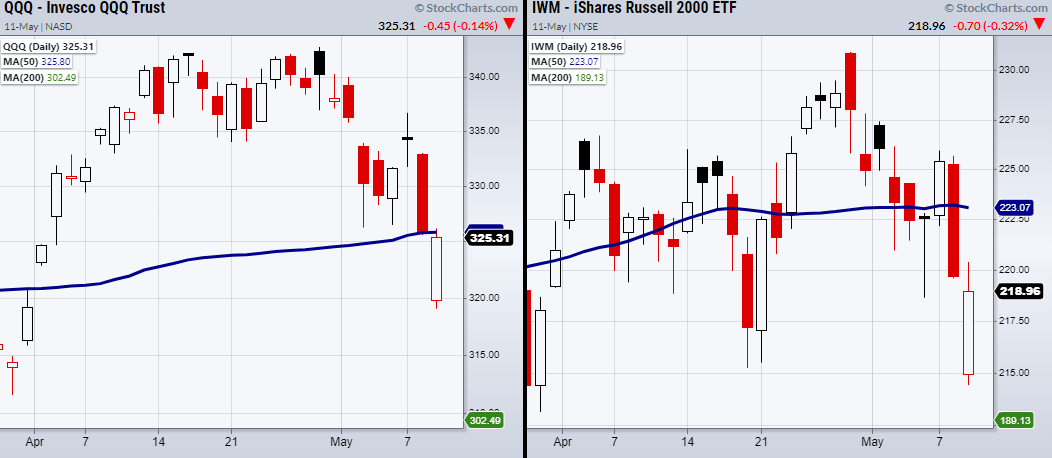

With that said, the QQQ also broke an important support area created not only by the 50-Day moving average, but also from consolidation in price action going back to this March.

Similarly, the small-cap index broke its 50-DMA.

However, IWMs’ price action is much sloppier with it repeatedly trading around the 50-DMA for over a month.

Additionally, the SPY and the SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA) were holding a bullish phase with price trading over their 50-DMA.

Therefore, the QQQ is key as it was sitting in a very pivotal area.

If it can clear back over its 50-DMA at $325.9 and hold, this will look good for the coming week. On the other hand, if the QQQs can’t clear back over the 50-DMA, stay cautious as fear could trigger a greater selloff.

ETF Summary

- S&P 500 (SPY) 411 support area.

- Russell 2000 (IWM) Like to see this hold over 217.

- Dow (DIA) 342.43 pivotal area.

- NASDAQ (QQQ) Needs to clear back over the 50-DMA at 325.91.

- KRE (Regional Banks) 67.83 support.

- SMH (Semiconductors) Filled the gap at 232.38.

- IYT (Transportation) Held the 10-DMA at 273.59.

- IBB (Biotechnology) Cleared back over the 200-DMA at 146.91.

- XRT (Retail) Bounced off the 50-DMA at 90.59.

- Volatility Index (VXX) Held over the 10-DMA at 39.10.

- Junk Bonds (JNK 108.53 support.

- XLU (Utilities) Resistance 67.38. support 64.97.

- SLV (Silver) 24.74 support.

- VBK (Small Cap Growth ETF) 275.08 next resistance.

- UGA (US Gas Fund) 34.68 resistance area.

- TLT (iShares 20+ Year Treasuries) Confirmed a bearish phase with second close under the 50-DMA.

- USD (Dollar) 90.00 support.

- MJ (Alternative Harvest ETF) 20.16 new support.

- LIT (Lithium) Needs to hold over 50-DMA at 60.36.

- XOP (Oil and Gas Exploration) Support 82.33.

- DBA (Agriculture) 18.74 support.