- Australian dollar steady after sharp gains on Thursday

- US nonfarm payrolls expected to climb to 180,000

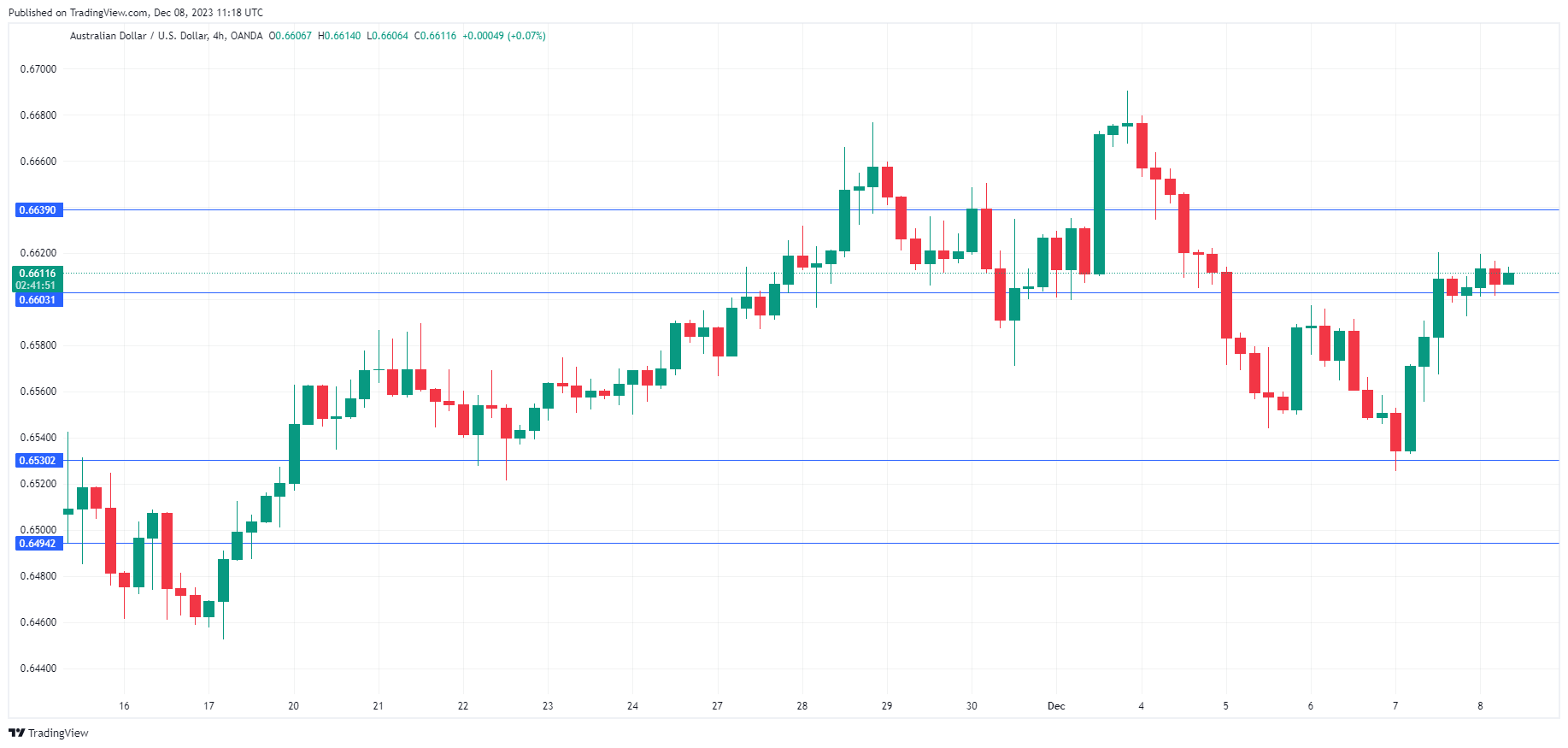

- AUD/USD is testing resistance at 0.6603. Above, there is resistance at 0.6639

- 0.6530 and 0.6494 are providing support

The Australian dollar is trading quietly on Friday. In the European session, AUD/USD is trading at 0.6611, up 0.14%.

It has been a roller-coaster week for the Australian dollar. After declining 1.88% early in the week, the Aussie rebounded on Thursday and gained 0.80%. Today’s US nonfarm payrolls report could result in further volatility from the Australian dollar in today’s North American session.

US Nonfarm Payrolls Expected to Rise

All eyes are on the US nonfarm payroll release later today. After falling sharply in October to 150,000 from a revised 297,000, nonfarm payrolls are expected to rebound to 180,000. If nonfarm payrolls are weaker than expected, speculation of a Fed rate cut will rise, while a hot report would undermine market confidence that a rate hike isn’t too far away.

Outside the headline data, average hourly earnings will be closely watched, as wage growth is a key driver of inflation. The consensus estimate for average hourly earnings in November stands at 0.3% m/m, compared to 0.2% in October. A higher-than-expected reading could generate a market reaction and give the US dollar a lift.

Australia’s largest trading partner is China and the slowdown in the world’s second-largest economy will likely dampen Australia’s economy. China’s economic woes were reflected in this week’s Australian GDP, which posted a weak 0.2% gain for the third quarter, compared to the 0.4% gain in Q2. Notably, exports dropped for the first time since Q1 2022.

China’s economic slowdown has resulted in disinflationary pressures. Chinese CPI decreased 0.1% in October and another 0.1% decline is expected in the November release on Saturday. If China’s economy continues to weaken, demand for Australian exports could fall even further and that could weigh on the Australian dollar.