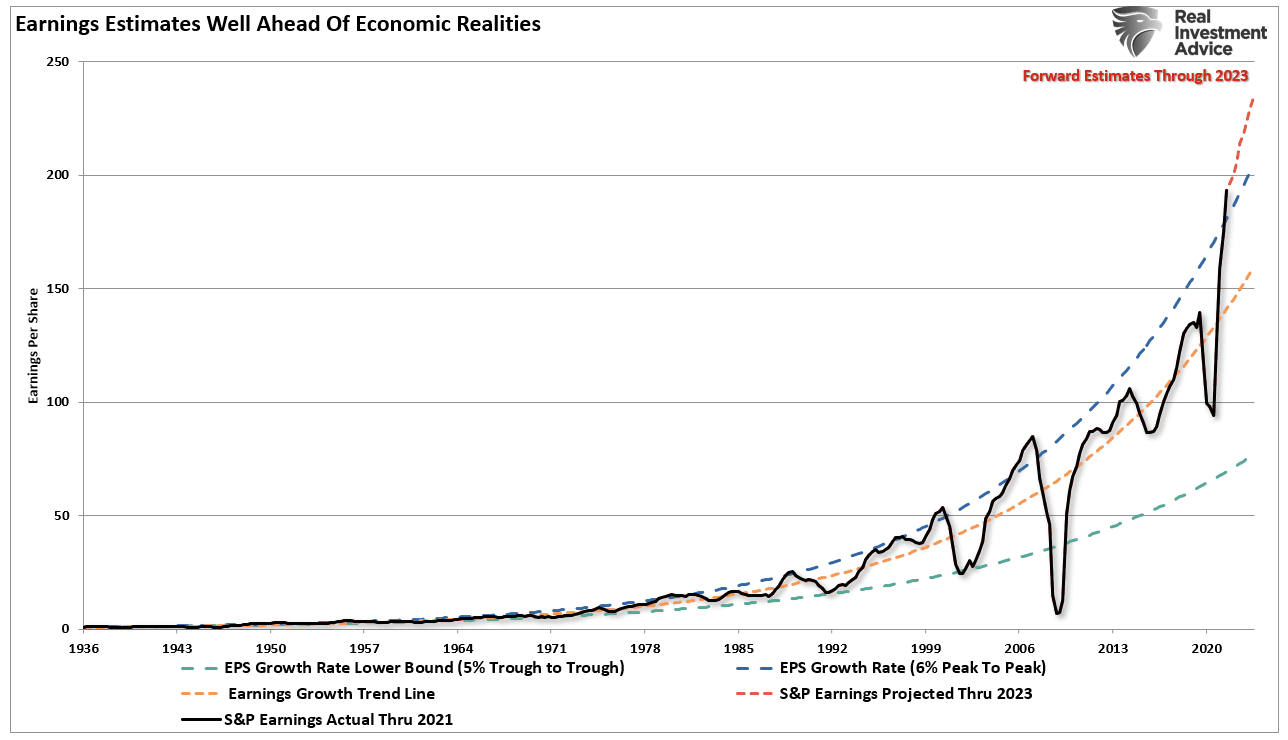

In “earnings estimates will disappoint,” we showed the extreme bullishness of estimates entering 2022.

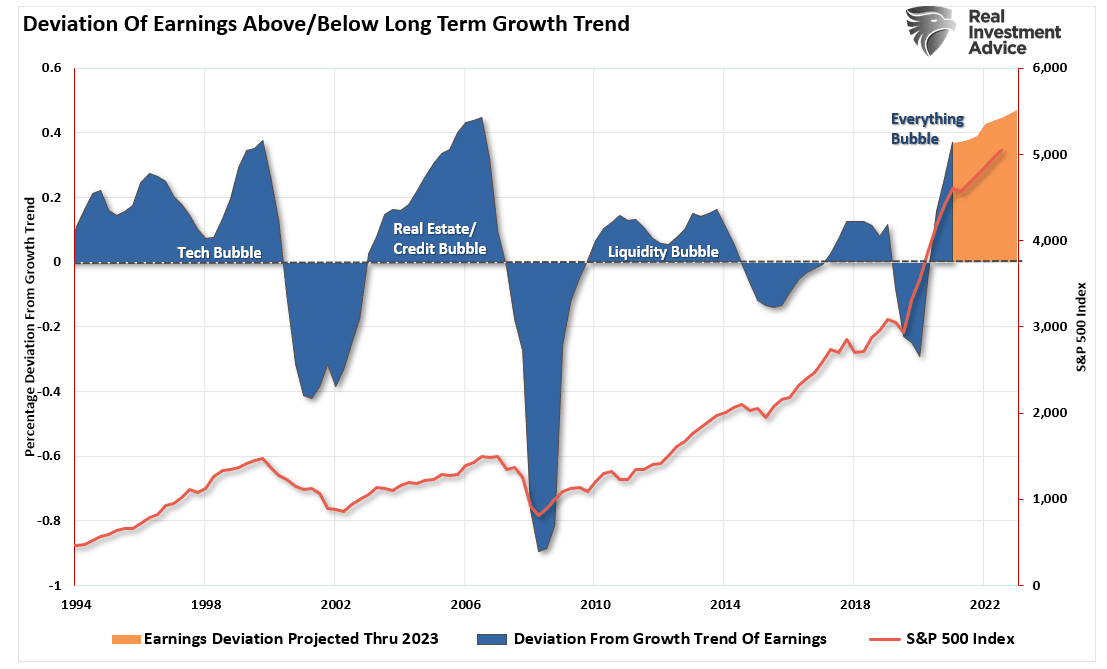

"Despite economic growth weakening as inflation increases, liquidity reducing, and profit margins under pressure, analysts continue increasing their earnings estimates. Currently, estimates for the Q4-2022 are $219.87/share according to S&P, up from $207/share at the end of 2021. As shown, that level will exceed the historical 6% exponential growth trend, which contained earnings growth since 1950, by the most significant deviation ever."

"The only two previous periods with similar deviations are the '"Financial Crisis"' and the '"Dot.com"' bubble.

"With analysts extremely exuberant, there seems to be little concern for investors. However, I would caution against such complacency. As shown, reversions are historically very swift.

As is always the case, "what goes up must come down." Such is particularly the case for earnings that are highly cyclical and tied to the economy. Notably, earnings reversions tend to be very swift.

The question is, what will drive that reversion.

Geopolitical Fallout

At the beginning of this year, few Wall Street analysts expected substantially weaker economic growth in 2022. As I stated then,

"There is a high probability [slower economic growth] will be a reality. The most considerable risk to earnings comes as the Fed begins to "'taper"' bond purchases and hike rates."

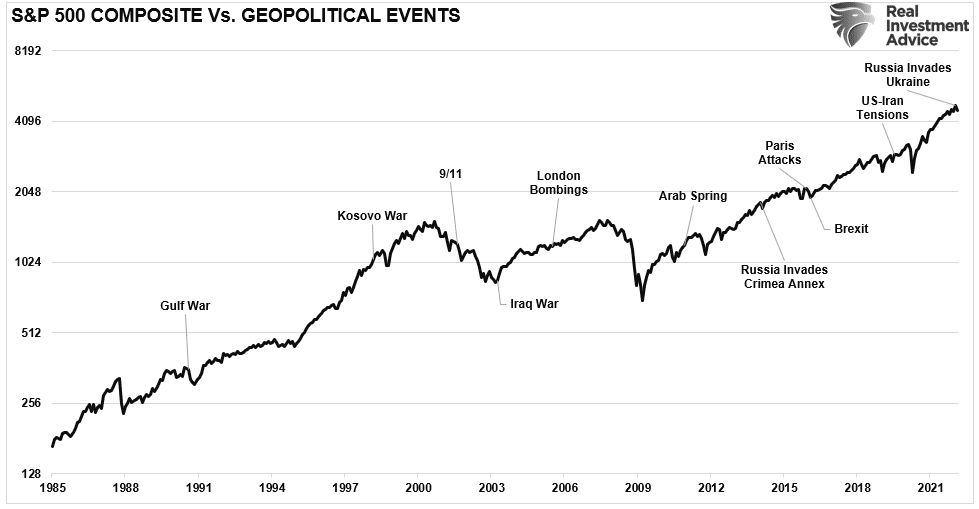

Of course, no one expected Russia to invade Ukraine at that time. As we stated many times previously, the one thing that "always trips up the bulls is an unexpected, exogenous event."

In the short term, geopolitical events tend to have a limited impact on financial markets.

However, when the geopolitical event involves sanctions, as with Russia, that could disrupt trade, cause credit-related issues, or create additional inflationary pressures, confidence and economic growth get impacted.

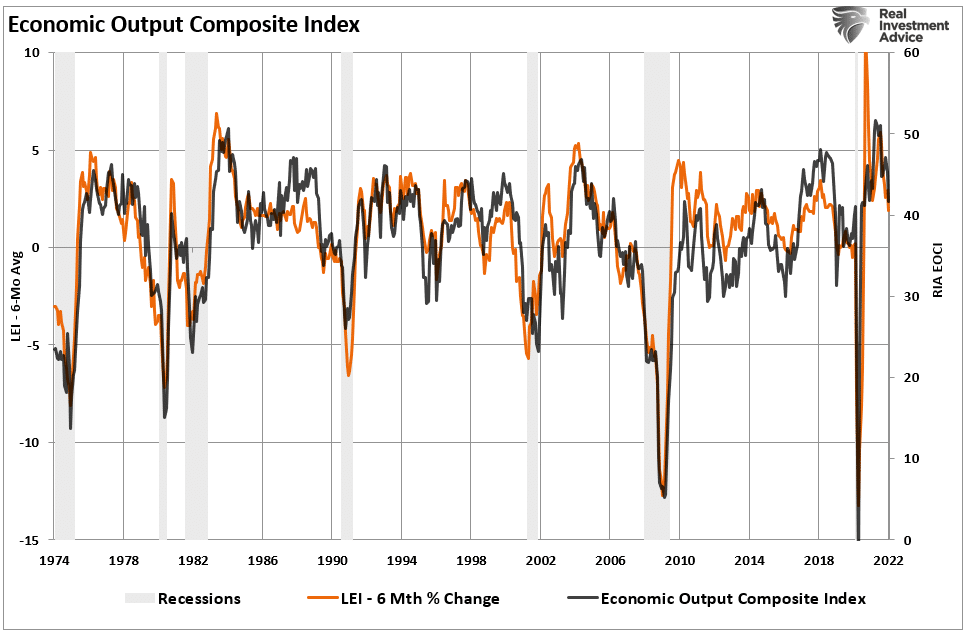

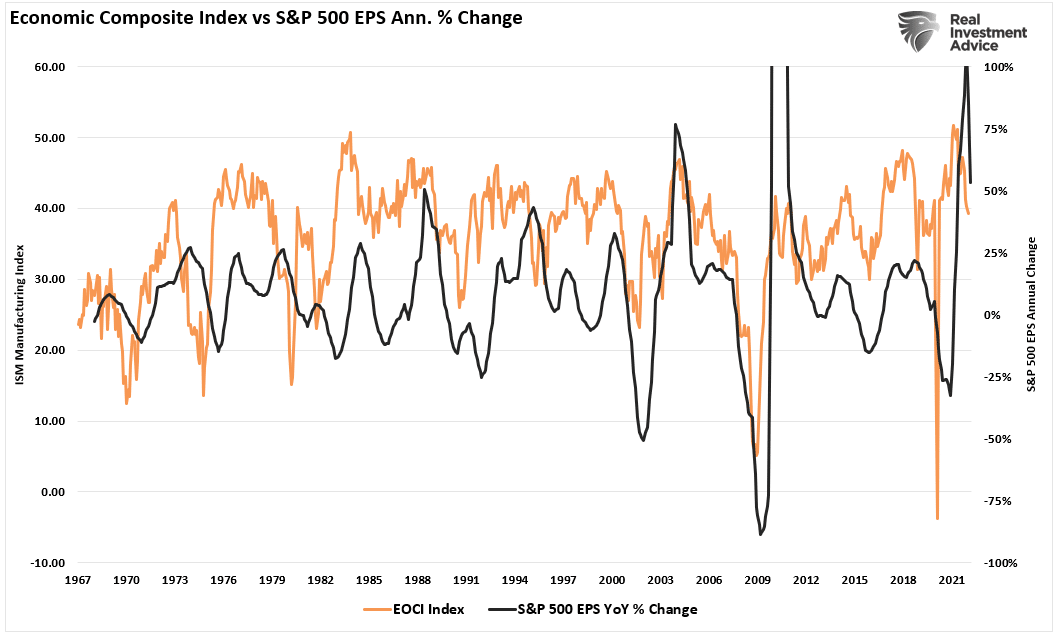

Already, we see a contraction in manufacturing activity as demand slows. Not surprisingly, there is a high correction between the annual change in earnings, estimates, and the economy.

The chart below is our Economic Output Composite Index (EOCI), which combines several Fed regional surveys, CFNAI, Chicago PMI, Conference Board and OECD Leading Indices, NFIB Small Business, and the ISM composite index. This comprehensive index has a high correlation to the economy, as shown by the 6-month average of the Leading Economic Index.

As shown, the economy peaked last quarter, and economic data points are softening on several fronts. Not surprisingly, earnings estimates are declining as economic growth rates slow.

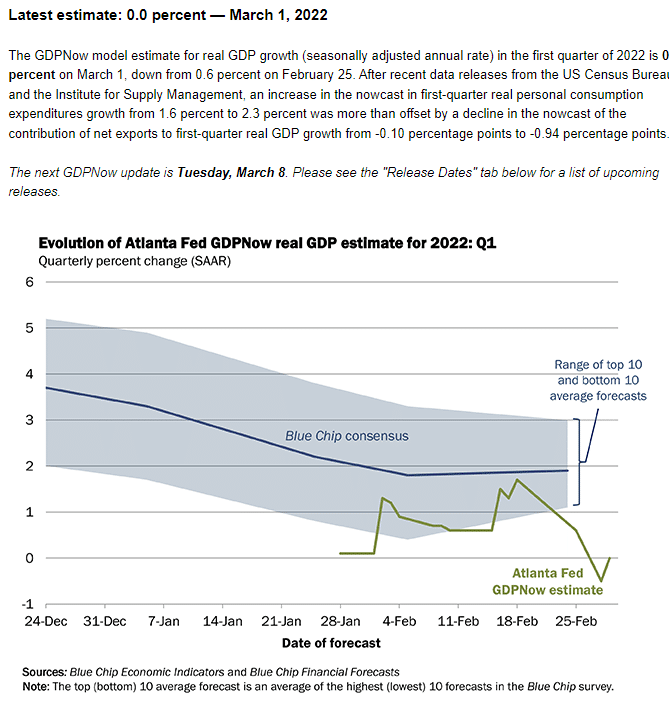

If "geopolitical events" lead to further deterioration of consumer confidence, particularly from an inflationary view, the rate of growth will slow further. Such, of course, should be of no surprise, and as the Atlanta Federal Reserve recently estimated, the economic growth rate in the first quarter will be 0.00%.

The Fed Problem

If "geopolitical events" push an earnings reversion, the Federal Reserve will likely create an earnings recession.

The Federal Reserve will meet in mid-March to discuss its first rate hike since 2018, when the Fed stopped raising rates amid a sharp market decline. However, as opposed to 2018, when there was little inflation, the Fed will be meeting with CPI running above 7% and oil prices hovering around $100/bbl.

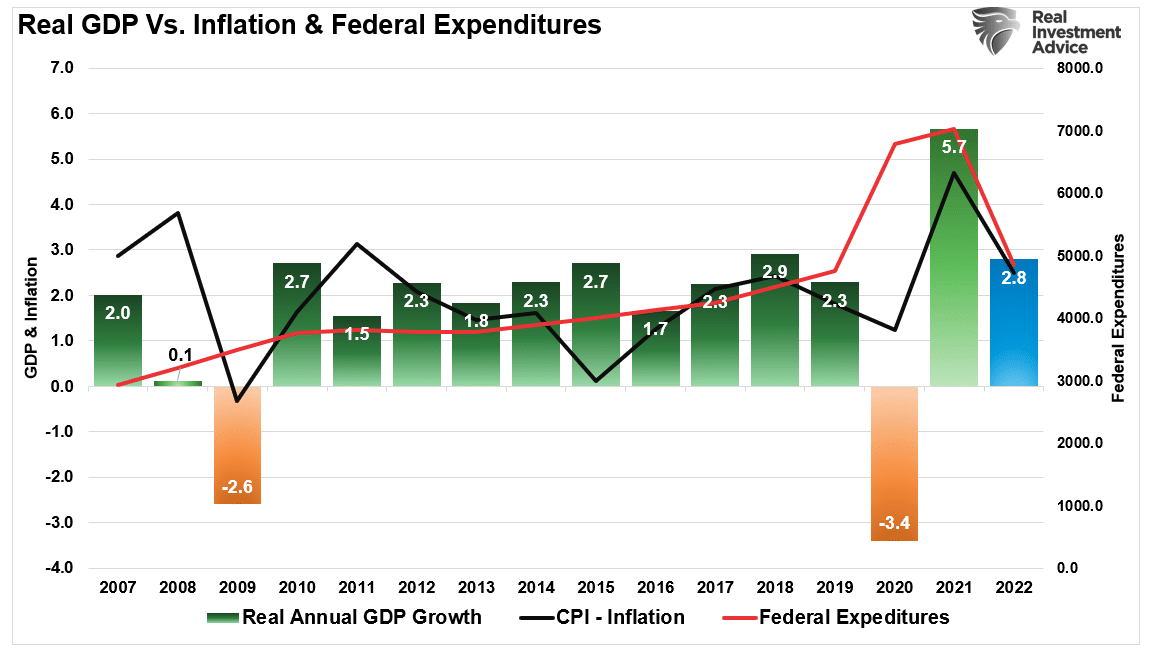

The whole point of the Fed hiking rates is to slow economic growth, thereby reducing inflation. Unfortunately, with the economy already slowing, additional tightening could exacerbate the risk of an economic contraction, given the dependence on low rates to support economic growth.

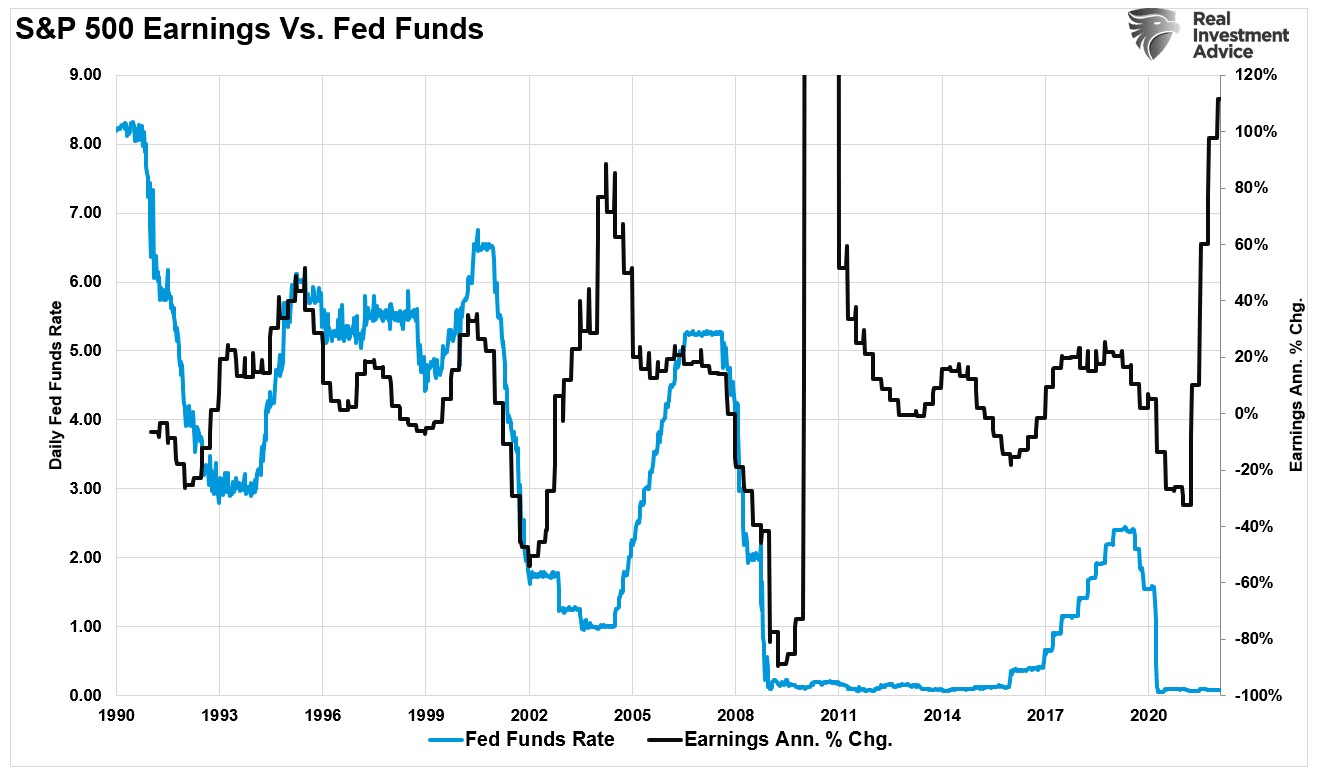

Given that earnings are highly correlated to economic growth, earnings don’t survive rate hikes.

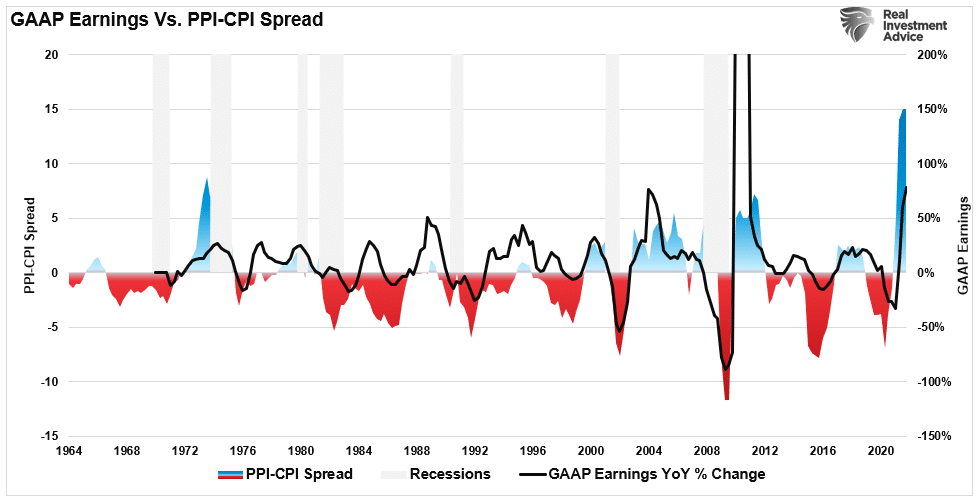

The Fed is in a difficult position. Producer prices, as shown below, have risen substantially faster than consumer prices. Such suggests that companies are absorbing input costs as they can’t pass all the price increases on to consumers. Eventually, the absorption of higher costs will impair profitability. As shown, there is a correlation between corporate earnings and inflation.

When the inflation spread rises enough to impair profitability, corporations take defensive measures to reduce costs (layoffs, cost cuts, automation.) As job losses increase, consumers contract spending, which pushes the economy towards a recession.

If the Fed hikes rates to slow inflation, the economy will slow even faster. However, a recession is coming, and for the Fed to get trapped at the "zero bound" leaves them few tools to reduce the economic drag.

While no one currently expects an earnings reversion, much less a recession, few tailwinds are supporting economic growth. The combination of geopolitical events and Fed policy will make continued growth even more challenging.

Reversal Of Liquidity

The most significant risk to earnings, and the eventual earning reversion, is the reversal of liquidity flows. In March 2020, the Federal Government and the Treasury, and Federal Reserve began dumping trillions of dollars into the economy. Unlike previous crisis events, this time, the Government started a monetary experiment of sending checks directly to households to boost consumption.

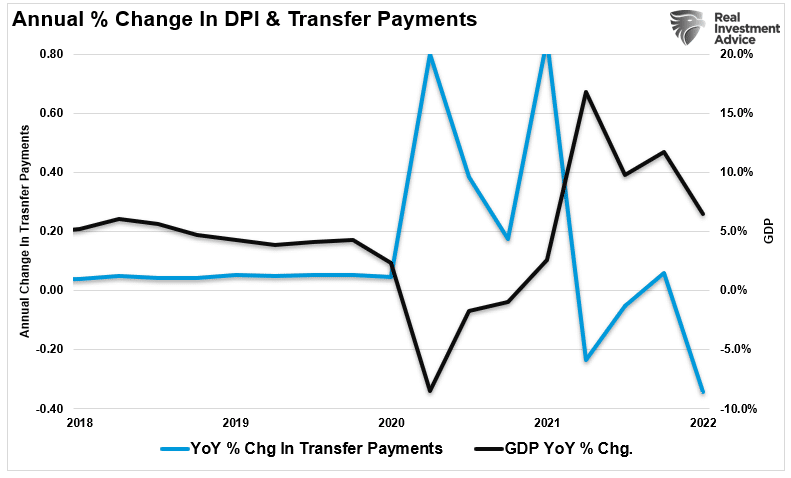

It worked, and as shown, GDP surged from the increase in economic activity. However, that liquidity is now reversing, and with it, as shown below, GDP is expected to slow markedly.

When it comes to the stock market, the impact of economic stagnation is crucial.

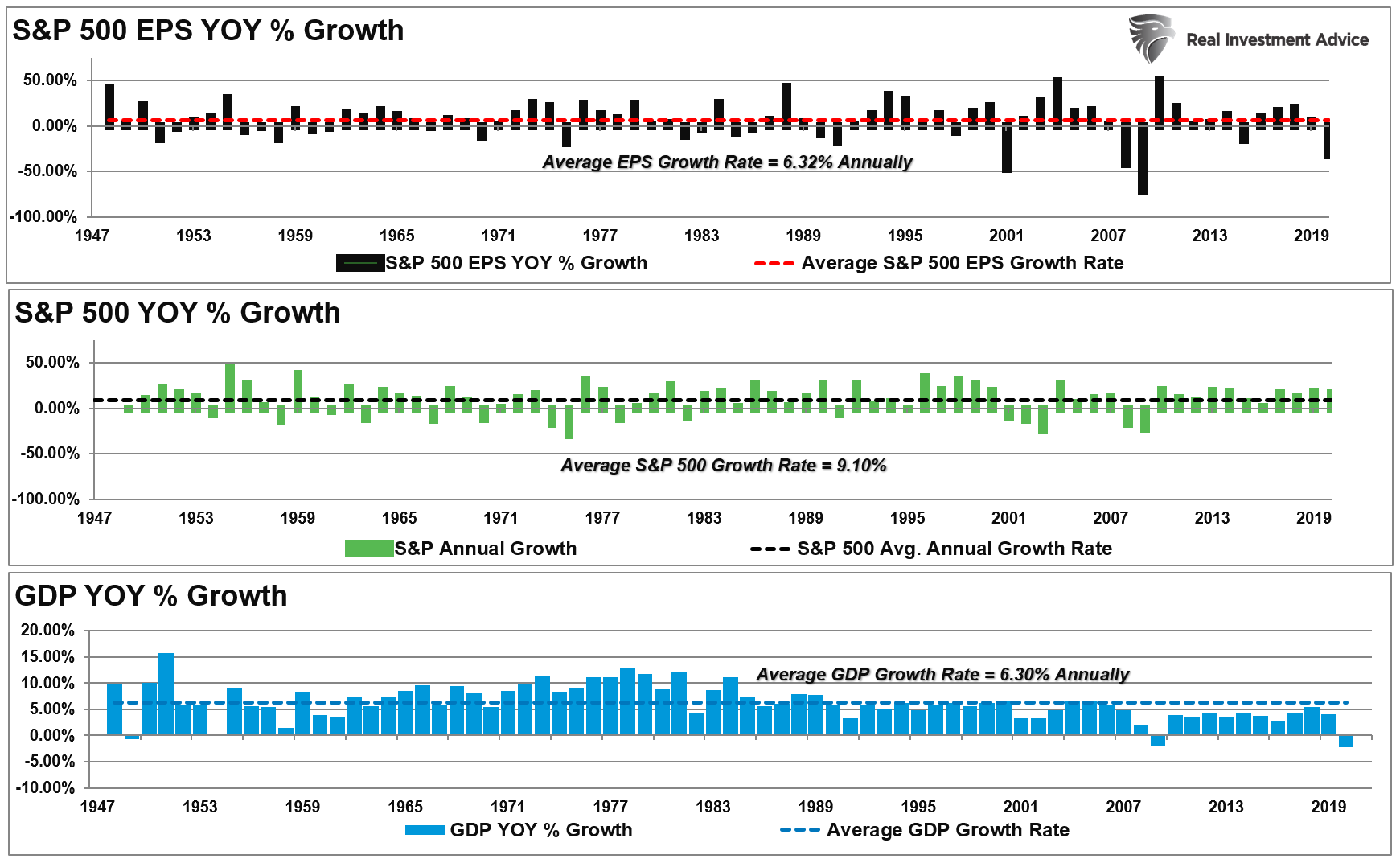

Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2020.

That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

Therefore, the reversal of liquidity will precede less consumption leading to an earnings reversion.

It is only a function of time.

The only question is how much of the earnings reversion already got priced into the market? With valuations still highly elevated, I would suspect not much.

I suspect the Fed’s next moves could be much more critical than most realize.