Buy now and pay later purchase financing provider Affirm Holdings (NASDAQ:AFRM) stock is rebounding after bottoming out at $13.64. The buy-now-pay-later (BNPL) platform had a very negative sentiment heading into its fiscal Q3 2022 earnings release on the heels of weak performances from Block (NYSE:SQ) and PayPal (NASDAQ:PYPL).

To the pleasant surprise of shareholders, the results were indeed impressive triggering a short squeeze that doubled its recent low price. Shares are still down (-74%) year-to-date, which leaves room both for upside and opportunity for pullbacks. The Company is still growing its top line at over 50% annually. Affirm continues to grow its active merchants now at 207,000 and active customers which have grown 137% to 12.7 million as total transactions grew to 10.5 million, up 162%. Perhaps, most importantly the 81% re-engagement rate from repeat customers underscores how sticky the network effect is with Affirm’s e-commerce platform. The Company announced a multi-year extension of its partnership with Shopify (NASDAQ:SHOP) and continues to partner with retail behemoths Target (NYSE:TGT) and Amazon (NASDAQ:AMZN). Travel and ticketing were strongly elevated in the quarter with double the volume from last year reflecting the accelerating recovery. Affirm seeks to reach run-rate profitability on an adjusted operating income basis by July 1, 2023. Prudent investors seeking exposure can watch for opportunistic pullbacks in shares of Affirm.

Q3 Fiscal 2022 Earnings Release

On May 12, 2022, Affirm released its fiscal third-quarter 2022 results for the quarter ending March 2022. The Company reported a GAAP earnings-per-share (EPS) loss of (-$0.19) excluding non-recurring items meeting consensus analyst estimates for a loss of (-$0.39), a $0.20 beat. Revenues grew by 53.8% year-over-year (YOY) to $354.8 million beating analyst estimates for $344.01 million. Adjusted operating income was $4 million down from $4.9 million in the year-ago period. Gross merchandise value (GMV) grew 73% YoY to $3.9 billion. Active merchants grew from 12,000 to 207,000 driven by the adoption of Shop Pay Installments by merchants. Active consumers grew 137% to 12.7 million, and increased by 1.5 million, up 13% sequentially. Affirm CEO Max Levchin commented:

“The number of active merchants on our platform grew from 12,000 to 207,000 year over year, and active consumers increased 137% to 12.7 million people. The secular trend toward adopting honest financial products and our ability to drive strong demand among merchants resulted in GMV growing by 73% year over year. We are especially proud of the re-engagement we are driving with consumers as 81% of our transactions were from repeat Affirm users. This represents the highest repeat transaction rate we have ever reported. As we advance our strategy to drive growth, maintain attractive unit economics, and deploy superior risk management, we plan to achieve a sustained profitability run rate on an adjusted operating income basis by July 1, 2023.”

In-line Guidance

Affirm issued inline guidance for fiscal Q4 2022 revenues of $345 million to $355 million versus $352.92 consensus analyst estimates.

Conference Call Takeaways

CEO Levchin set the tone by pointing out that active merchants have grown 16-fold YoY and total transactions grew 162% YoY. Most notably, 81% of those transactions are from repeat Affirm customers. GMV grew 73% YoY to $3.9 billion, excluding Peloton (NASDAQ:PTON). He noted how the travel and ticketing segment has been strong as volume more than doubled from the year-ago. Affirm became available on American Airlines (NASDAQ:AAL) in the quarter. The Company announced a new agreement with Stripe. He pointed out, “Our plan is to achieve a sustained profitability run-rate on an adjusted basis by the end of the next fiscal year. That is to say, we expect to generate revenue that consistently exceeds our adjusted operating expense starting July 1, 2023. We do not expect our plan for reaching profitability to compromise growth just as we demonstrated this quarter. We also do not plan to raise any new equity capital, because we believe Affirm is fully funded to profitability. We will share our full fiscal year ‘23 outlook and full-year guidance in our next earnings report.”

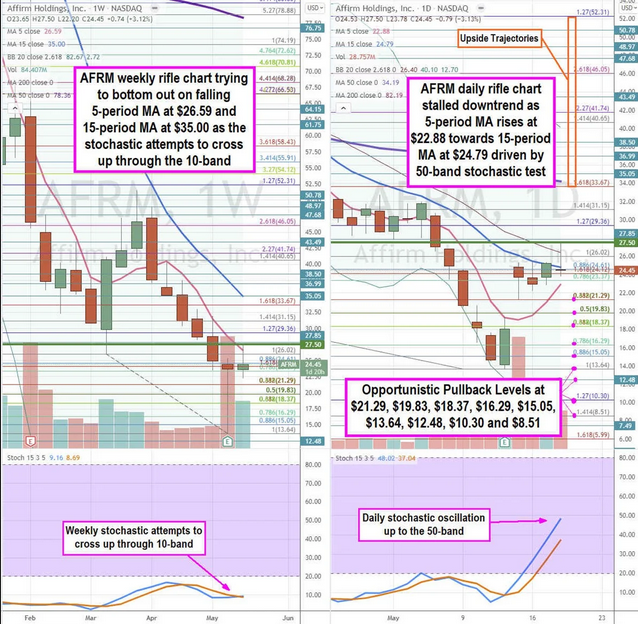

AFRM Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the playing field for AFRM stock. AFRM stock bottomed out at the $13.64 Fibonacci (fib) level and staged a rally into its fiscal Q3 2022 earnings which ended up accelerating the share price on the gap to peak at $27.50. The weekly market structure low (MSL) buy triggers a breakout through $27.50. The weekly rifle chart has an inverse pup breakdown with a falling 5-period moving average (MA) at $26.59 followed by the 15-period MA at $35.00. The weekly stochastic is attempting a 10-band cross-up. The daily rifle chart is attempting to reverse the downtrend with a rising 5-period MA at $22.88 that needs to crossover up through the 15-period MA at $24.79. The daily 50-period MA resistance sits at $34.19 with daily upper Bollinger Bands (BBs) at $40.10. The daily stochastic is rising towards the 50-band. Prudent investors can look for opportunistic pullback levels at the $21.29 fib, $19.83 fib, $18.37 fib, $16.29 fib, $15.05 fib, $13.64 fib, $12.48, $10.38 fib, and the $8.51 fib level. Upside trajectories range from the $33.67 fib level up to the $52.41 fib level.