It will be a holiday-shortened trading week, with the markets closed on Friday ahead of the Easter Holiday. That will move the Options expiration to Thursday.

The big news will come on Tuesday with CPI and real wage data. CPI is forecast to rise by 1.2% m/m and 8.4% y/y.

Then on Wednesday, we get the PPI report, which is seen rising by 1.1% m/m and 10.6% y/y. On Thursday, we get Retail Sales, which are forecast to increase by 0.6% m/m.

Also, this week, there will be a 3, 10, and 30-Yr-Yr bond auction. Finally, FOMC Vice-Chair Brainard will participate in a Wall Street Journal event Q&A session on Apr. 12.

1. 10-Yr Rate

There will undoubtedly be plenty of market-moving news in a short four-day week, with rates likely to respond. 10-Yr yields are now very close to making a significant breakout that could send them to their highest levels since 2018 and back to 3.25%.

There is only one resistance level left at 2.8%, and then there is nothing stopping the 10-yr from rising back to its 2018 high.

2. Real Yields

Rising nominal yields have been helping to drag real yields up. Rising real yields have been weighing on stocks, especially those in the NASDAQ. The iShares TIPS Bond ETF (NYSE:TIP) is one of the essential signals that should be watched throughout the week, as a falling TIP ETF represents rising real yields, which is bad for stocks.

3. NASDAQ ETF

The Invesco QQQ Trust (NASDAQ:QQQ) fell sharply last week and is now firmly trading below the 10-day exponential moving average, a trend change signal. Additionally, the RSI moved firmly back to within the downtrend, also an indication that the move higher at the end of March is now over.

Rising yields will only pressure the NASDAQ even more, and a break below $348 early this week could send the shares to around $336.

4. S&P 500 ETF

The SPDR® S&P 500 (NYSE:SPY) has a head and shoulders pattern, with the neckline broken following a gap lower on Apr. 6. The significant level of support for the SPY remains around $446, and given the bearish head and shoulders pattern, support should break this week, resulting in the ETF dropping back down to $432.

5. Shopify

Last week, I spoke about the head and shoulders pattern in Shopify (NYSE:SHOP), which played out well, with the shares dropping below support and heading to $600.

With support at $600 in question and a gap to fill at $560, Shopify may have another leg lower coming.

6. Amazon

Amazon.com (NASDAQ:AMZN) had the same pattern type as Shopify, and it has moved back into the RSI’s downtrend and is likely heading back to $2,890.

7. NVIDIA

NVIDIA (NASDAQ:NVDA) has the same pattern as Amazon and Shopify, and it finds itself at support around $230. But, once that level breaks, it will be on its way to $207.

8. Advanced Micro Devices

Advanced Micro Devices Inc (NASDAQ:AMD) is in a massive descending triangle and at critical support at around $100. Once $100 breaks, nothing keeps this stock from falling back to $89.

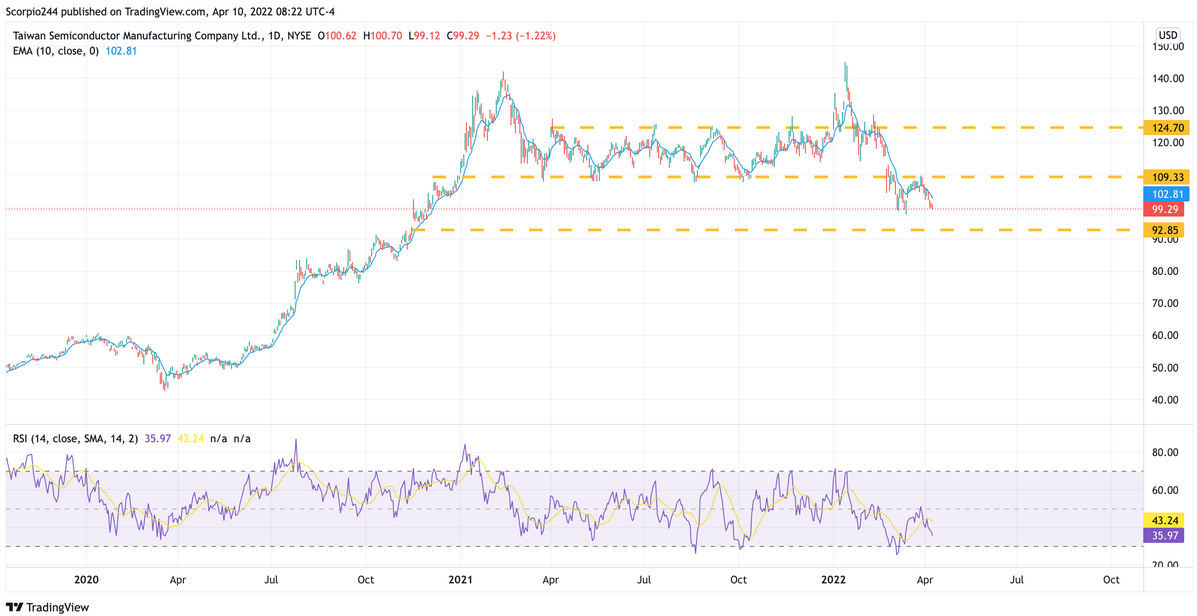

9. Taiwan Semi

Taiwan Semiconductor Manufacturing (NYSE:TSM) will report results this week, and this is a critical stock to watch given the weight their guidance may have on the entire semi and technology sector.

Shares have not been healthy and will need to hold above support at $93.

This week's free YouTube video

I

Good luck this week