- Watchlists are pivotal for making investment decisions

- The InvestingPro advanced watchlist is a boon for investors

- Let's see how we can use it to our advantage with this step-by-step guide

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

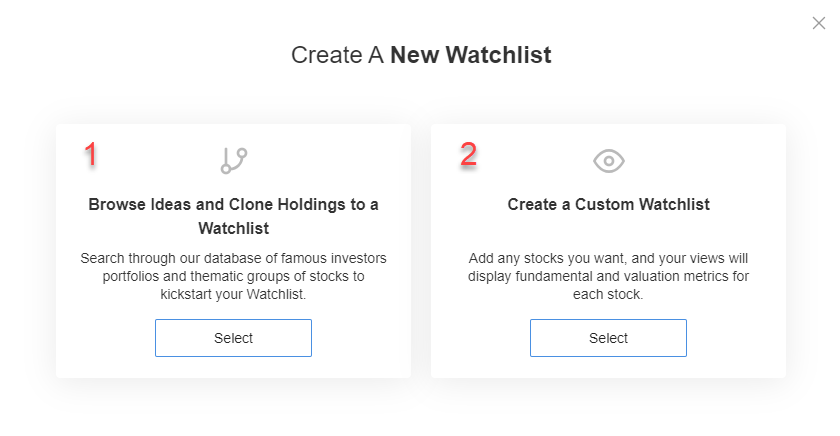

- Browse ideas and clone holdings to a watchlist.

- Create a custom list.

- The option to clone or copy ideas is handy if you want to follow the strategy of great investors like Warren Buffett or Ray Dalio.

- Use this option to see what stocks they have in their portfolio and how you can profit from it by 'copying' their strategies.

- Remember: Tomorrow's billionaires often emerge by learning from the successes and failures of those who came before them.

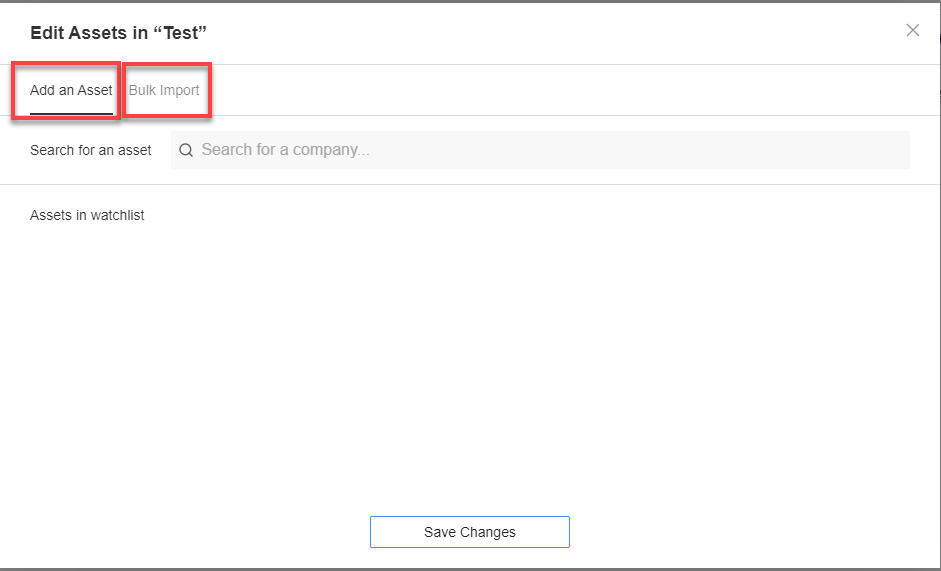

- Bulk import saves time and creates a diversified portfolio across sectors and geographic locations.

- It is also the preferred option to 'bring' your watchlist from another platform to InvestingPro.

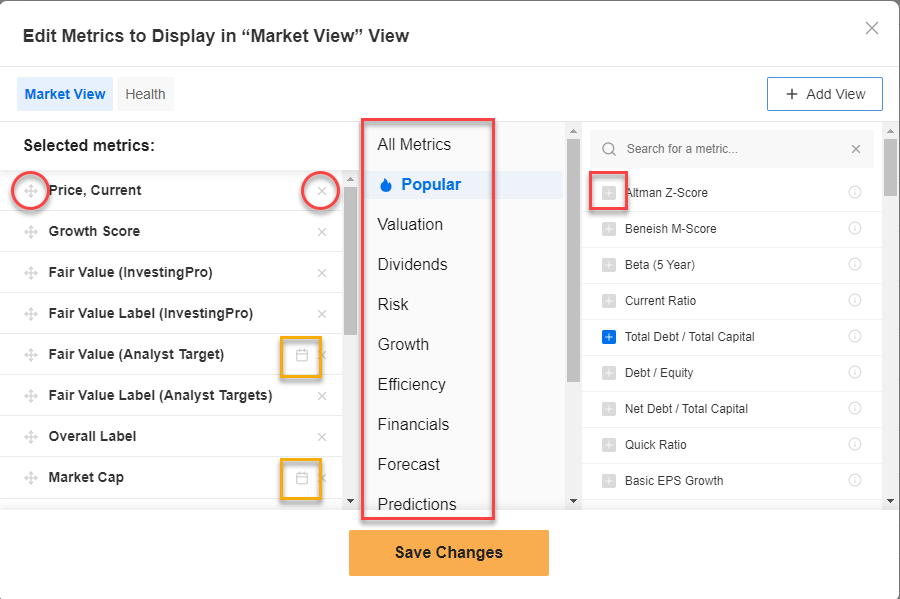

- You have the flexibility to customize your views based on different metrics. For example, you can create a view that displays metrics related to market value and fair value, another that focuses on dividend information, and another that includes metrics related to company valuation, status, and finances.

- Once you have created and arranged these views according to your preferences, you can categorize your stocks based on any metrics. This allows you to quickly assess their performance and determine whether they perform better or worse based on the chosen criteria.

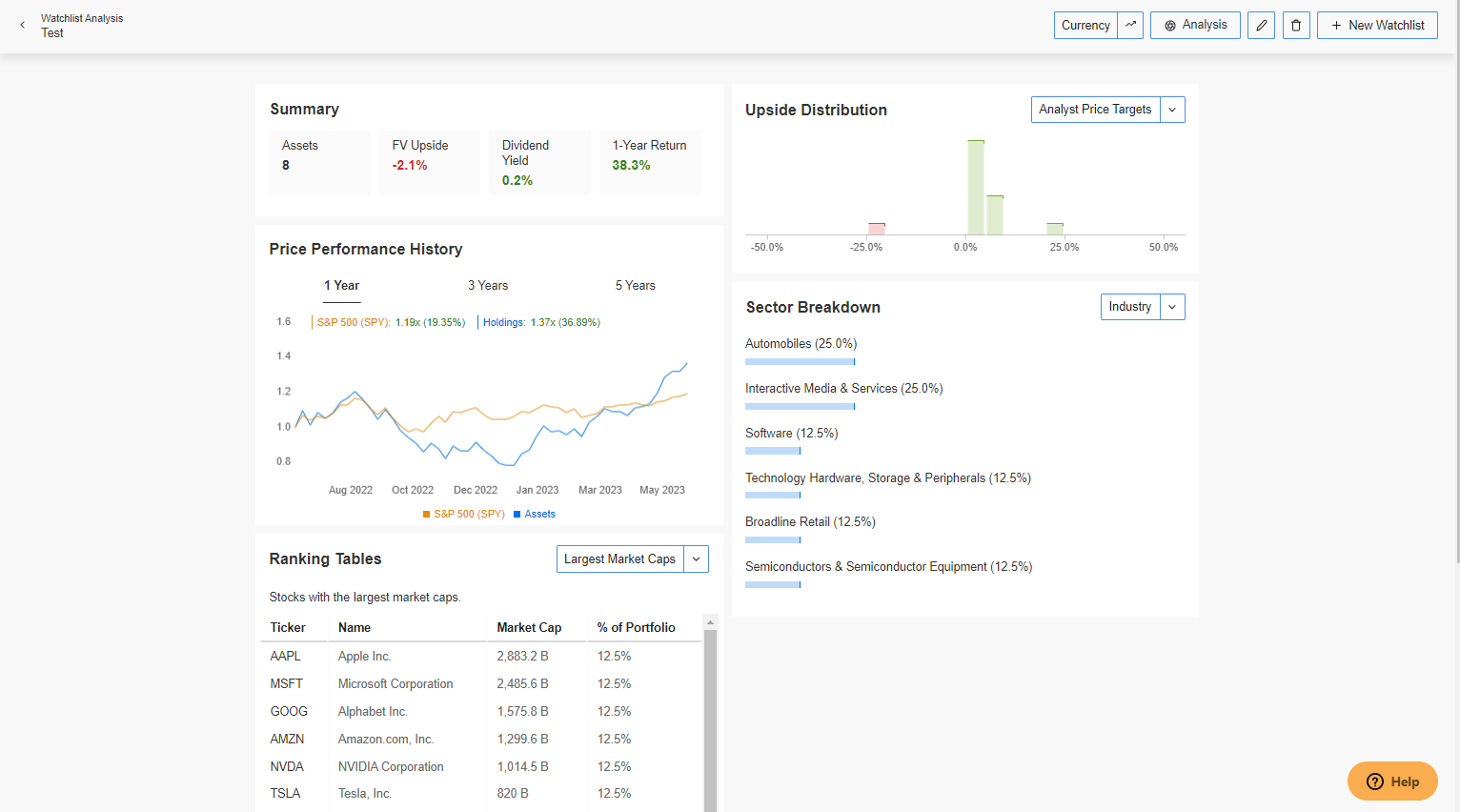

- Use the magic of InvestingPro's analysis button to see an overall summary of your portfolio in reference to yields, dividends, returns, sector distribution, its comparison with the S&P 500 index, and capitalization.

- If you have several portfolios, this option is essential to know which one is performing better.

Watchlists play a vital role in the world of investments, especially for savvy investors. Over time, carefully chosen stocks from these watchlists make their way into one's portfolio, delivering favorable returns.

In the forthcoming article, I will guide you on maximizing your investments by creating an optimal watchlist using InvestingPro.

Whether you are new to investing or an experienced investor, a robust equity portfolio serves as a tool to monitor income generation, amplify your wealth, and safeguard your capital, particularly in periods of substantial inflation.

Not yet a Pro user? Subscribe now for under $9 a month and start outperforming the market today!

1. Creating and Customizing Your Watchlist

Building a watchlist on InvestingPro is a straightforward process that empowers you to track and analyze your investments.

In this article, we will unveil some valuable tips and secrets to help you customize your watchlist with exceptional features that set it apart from other fundamental analysis tools available in the market.

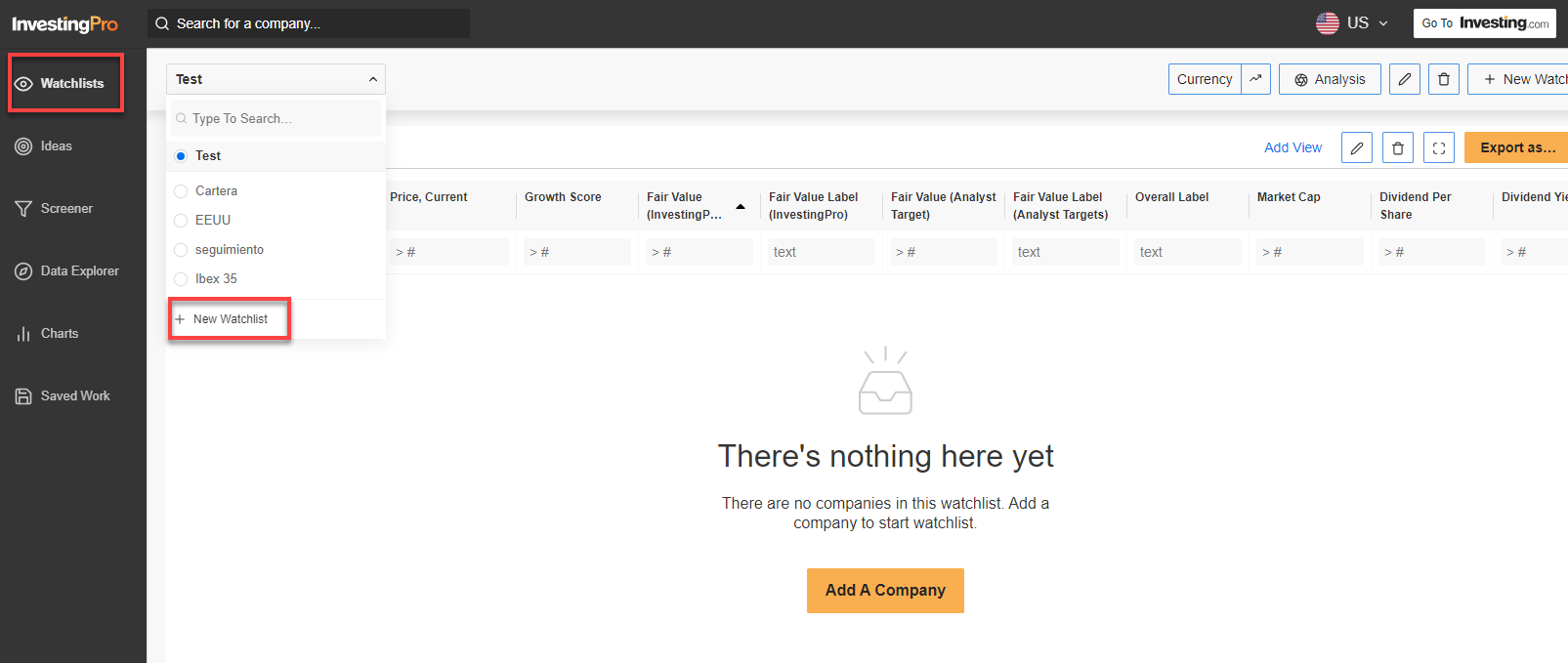

To begin, simply navigate to the 'Watchlists' menu in the sidebar and click on the '+ New Watchlist' button.

Source: InvestingPro

Once this is created, the system will ask you for two options:

Source: InvestingPro

Pro Tips:

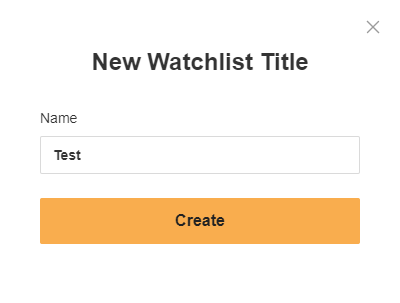

2. Naming and Adding Stocks

Once the watchlist is created, you can name it. This will help you remember which assets are included in the list.

It's worth noting that more experienced investors may have multiple portfolios or watchlists, so giving each set of instruments an appropriate name is crucial for quick and efficient access, saving you time and avoiding the need to search through each list individually.

Source: InvestingPro

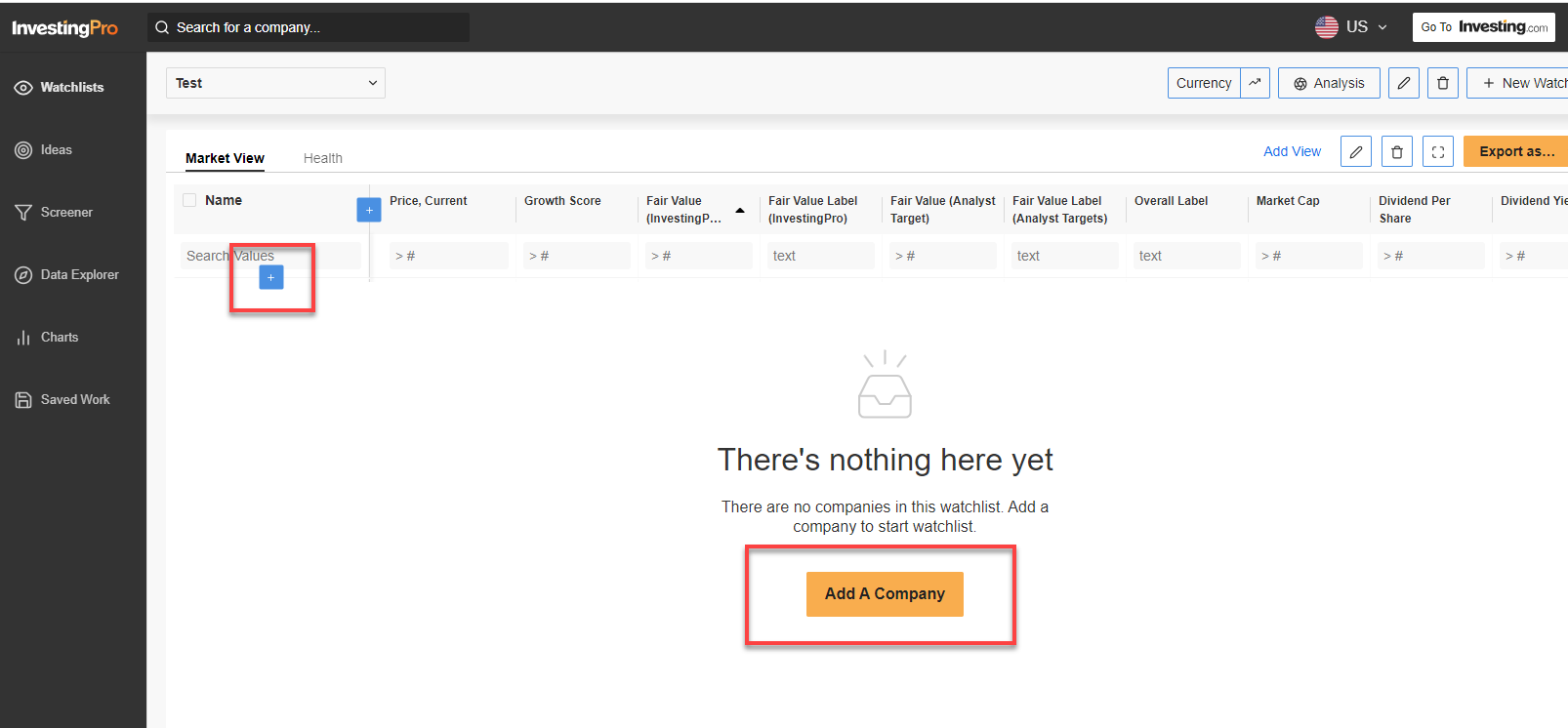

At this point, it is time to add the stocks we want to the watchlist via the '+' symbol at the top or by clicking the 'Add a company' button further down.

Source: InvestingPro

We can now add companies one by one or import a larger selection of stocks through a 'bulk import' feature.

Source: InvestingPro

Pro Tips:

3. Use the Superpowers of the InvestingPro Watchlist

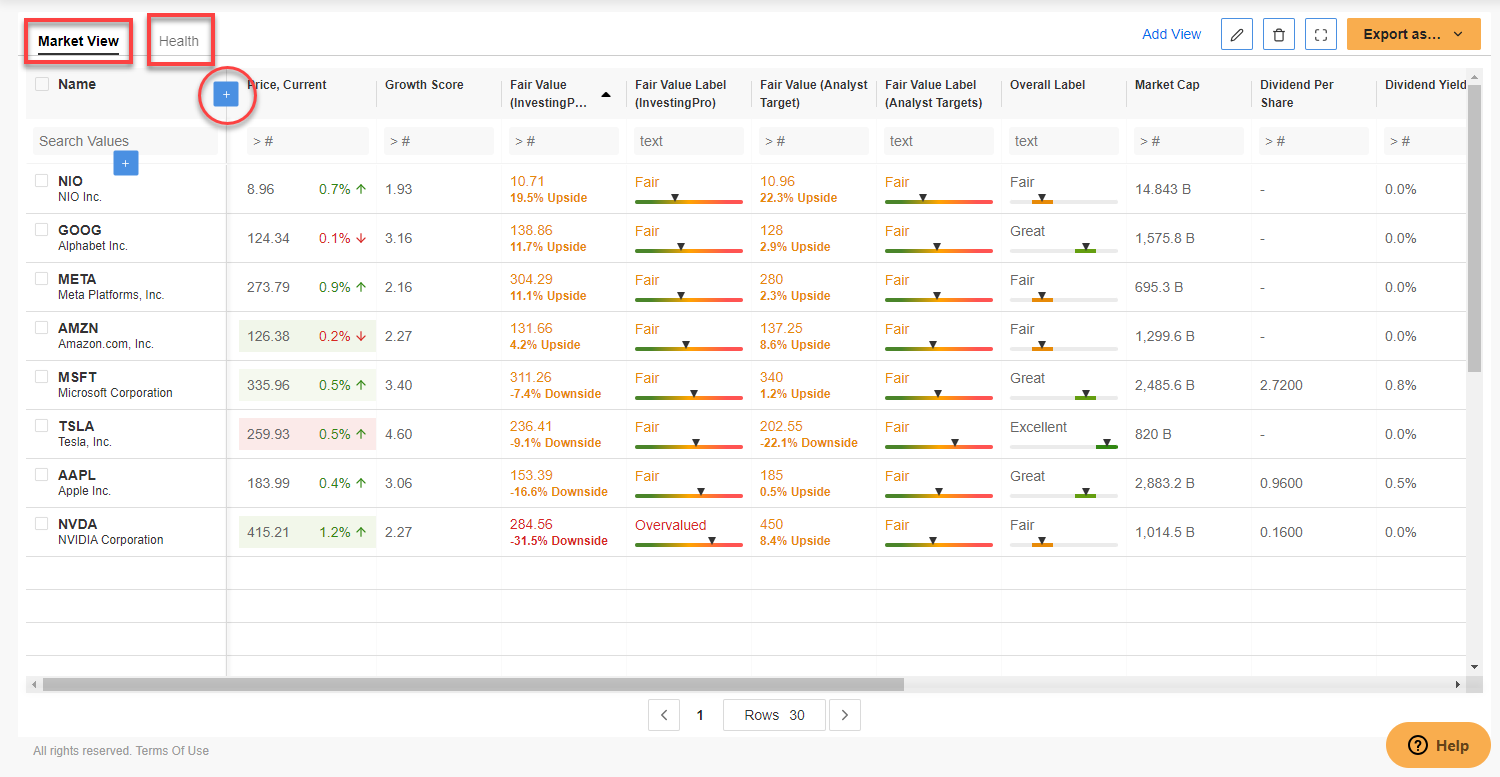

After explaining the basic steps to create a portfolio, let's customize our list or portfolio. By default, InvestingPro provides the most commonly used metrics in two separate sections: Market view and status.

Source: InvestingPro

Within 'Market View, ' 17 default metrics appear Current Price, Financial Health Growth Score, Market Value, Fair Value Label, Fair Value (Analyst Target, Fair Value Label, Global Label, Market Cap, Dividend Per Share, Dividend Yield, Relative Strength Index (14d), P/E, Price/Book Value, Price / Sales Last 12 Months, Enterprise Value (EV), Total Debt / Total Equity and Floating / Outstanding Shares.

Meanwhile, the 'Status' tab has 8 default metrics: Global Label, Financial Health Growth Score, Relative Value Label, Relative Value Score, Earnings Label, Price Trend Label, Overall Score, and Price Momentum Score.

To edit either of these sections or create a new one, simply click on the '+' symbol next to the metrics. This will open a menu where you can move, delete, or add new metrics to each section. You can also create a new section with the desired metrics. Once you have made the desired changes, click on the 'Save Changes' button to apply them to your portfolio.

Source: InvestingPro

Pro Tips:

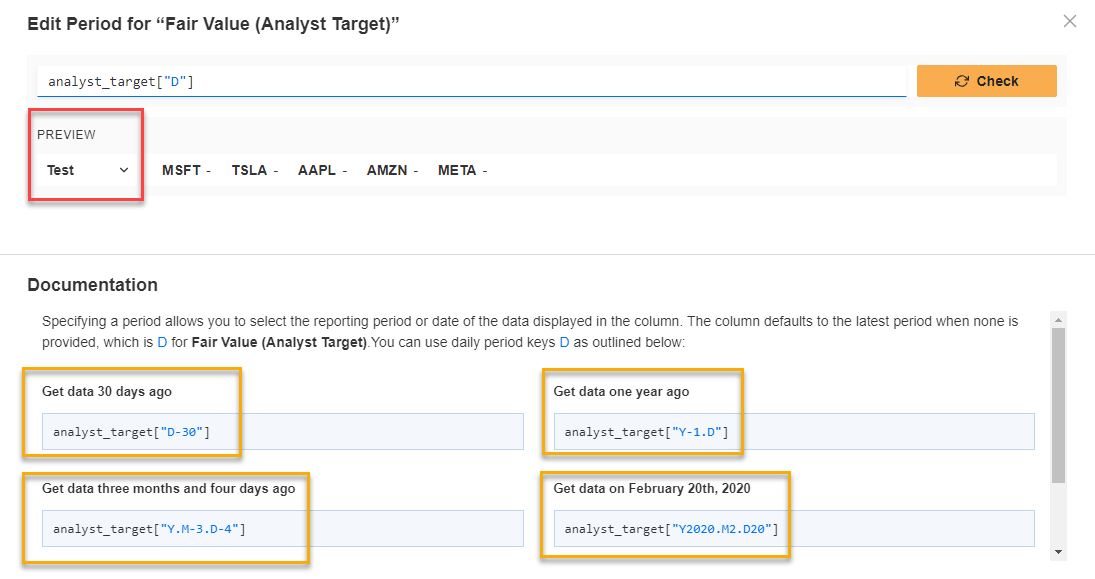

4. Customize Down to the Last Detail

Specific metrics in InvestingPro are denoted by a calendar symbol (as shown by the orange box in the image above). This indicates that you can customize these metrics by selecting a specific period for analysis.

By clicking on the calendar symbol, you can set a desired timeframe for the metric, allowing you to focus on specific historical data or project future trends.

This feature provides you with additional flexibility in tailoring the metrics to your specific needs and time horizon.

Source: InvestingPro

In the customization process, you can modify the metrics and collect data from various time periods such as 30 days, a year, three months, 2 years, and more.

Additionally, if you have multiple portfolios, you can select a specific portfolio from your list and customize different date ranges for each of them.

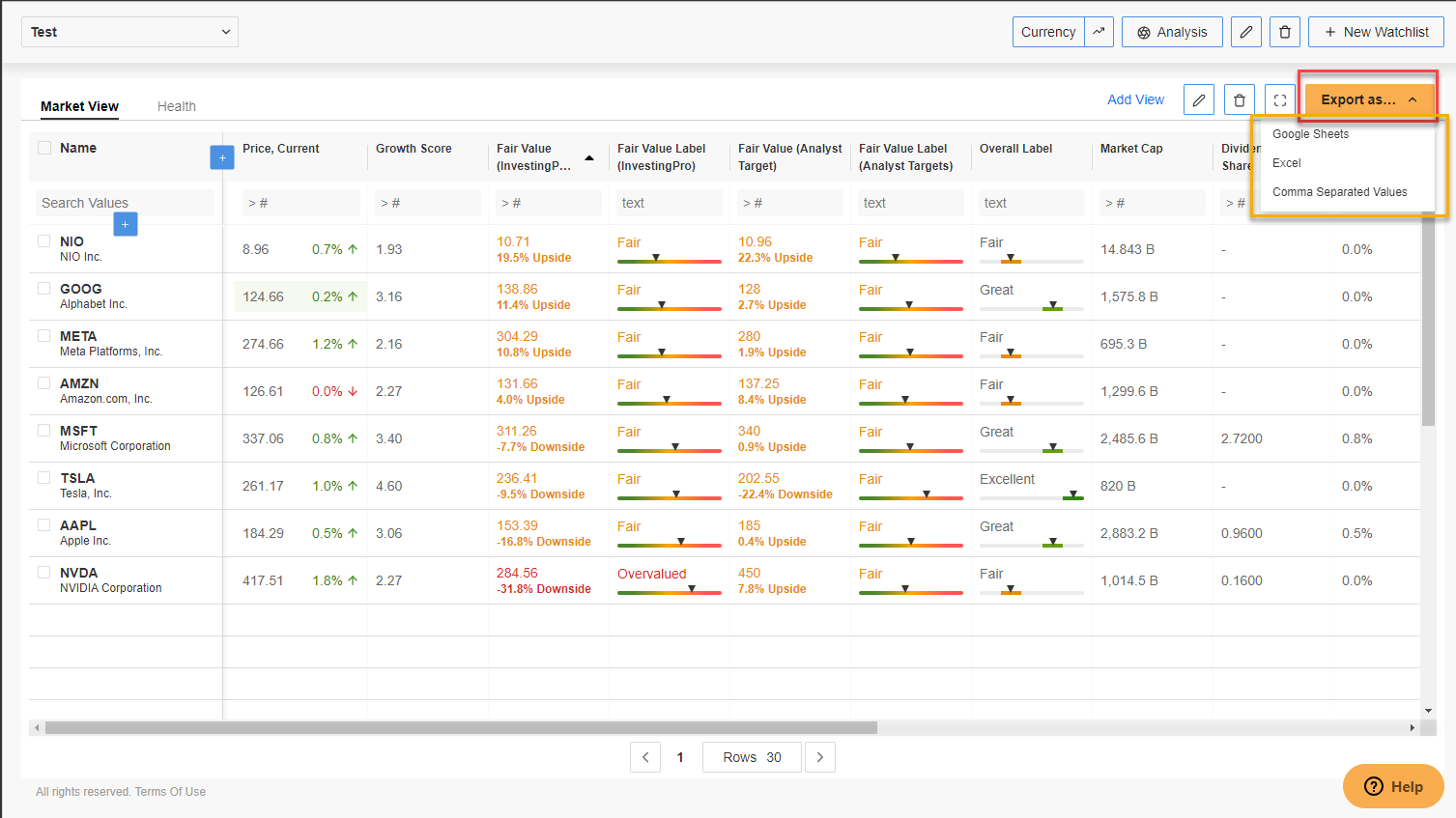

Once you have tailored your portfolio to suit your preferences and included the desired data, you can conveniently download it in different formats.

This allows you to work with the portfolio offline or easily cross-reference it with other data you have, enhancing your analysis capabilities.

Source: InvestingPro

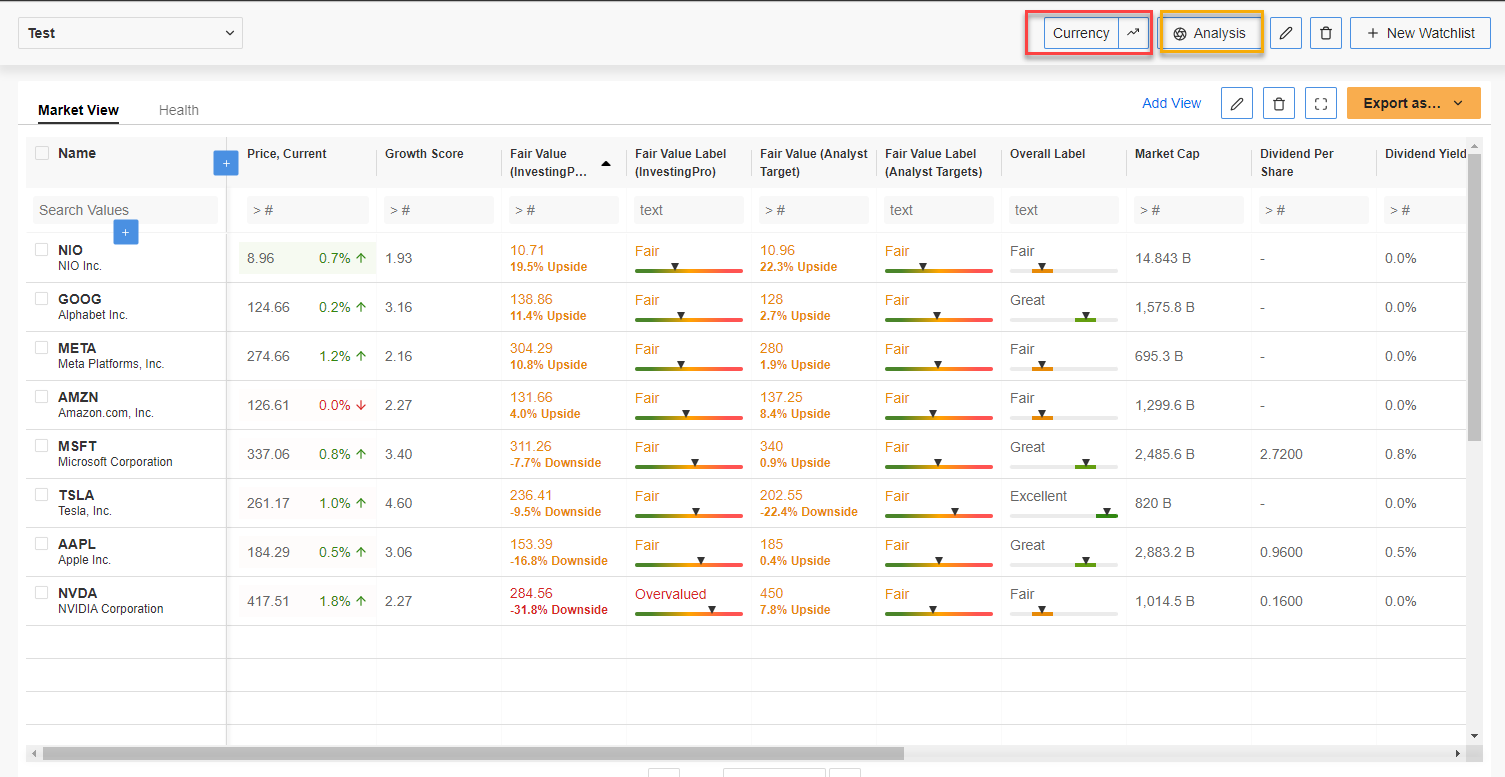

Finally, you can always change the currency of your portfolio by clicking on the 'Currencies' button at the top and get a complete analysis of your portfolio by clicking on the 'Analysis' button.

Source: InvestingPro

Pro Tips:

So what are you waiting for? Subscribe now for under $9 a month and start outperforming the market today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such and is in no way intended to encourage the purchase of assets. It must be remembered that any asset class is evaluated from multiple points of view and is highly risky and; therefore, any investment decision and associated risk remains the investor's decision.