Today I’m going to show you 4 funds that, when put together, give you a juicy 7.2% dividend yield.

And that’s just the start. In addition to giving you $595 per month in income for every $100,000 invested, this “instant” 4-fund portfolio gives you diversification that limits your risk of losing cash in a market downturn.

Oh, and there is capital gains upside here for you, too.

The reason for that upside is that all of these funds are trading at a pretty big discount to their net asset value (NAV).

Let me explain.

Each of these picks is a “closed-end fund,” a unique type of fund that has a few key advantages over more familiar mutual funds and exchange-traded funds. A big one is that CEFs can—and very often do—trade on the market at a price that is below the actual market price of all of the assets inside the CEF.

How is this possible?

It boils down to this: CEFs set how many shares are in the fund when they do an initial public offering and don’t release new shares in the future. That weird mechanism means funds will often trade for less than their NAV—and those discounts can be really big.

Which brings me to…

“Instant Portfolio” Pick #1: A Real Estate Titan With a 7.9% Dividend

Every real estate developer, landlord and house flipper’s dream is to get their hands on a property that’s selling for 17% below its actual market value. But those deals are hard to come by.

In CEF land, however, they’re easy to get.

All you need to do is buy shares in the RMR Real Estate IF (NYSE:RIF), a CEF that’s been around since 2005 and not only survived the bursting of the 2008–09 real estate bubble but has also been paying out massive dividend checks ever since.

And right now, RIF is paying out a 7.9% yield.

The fund’s portfolio makes this possible. RIF owns shares in some of the largest real estate investment trusts (REITs) in the world—basically companies whose sole purpose is to buy, manage and rent out real estate.

And since RIF’s portfolio is diversified across 125 REITs, shareholders are getting a slice of literally thousands of properties in all kinds of sectors: retail outlets, assisted-living facilities, offices and even data centers for cloud-computing companies.

And here’s why you want to buy now:

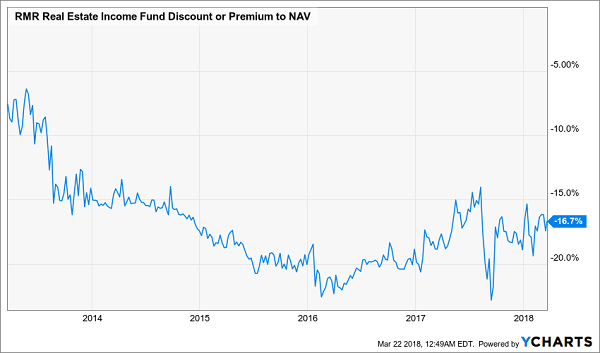

A Big Sale Ending Soon

Notice how the fund’s discount to its NAV has gone off a cliff in recent years—but it’s starting to recover? The current 16.7% discount is a bargain that may end soon thanks to a pile-in back into CEFs. That makes this one a fund to consider now—because buying at this point could set you up for 25% capital gains while this fund’s discount disappears.

“Instant Portfolio” Pick #2: Peace of Mind and a Tax-Free 5.7% Payout

The Nuveen Dividend Advantage Municipal Fund (NYSE:NAD) is not only a great option because of its 5.7% dividend yield but also because of the diversification and low volatility it provides.

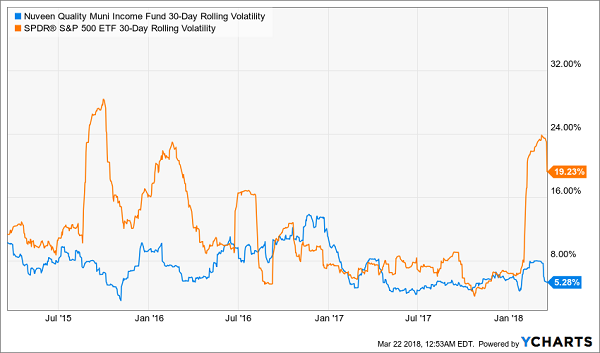

Let me explain by comparing this fund to the S&P 500, which we will do with the benchmark SPDR S&P 500 ETF (NYSE:SPY). In 2017, the stock market famously saw extremely low volatility, steady gains and little fear, which resulted in stocks climbing up and up, with few corrections.

Then 2018 happened.

Fear Is Back!

The orange line here represents volatility in price changes over the last month for SPY, and you can see how the line fell sharply and stayed low throughout 2017.

But this is an aberration. Big spikes, like we saw in 2015 and 2016, are the norm—moments when the market goes into a panic and starts selling shares. The blue line, however, represents the volatility we saw with NAD, a fund with bonds from as diverse places as Utah and New York.

Although the fund’s price swings did accelerate a bit in late 2016, after Donald Trump was elected president (and the market worried about how his tax plans would affect municipal bonds), the blue line stays pretty quiet all the time.

There’s a reason for this: municipal bond values do not go up and down a lot. That means buying NAD gets you steady income without big paper losses when the market freaks out.

That’s why you need to diversify your portfolio so you aren’t forced to sell when the market collapses. With NAD, you can hedge against a market downturn by diversifying beyond stocks and into these low-volatility, high-quality municipal bonds.

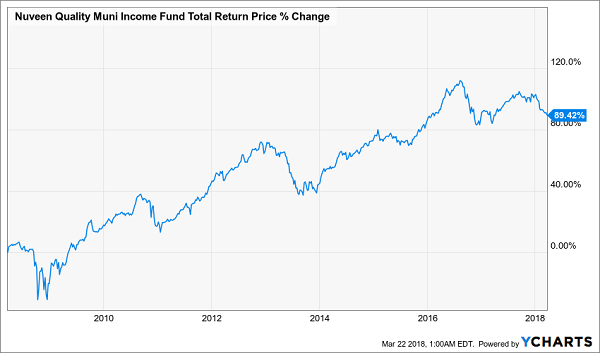

And if you’re worried about missing out on gains, don’t be. Here are NAD’s total returns over the last decade:

Strong Gains in a Safe Haven

A 6.8% average annual return from a fund with such low risk shouldn’t be possible. But here it is.

“Instant Portfolio” Pick #3: A 7.1% Dividend From Top-Quality Stocks

Of course, we still need stocks in our portfolio so we can profit from the good times in the stock market—and I see many of those still to come. As I wrote in a March 8 article, stocks are set for a good year, thanks to rising earnings and a better economic environment, and we want to be part of that.

That’s why you should take a serious look at the AllianzGI Equity & Convertible Income Closed Fund (NYSE:NIE).

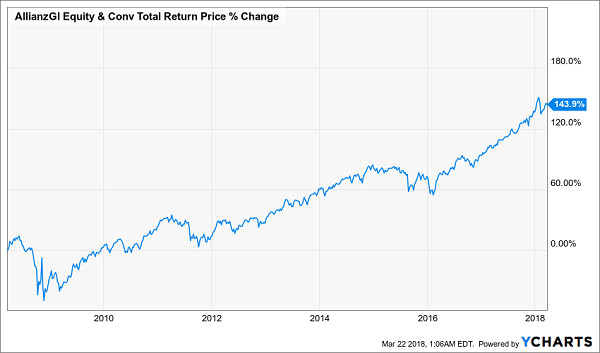

Not only does NIE pay a 7.1% dividend, but it also has an enviable portfolio full of winners, such as Amazon.com (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) and Visa Inc (NYSE:V). NIE is able to turn big gains from these stocks into steady income for shareholders. That’s why the fund has been able to deliver this massive 9.8% average annualized return over the last decade:

Strong and Steady Returns

The fund also makes its dividend safer with convertible bonds. Let me explain.

In addition to shares in the best companies in the world, NIE also buys and trades a group of unique bonds that smaller and riskier companies issue. These “convertible bonds” are a kind of debt with a special agreement that, if the company’s stock rises to a certain level, the bonds will turn into common stock.

NIE buys these convertibles because it gets them a reliable income stream from these companies and the potential upside of owning actual shares in the firm. The fund has a long track record of using these to secure its dividend and provide more capital gains upside for shareholders.

And despite its amazing track record, NIE is selling at a 10.4% discount! That’s why it’s time to buy now.

“Instant Portfolio” Pick #4: A Rock-Steady Corporate-Bond CEF With a 7.3% Dividend

Speaking of bonds, we should also add some corporate bonds to our “instant” portfolio. Not only can we get a 7.3% dividend by doing this with the Western Asset High Yield Defined Opportunity Fund (NYSE:HYI), but we can also dip our toes in this asset class at a massive 10.2% discount.

And now is clearly the time for HYI to shine.

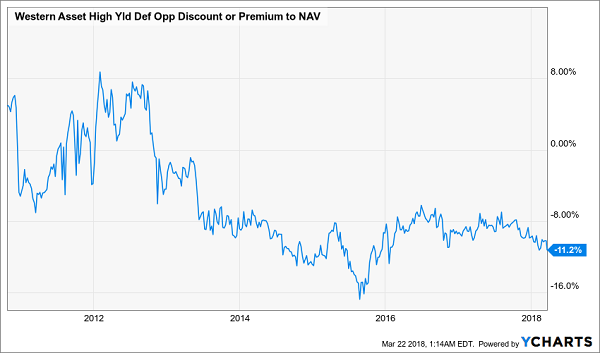

That’s because the market has turned its back on this fund for too long, despite the recent improvements management has made. Specifically, HYI has focused more on companies that are on the cusp of getting credit upgrades that will raise the value of their bonds. Just take a look at how its discount to NAV has trended over the last few years:

The Discounts Just Get Bigger

The market has sold off HYI in a big way, sending it from an 8% premium to NAV to an 11.2% discount.

And there was a good reason for that back in the mid-2010’s: HYI was not doing well. Its total return was about 17.5% from mid-2010 to 2014, which isn’t great and definitely lagged the S&P 500 over the same period (SPY rose 65% during that same timeframe).

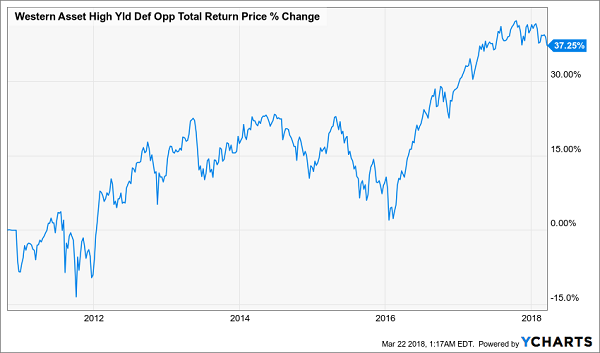

But that’s been changing. Take a look at this chart.

Gains Accelerating for HYI

HYI is up 25% from the beginning of 2016, and its strong gains are just getting started. Why? Because, again, the economy is improving—which means the credit quality of the bonds HYI holds is starting to go up. That increases demand for them, resulting in higher prices on the market and profits for HYI shareholders.

Exposed: The “Billionaires Only” 7.6%+ Dividends You Can Buy NOW

Here’s something else you may not know about CEFs: some of the world’s richest billionaires have been quietly cashing in on them for years.

I’m talking about financial titans like Bill Gates, Bill Ackman and Jeffrey Gundlach, the legendary “Bond God.”

Then there’s Boaz Weinstein, who made a fortune betting against the ridiculous trades of JPMorgan’s so-called “London Whale” back in 2012.

In 2017, Weinstein dropped a cool billion into—you guessed it—CEFs.

Here’s what he had to say about the big profits waiting to be made from these funds:

“You go into it hoping the discount will narrow on its own, but one of the nicest points about this investment is that while you wait, you earn an above-average yield, given the discounted price.”

He also called CEFs “a rare corner of the market where retail investors can get an edge over institutions.”

I couldn’t have said it better myself!

And now is your chance to grab your share of the profits from this exclusive corner of the market.

The 4 CEFs I just told you about are a great start. But right now I’m pounding the table on 4 OTHER funds throwing off fatter average dividends—7.6% as I write—and one of these unsung cash machines even pays an amazing (and growing!) 8.1%.

Better yet, all 4 trade at even more outrageous discounts to NAV, putting you well on your way to 20%+ GAINS in the next 12 months! Throw in that 7.6% average dividend and you’re looking at a fast 28%+ gain here—with a big chunk of that in CASH!

Returns like these are common in the CEF space. No wonder billionaires like Weinstein, Gates and others have silently flocked to them.

Your opportunity to join this “billionaire’s club” through the 4 very best funds in the space is open now. But the weird discounts on these stout 7.6%+ payers are already starting to slam shut, so you need to make your move!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."