You’re no doubt wondering if there’s anywhere you can invest and still get a decent return—without wincing every time you open your brokerage account.

Good news: there is just such a place. And today I’m going to show it to you—along with three specific “crash-resistant” funds yielding up to 7.1%.

The magical place I’m talking about is an often-ignored corner of the market called closed-end funds (CEFs).

Steady Dividends for Rocky Markets

There’s a weird twist that lets CEFs pay us dividends of 7.1% (and a lot higher) without exposing us to the risk of a surprise payout cut.

It comes down to the fact that several CEFs’ prices (on the open market) trade at a discount to the per-share net asset value (or the liquidation value of their portfolios).

In English?

This means that a CEF’s dividend yield based on NAV—the value that really matters to fund managers—is lower than the yield on market price. That simply makes the dividend easier for management to cover than you might think if you just looked at the “headline” yield.

Aside from a safe yield, these discounts to NAV also give us something else: bargains! Like these three ridiculously cheap, high-yielding and—most important—low-volatility funds:

CEF Pick #1: A Mega-Cap Fund With a Mega 6.8% Dividend

The Nuveen Dow 30 Dynamic Overwrite Fund (NYSE:DIAX) is a large-cap index fund with a difference: it also sells call options against its portfolio.

Call options are a kind of insurance that essentially protects investors if they’re short the market and think it’s going to go down. DIAX sells those short sellers their insurance, meaning DIAX’s options will go down in value when the market goes up.

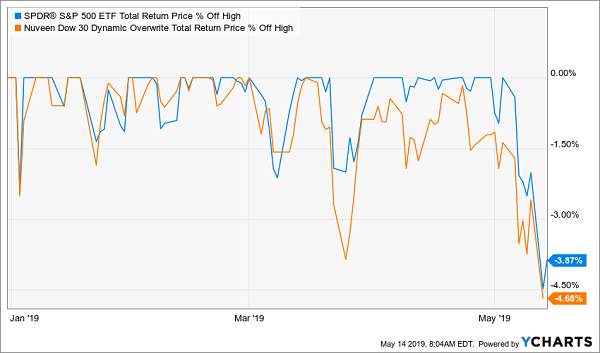

That’s one way that DIAX limits its downside. But its downside is already theoretically limited by its mandate: to buy Dow Jones blue-chip stocks. That focus on huge, well-established companies has helped the fund decline a bit less than the S&P 500 itself in this latest selloff:

A Lighter Downside

But that isn’t the best part. DIAX gets cash for selling those call options, and it returns that cash to shareholders. As a result, this fund yields 6.8% based on its market price, a whopping nine times more than the SPDR Dow Jones industrial Average ETF (NYSE:DIA), which holds the exact same stocks.

CEF Pick #2: A Tax-Free 5.1% Dividend Perfect for the “Tariff Tantrum”

Of course, the best way to avoid stock-market volatility is to avoid stocks altogether. But how do you do that without getting a 0% (and worse, after inflation) return in cash or locking your cash up in Treasuries for 10 years for a crummy (and taxable) 2.4% yield?

The answer? CEFs that hold municipal bonds, such as the Invesco PA Value Municipal Income Trust (NYSE:VPV). This fund pays a nice 5.1% yield on its market price (4.7% based on NAV) that in reality is even higher for many folks, as that dividend is tax-free.

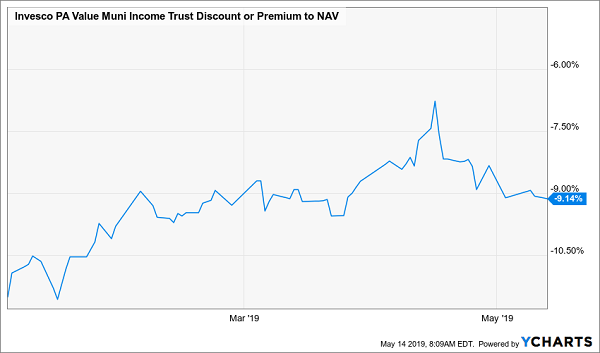

VPV also lacks the volatility of the market, and the best part is that it’s on sale:

A Sale Appears

With a 9.1% discount to NAV, you’re getting $1 of assets for less than a buck. But since the fund recently traded at a smaller discount, you’ll also likely have a chance to sell VPV for a gain if you hold for just a few months. Plus, the stock is much less volatile than the market (blue line below):

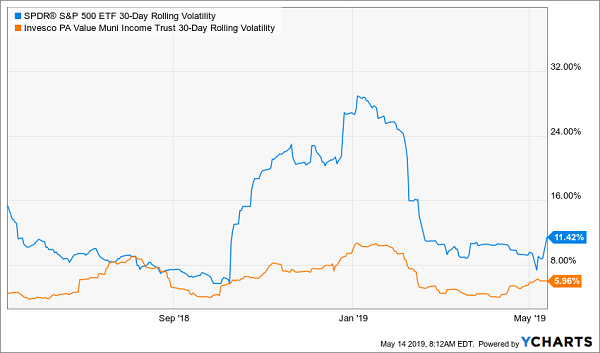

A Smoother Ride

With nearly half the volatility of the SPDR S&P 500 ETF (NYSE:SPY), VPV will not see 20% drops in weeks like stocks do. But it will keep paying its big tax-free income stream, month in and month out.

CEF Pick #3: A Bargain Real Estate Buy With a 7.1% Payout

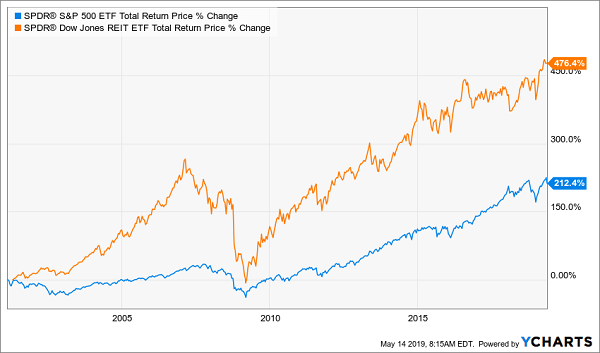

With 2008 being still relatively recent history, it’s easy to think of real estate as risky. But not only is real estate less volatile than equities over the long term, it also beats the market by a pretty big margin.

Real Estate for the Win

The SPDR Dow Jones REIT ETF (NYSE:RWR) has crushed the S&P 500 over the long haul, with over double the total return. Note that this includes the massive bear market caused by the subprime mortgage crisis, which hit real estate much harder than stocks. Yet RWR is still the big winner.

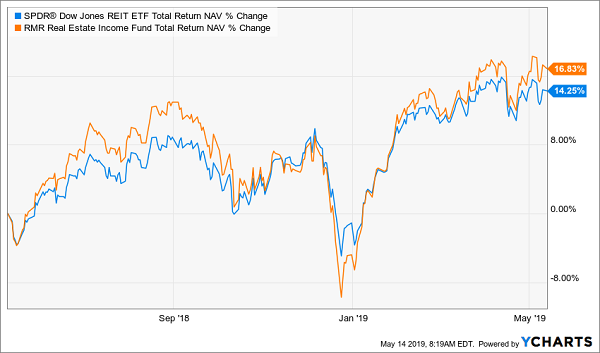

We can do better than RWR’s 2.2% yield, though. The RMR Real Estate Income Fund (NYSE:RIF) has a 7.1% yield on market price and trades at a huge 20.8% discount (giving it just a 5.6% yield on NAV). There’s a reason for that discount: RIF’s long-term total returns of 4.3% on NAV are far worse than those of the competition. But that’s history. Thanks to some management adjustments, RIF has been doing much better, and has even started to outperform the REIT index fund:

Outperformance—Finally!

When the market realizes RIF isn’t the dud it used to be, expect its 20% discount to disappear—meaning some very nice price upside to go along with the fund’s 7.1% income stream.

NEW: The 4 CEFs You Must Buy Now (8.7% Dividends, Double-Digit Gains Ahead)

The story you just saw with RIF—a fund that has demolishes the market but is still cheap today—is something I see a lot in CEFs.

A situation like that really is the “sweet spot”: the outperformance shows that management has the chops to beat the market, while the yawning discount to NAV sets you up for even more upside!

And you’ll grab a 7%+ cash dividend while you wait for those gains to kick in!

For good measure, it’s also thoroughly bested the market this year, with a 22% total return:

A Market-Beating Fund

Despite that gain, this fund is still cheap, trading at a ridiculous 13% discount to NAV. That’s why I’m calling for 20% price upside in the next 12 months, to go along with that rich 7.9% payout!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."