- 10-Y yields to settle between 3.5% and 4.5%

- China and Europe to stabilize and show signs of recovery

- Inflation to remain persistent, but not rampant

- Industrial technology could drive the next tech wave

- Semis and retail among fist to come out; trucking data turning positive

- Commodities to benefit from China re-opening

- What we are avoiding?

- Autos: expect a tough year for electric vehicles (EVs)

What do we like?

Investment Themes for 2023

Downturns are caused by shocks to the market, and there were two significant shocks that occurred in the first half of 2022. High inflation squeezed consumers' budgets, which was followed by an aggressive Fed tightening that slowed the economy. The worry shifted from inflation to recession as we progressed through the year.

From a fundamental standpoint, the areas that experienced a slowdown first were sectors with high inventories, e.g., semis, commodities, and consumer discretionary. These sectors are usually the first ones to go into a downturn and are the first to come out. As we progressed through the year, the weakness broadened to all sub-sectors and caused enterprises to pause spending and reduce their workforce.

Technology was the sector that was hardest hit, with 1. interest rates impacting valuations in the first half of the year and 2. earnings re-set in the second half. Interestingly, this sell-off coincided with what we believe is a new tech wave, i.e., technology transforming most traditional industries, making it an exciting time to acquire the next technology winners at what we believe are attractive prices.

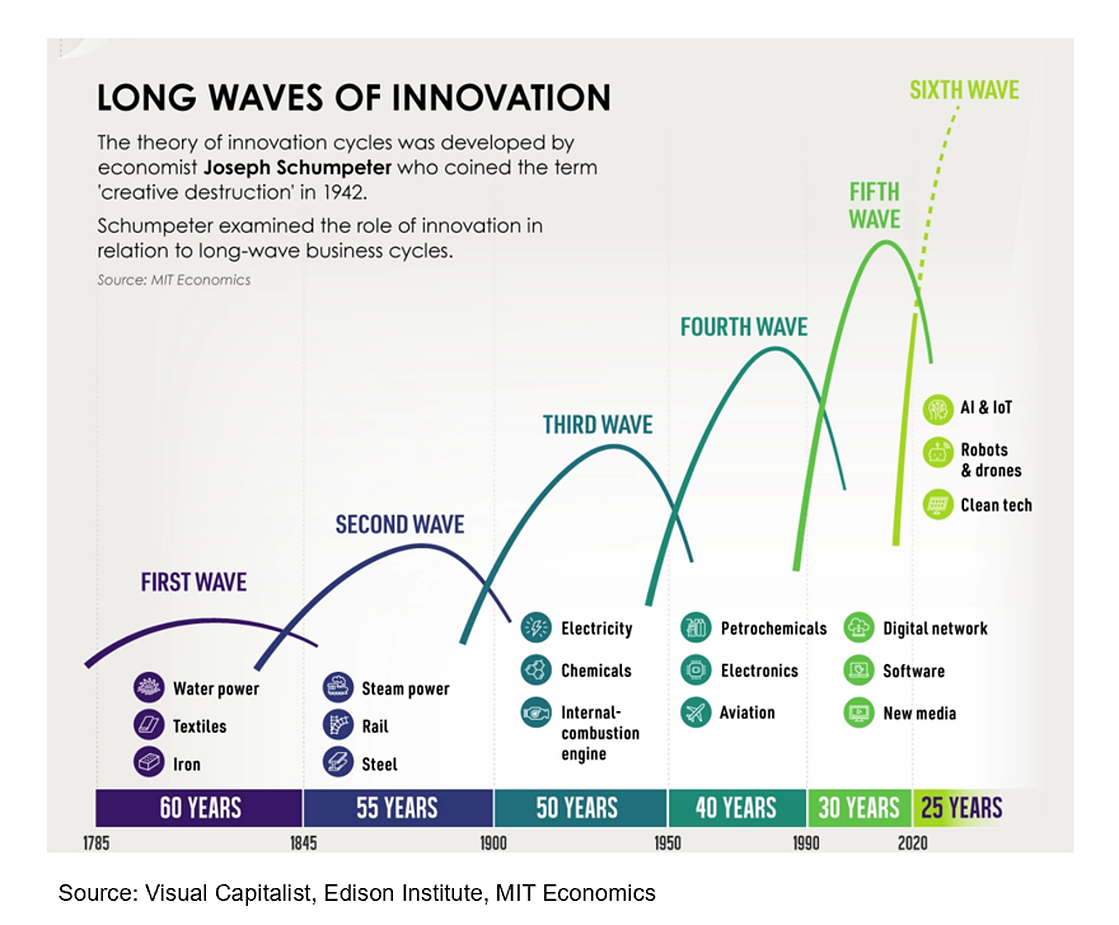

The Next Wave

The prior tech cycle was driven by consumer technologies. The internet grew from less than 200 websites in the 90s to 2 billion today. Search engines, social media, and streaming were the key areas of innovation. We expect that industrial/B2B tech will drive the next cycle, with technology transforming many traditional industries, e.g., retail, logistics, automotive, food & beverage, life sciences, healthcare, energy, commodities etc.

Artificial Intelligence (AI), in our view, will be the most important theme over the next 10 years. The outsized winners, however, may not be the obvious companies that build AI solutions but those that make AI possible (both hardware and software). Beware of value traps.

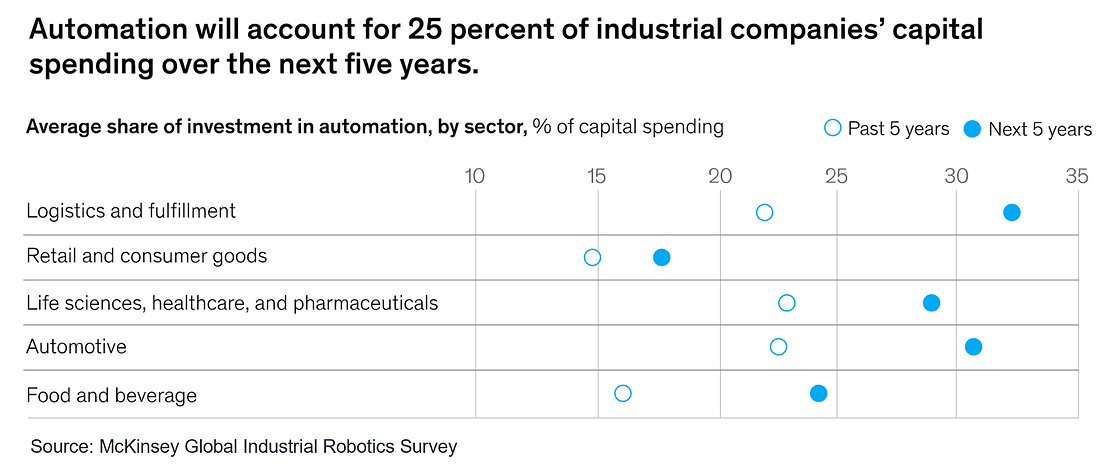

We expect that AI will play a key role in robotics and automation and will overcome many of the limitations that those fields are facing today. Per a recent McKinsey report and survey, automation is expected to account for 25% of industrial companies' capital spending over the next five years, significantly higher compared to the previous 5 years. But many are facing challenges with implementation.

It is worth highlighting that effective usage of AI will require different solutions for cloud storage and computing. AI/ML processes often require real-time querying with fast response times and are based on large amounts of data that needs to be stored efficiently (otherwise, they become cost prohibitive).

Some of these solutions are just getting introduced, which broadens the potential use cases for AI. Cloud cybersecurity adoption is also in the early innings of adoption with only 1 in 5 companies regularly assessing their overall cloud security posture, per Crowdstrike, a leading cybersecurity platform.

While cloud spending is going through a period of consolidation as enterprises cut their budgets, many investors are now wondering if it has matured. We could not disagree more and see this as an area to continue to add exposure to, even if these stocks continue to struggle in 1Q23.

First Out of the Downturn: Retail, Semis, Commodities

Expect that the areas that went first into this downturn will be the first to come out.

Consumer spending was hard hit in 1H22 but is stabilizing as consumers are adjusting to the new interest rate reality. While we expect big-ticket items that require financing to remain challenged as long as interest rates remain high, some areas of retail have started to recover.

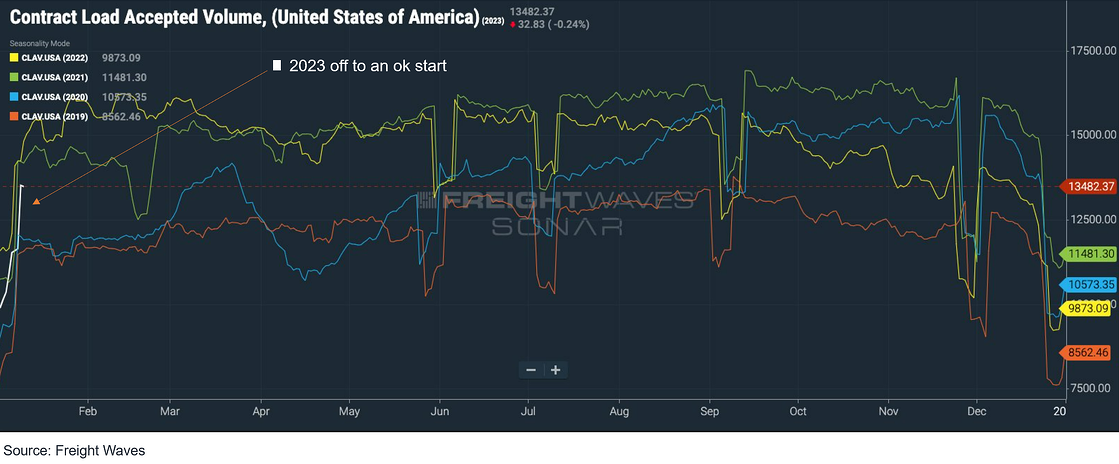

We have recently noted several positive data points, such as stronger-than-expected January trucking contract volumes, which followed our last month's channel checks that implied improving shipper sentiment.

Commodities were another hard hit sector in May/June of last year and we believe are now poised to recover. While demand has been under pressure, sentiment has been even worse resulting in meaningful inventory drawdowns. Consequently even small improvement in demand (e.g., China recovery) could support a recovery.

Lastly, semiconductors faced enormous inventory challenges in addition to slowing demand in the first half of last year. While we are not seeing demand pick up just yet, inventories are normalizing. China re-opening could drive significant upside to demand. In semis, we are particularly focused on capitalizing on the multi-year AI trend and would highlight Nvidia (NASDAQ:NVDA) as a leader in AI processors.

Avoiding Autos, Specifically EVs

While we have been cautious on autos for the most part of 2022, we now believe that electric vehicles (EVs), specifically, could face a very challenging year.

Analysts are projecting 40%+ growth for EVs in the US this year which will be very difficult to achieve in an environment where there is a glut of used cars in addition to slowing demand. Moreover, both Toyota and GM recently made comments implying that consumer preferences are not shifting to EVs at the rate previously assumed.

Increased competition in China caused Tesla (NASDAQ:TSLA) to meaningfully drop pricing, and we expect price declines to follow in the US and Europe. Declining pricing in addition to disappointing volumes could be detrimental to profits for a company like Tesla, and could result in bankruptcies for new-entrants and legacy players that overspent on capex.

While the long-term EV trend remains intact, there may be several difficult years for EV manufacturers ahead. Consequently, we are avoiding EV OEMs until estimates get re-set lower.

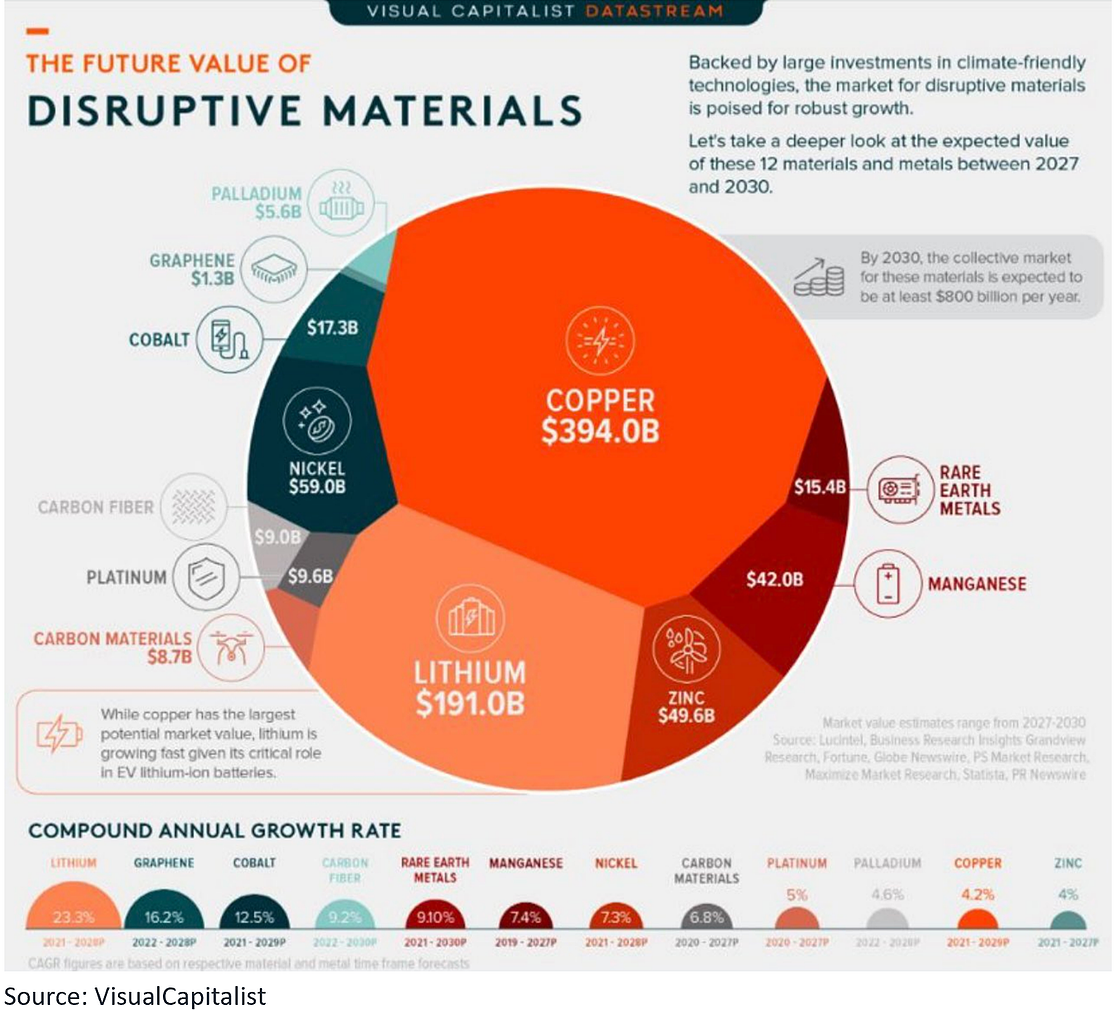

We believe a more attractive way to get exposure to the electrification theme is through investing in the underlying commodities required for electrification. Out of the commodities produced at scale, supply/demand for copper looks particularly favorable.

DISCLOSURES: Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR's current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR's objectives will be achieved.