he S&P 500 index is a popular investor tool. Professionals investors such as big insurance companies or pension funds allocate their portfolio weighting on indices like the Dow Jones Index and Standard & Poor’s 500. The S&P 500 is a free-float capitalization-weighted index that, since 1957, has been published by Standard & Poor's, a division of McGraw-Hill Companies.

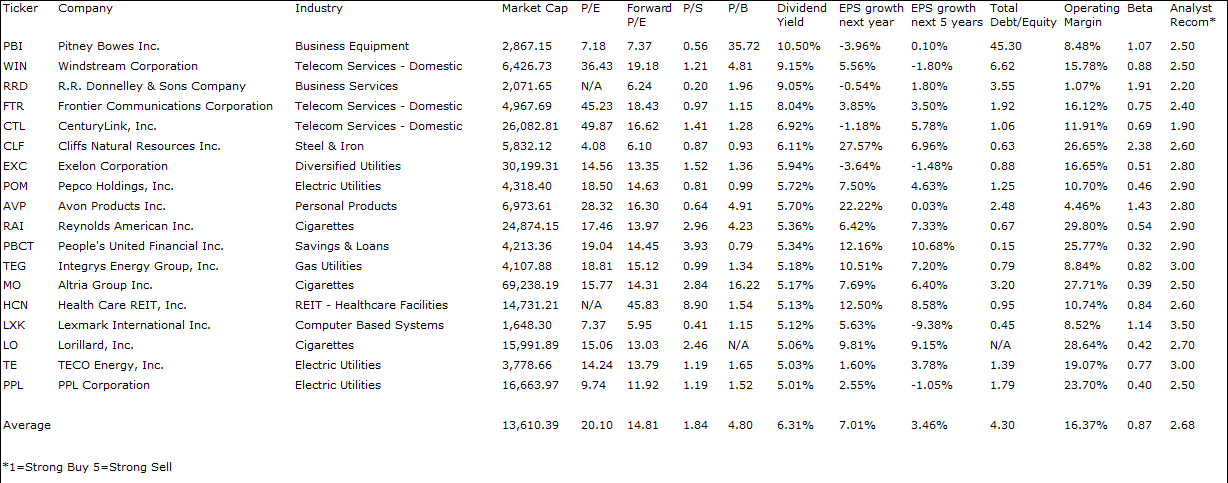

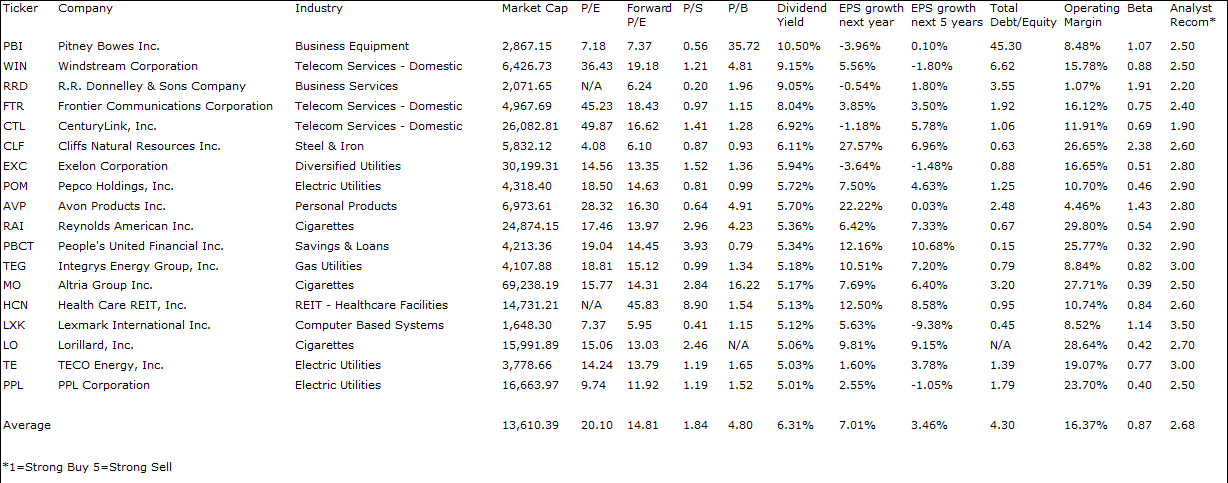

I screened the index with its 500 companies for the best dividend yields. The index has eighteen high yielders and the highest yield amounts to 10.50 percent, paid by Pitney Bowes (PBI). Six high yields have a P/E ratio below 15 and seven are currently recommended to buy.

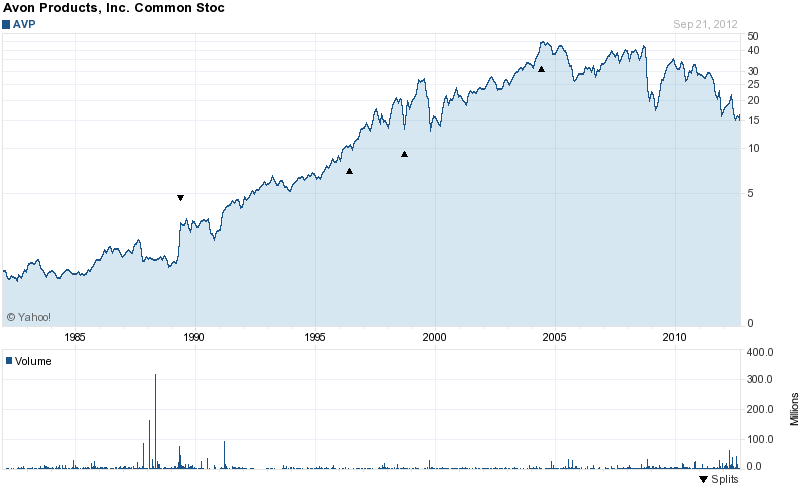

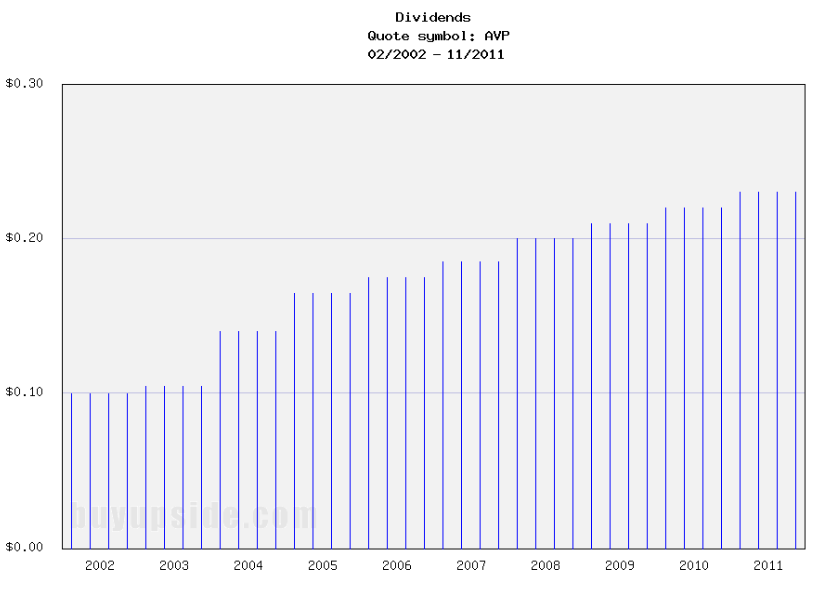

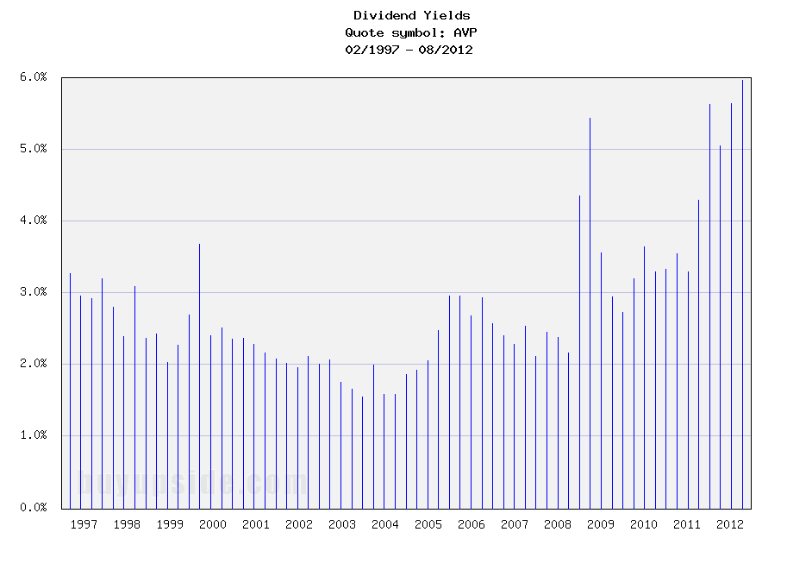

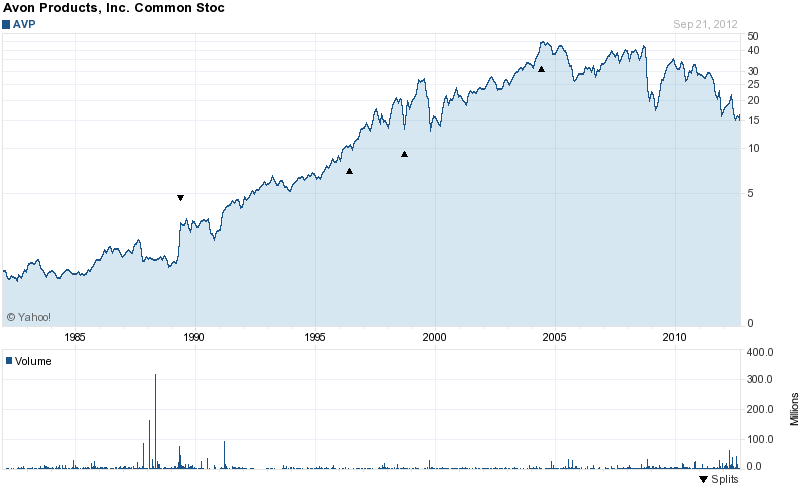

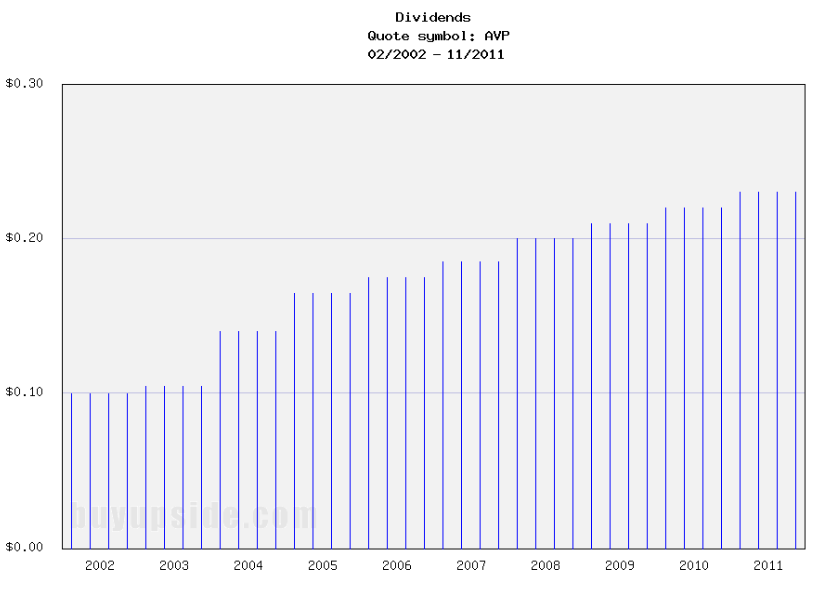

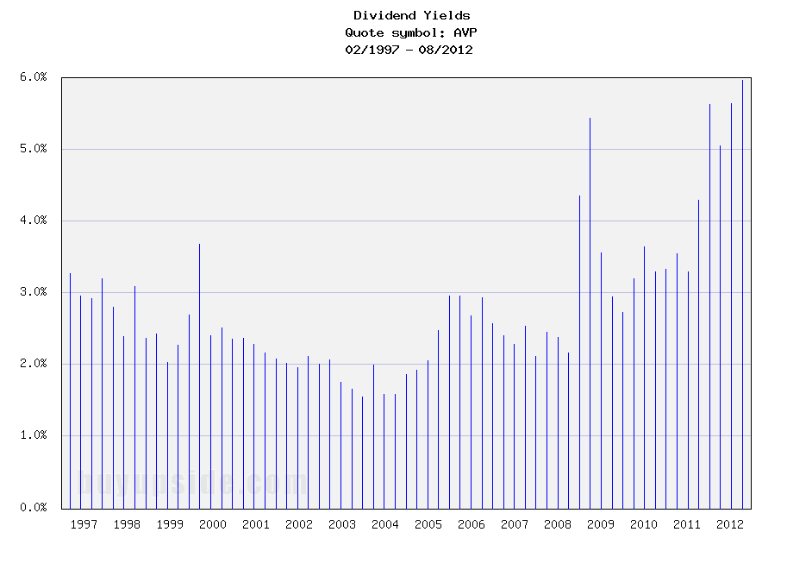

Avon Products (NYSE:AVP) has a market capitalization of $6.97 billion. The company employs 40,600 people, generates revenue of $11,291.60 million and has a net income of $526.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1,094.20 million. The EBITDA margin is 9.69 percent (operating margin 7.57 percent and net profit margin 4.66 percent).

Financial Analysis: The total debt represents 42.77 percent of the company’s assets and the total debt in relation to the equity amounts to 210.67 percent. Due to the financial situation, a return on equity of 32.08 percent was realized. Twelve trailing months earnings per share reached a value of $0.57. Last fiscal year, the company paid $0.92 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 28.17, P/S ratio 0.62 and P/B ratio 4.43. Dividend Yield: 5.70 percent. The beta ratio is 1.43.

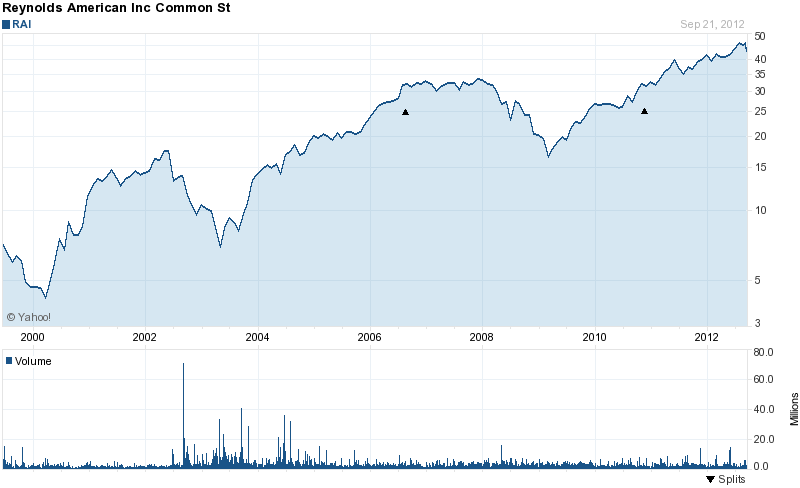

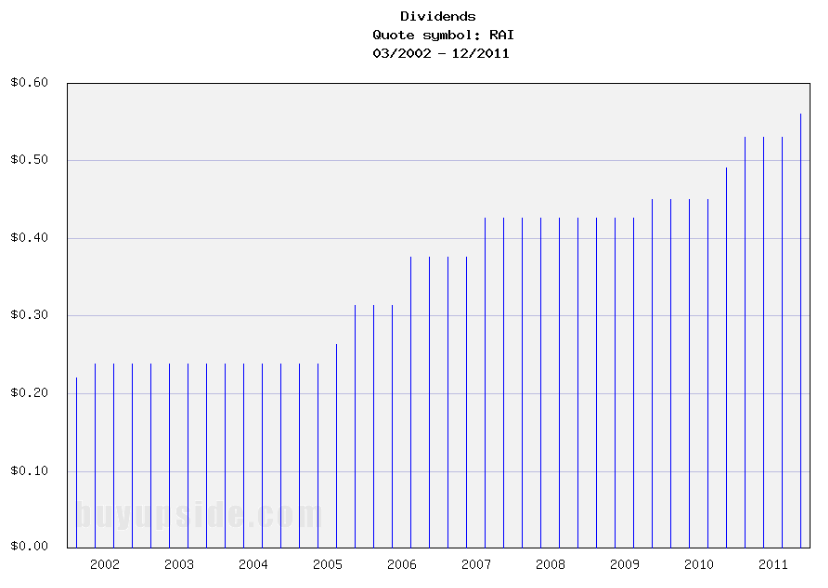

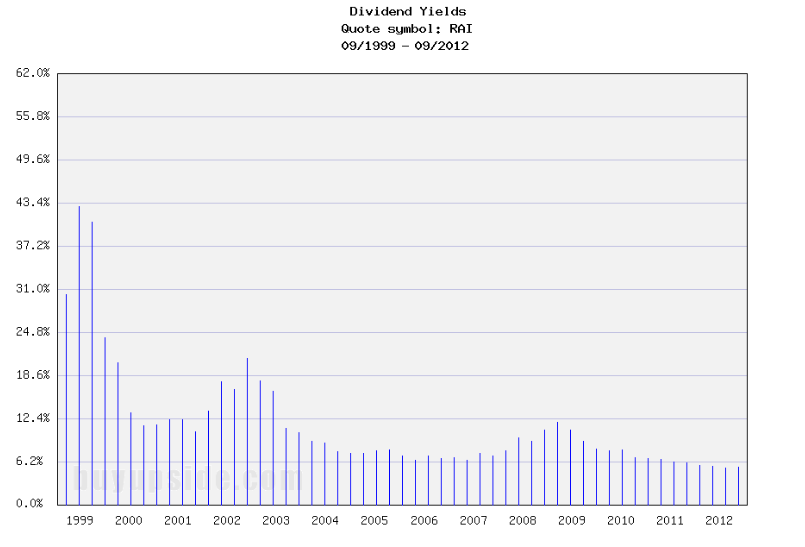

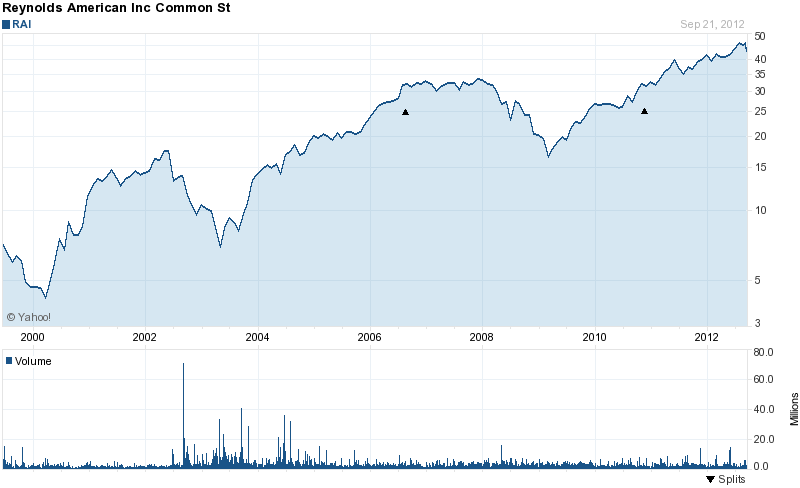

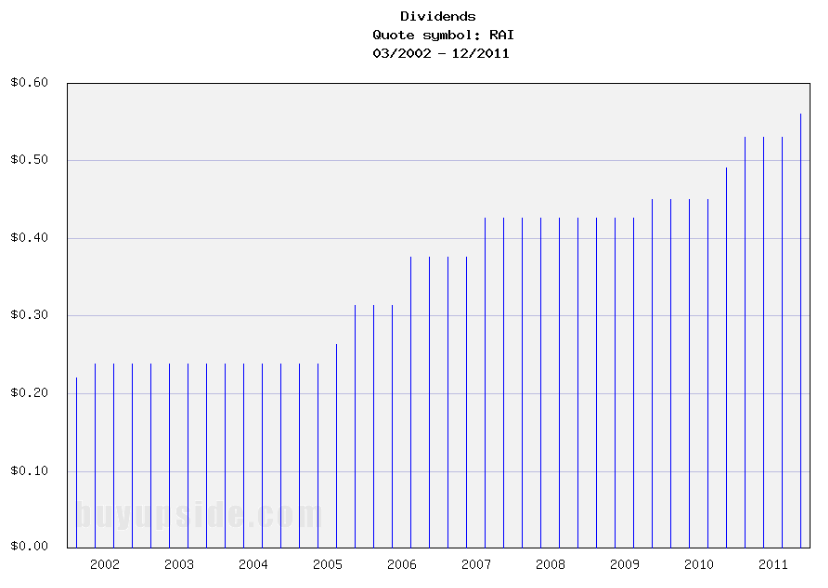

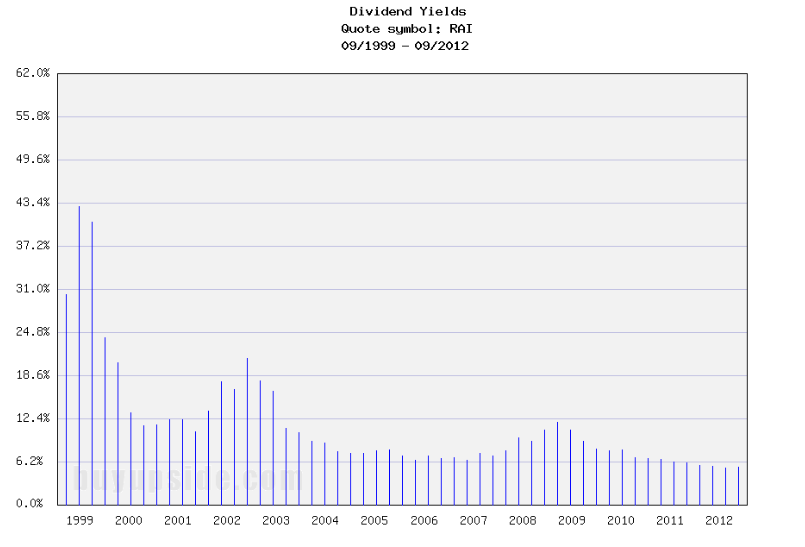

Reynolds American (NYSE:RAI) has a market capitalization of $24.87 billion. The company employs 5,400 people, generates revenue of $8,541.00 million and has a net income of $1,406.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2,537.00 million. The EBITDA margin is 29.70 percent (operating margin 28.09 percent and net profit margin 16.46 percent).

Financial Analysis: The total debt represents 22.54 percent of the company’s assets and the total debt in relation to the equity amounts to 58.60 percent. Due to the financial situation, a return on equity of 22.04 percent was realized. Twelve trailing months earnings per share reached a value of $2.52. Last fiscal year, the company paid $2.15 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.43, P/S ratio 2.91 and P/B ratio 4.05. Dividend Yield: 5.36 percent. The beta ratio is 0.54.

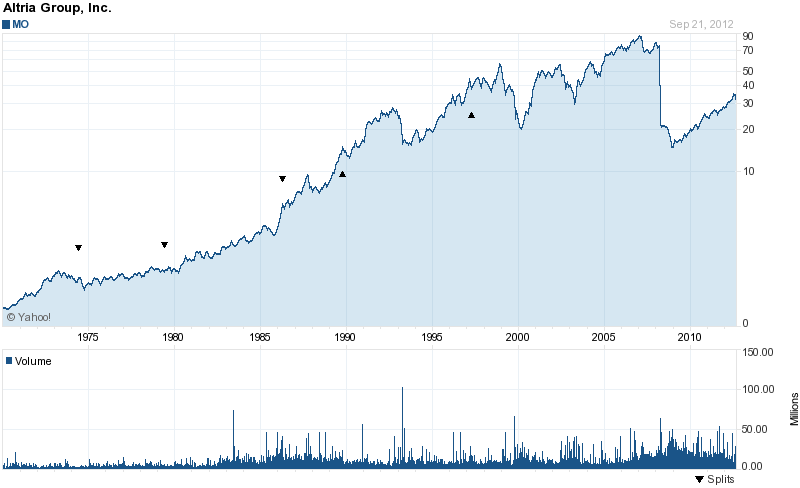

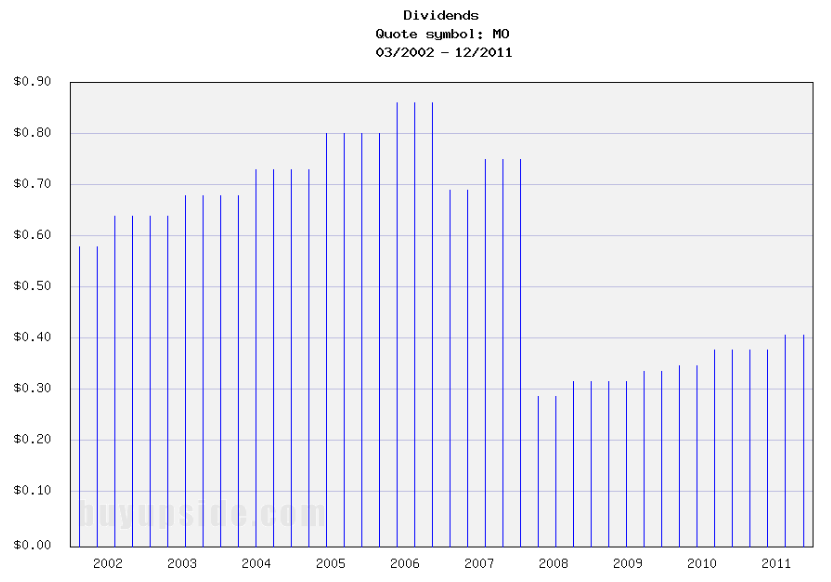

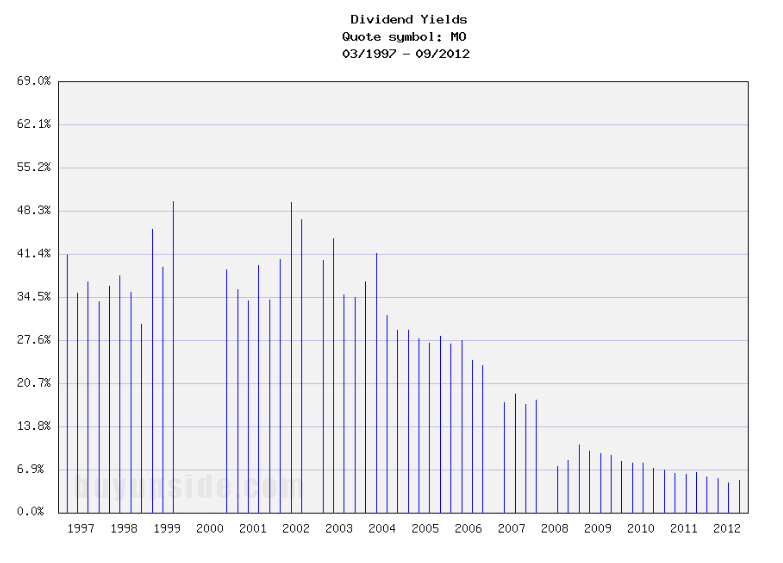

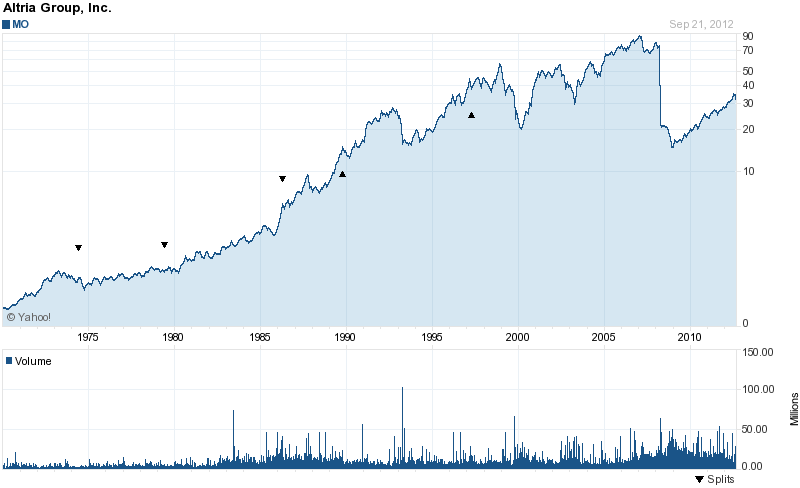

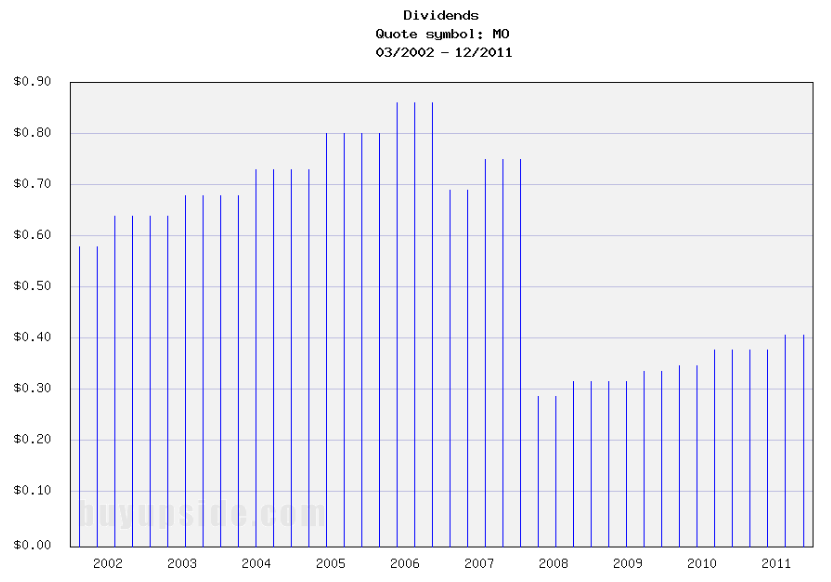

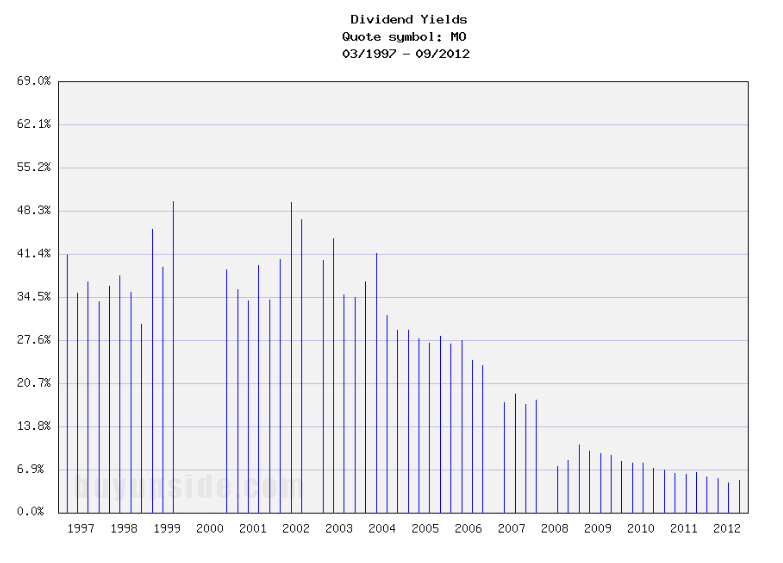

Altria Group (NYSE:MO) has a market capitalization of $69.24 billion. The company employs 9,900 people, generates revenue of $23,800.00 million and has a net income of $3,393.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6,321.00 million. The EBITDA margin is 26.56 percent (operating margin 25.50 percent and net profit margin 14.26 percent).

Financial Analysis: The total debt represents 37.04 percent of the company’s assets and the total debt in relation to the equity amounts to 371.98 percent. Due to the financial situation, a return on equity of 76.13 percent was realized. Twelve trailing months earnings per share reached a value of $2.16. Last fiscal year, the company paid $1.58 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.73, P/S ratio 2.91 and P/B ratio 18.92. Dividend Yield: 5.17 percent. The beta ratio is 0.39.

The average price to earnings ratio (P/E ratio) amounts to 20.10 and forward P/E ratio is 14.81. The dividend yield has a value of 6.31 percent. Price to book ratio is 4.80 and price to sales ratio 1.84. The operating margin amounts to 16.37 percent and the beta ratio is 0.87. The average stock has a debt to equity ratio of 4.30.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

PBI, WIN, RRD, FTR, CTL, CLF, EXC, POM, AVP, RAI, PBCT, TEG, MO,

HCN, LXK, LO, TE, PPL

I screened the index with its 500 companies for the best dividend yields. The index has eighteen high yielders and the highest yield amounts to 10.50 percent, paid by Pitney Bowes (PBI). Six high yields have a P/E ratio below 15 and seven are currently recommended to buy.

Avon Products (NYSE:AVP) has a market capitalization of $6.97 billion. The company employs 40,600 people, generates revenue of $11,291.60 million and has a net income of $526.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1,094.20 million. The EBITDA margin is 9.69 percent (operating margin 7.57 percent and net profit margin 4.66 percent).

Financial Analysis: The total debt represents 42.77 percent of the company’s assets and the total debt in relation to the equity amounts to 210.67 percent. Due to the financial situation, a return on equity of 32.08 percent was realized. Twelve trailing months earnings per share reached a value of $0.57. Last fiscal year, the company paid $0.92 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 28.17, P/S ratio 0.62 and P/B ratio 4.43. Dividend Yield: 5.70 percent. The beta ratio is 1.43.

Reynolds American (NYSE:RAI) has a market capitalization of $24.87 billion. The company employs 5,400 people, generates revenue of $8,541.00 million and has a net income of $1,406.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2,537.00 million. The EBITDA margin is 29.70 percent (operating margin 28.09 percent and net profit margin 16.46 percent).

Financial Analysis: The total debt represents 22.54 percent of the company’s assets and the total debt in relation to the equity amounts to 58.60 percent. Due to the financial situation, a return on equity of 22.04 percent was realized. Twelve trailing months earnings per share reached a value of $2.52. Last fiscal year, the company paid $2.15 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.43, P/S ratio 2.91 and P/B ratio 4.05. Dividend Yield: 5.36 percent. The beta ratio is 0.54.

Altria Group (NYSE:MO) has a market capitalization of $69.24 billion. The company employs 9,900 people, generates revenue of $23,800.00 million and has a net income of $3,393.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $6,321.00 million. The EBITDA margin is 26.56 percent (operating margin 25.50 percent and net profit margin 14.26 percent).

Financial Analysis: The total debt represents 37.04 percent of the company’s assets and the total debt in relation to the equity amounts to 371.98 percent. Due to the financial situation, a return on equity of 76.13 percent was realized. Twelve trailing months earnings per share reached a value of $2.16. Last fiscal year, the company paid $1.58 in form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.73, P/S ratio 2.91 and P/B ratio 18.92. Dividend Yield: 5.17 percent. The beta ratio is 0.39.

The average price to earnings ratio (P/E ratio) amounts to 20.10 and forward P/E ratio is 14.81. The dividend yield has a value of 6.31 percent. Price to book ratio is 4.80 and price to sales ratio 1.84. The operating margin amounts to 16.37 percent and the beta ratio is 0.87. The average stock has a debt to equity ratio of 4.30.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

PBI, WIN, RRD, FTR, CTL, CLF, EXC, POM, AVP, RAI, PBCT, TEG, MO,

HCN, LXK, LO, TE, PPL