- PCE inflation data, Powell speech, recession fears in focus.

- Snowflake is set to shine ahead of "Snowflake Summit 2023" event.

- Micron stock is set to struggle amid shrinking profit and revenue growth.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

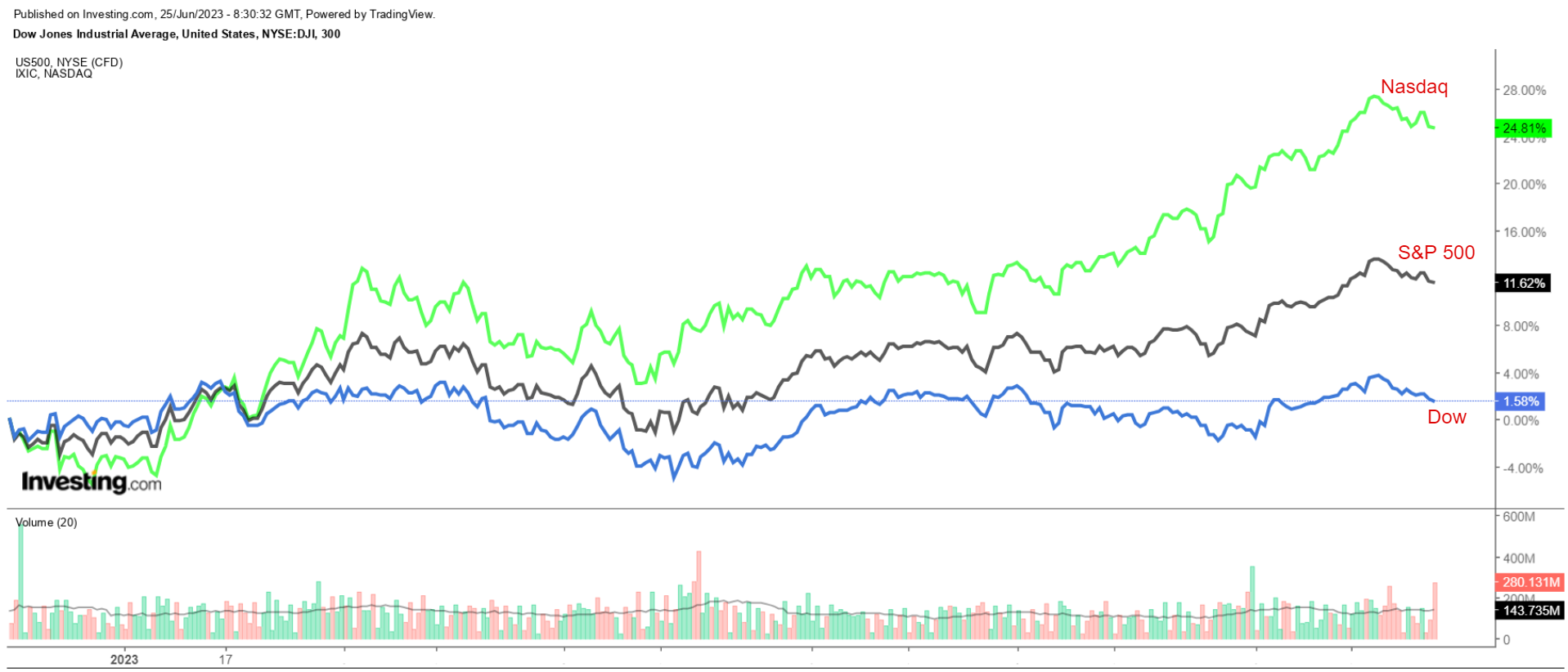

Stocks on Wall Street tumbled on Friday, with all three major indices snapping multi-week win streaks amid renewed fears over higher Federal Reserve interest rates as well as growing concerns about a potential recession.

The blue-chip Dow Jones Industrial Average slumped 1.7% to break a three-week winning streak, while the benchmark S&P 500 shed 1.4% to end a five-week streak of gains, its longest since November 2021.

Meanwhile, the tech-heavy Nasdaq Composite fell 1.4%, bringing an end to a powerful eight-week rally, which was its longest string of weekly gains since March 2019.

Source: Investing.com

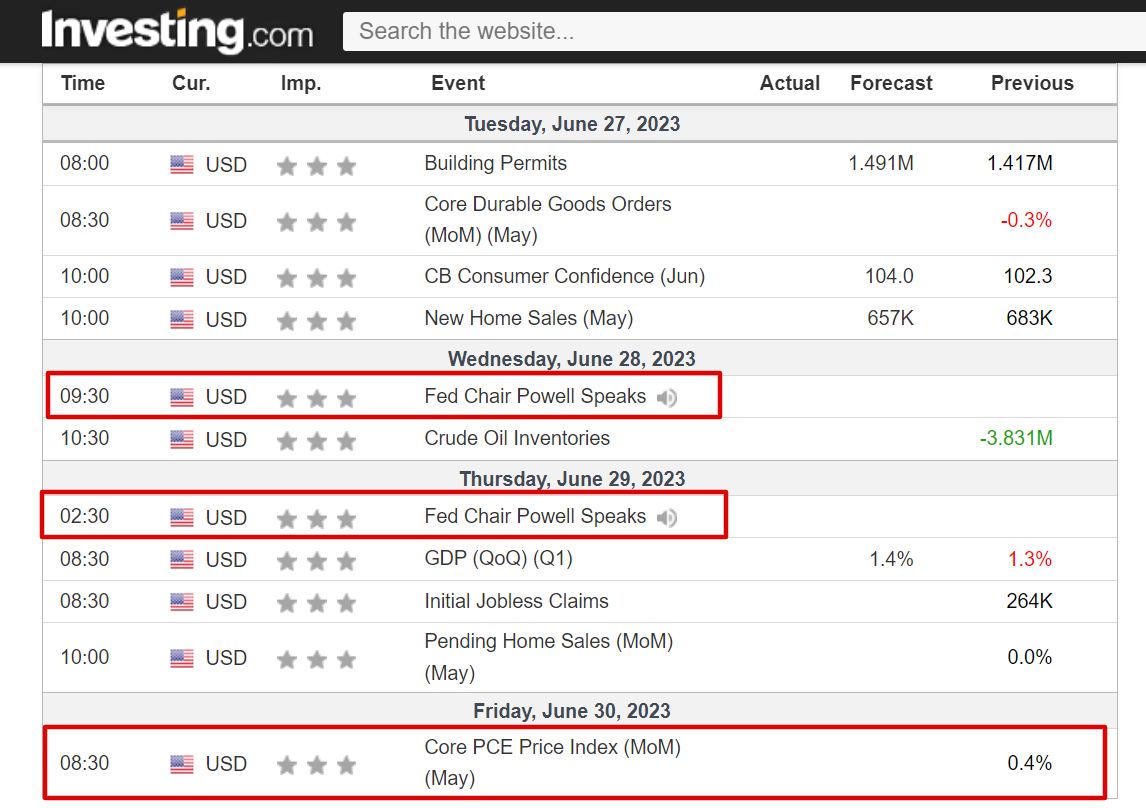

The week ahead is expected to be another busy one as market players continue to assess the outlook for interest rates, the economy, and inflation.

On the economic calendar, most important will be Friday’s core personal consumption expenditures (PCE) price index, which is the Fed’s preferred inflation measure. Per Investing.com, analysts expect both the month-over-month (+0.4%) and year-over-year rates (+4.7%) to remain at elevated levels.

Source: Investing.com

Comments from Federal Reserve Chairman Jerome Powell are also on the agenda as investors look for more clues on the size and pace of future rate hikes.

Markets are currently pricing in a roughly 72% chance of a 25-basis point hike at the Fed’s July policy meeting, according to Investing.com’s Fed Rate Monitor Tool.

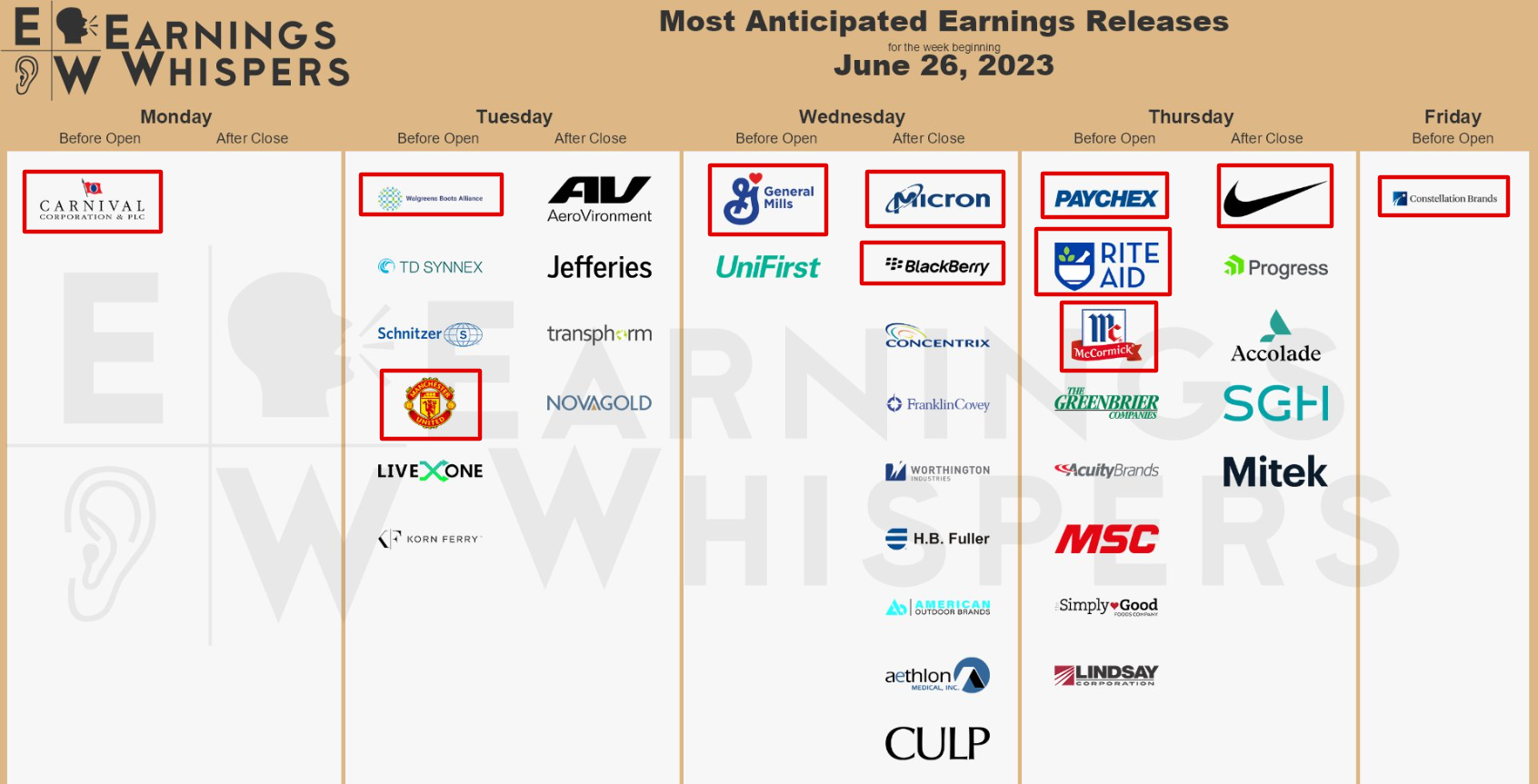

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including updates from Nike (NYSE:NKE), Walgreens, Constellation Brands (NYSE:STZ), General Mills (NYSE:GIS), and Carnival (NYSE:CCL).

Regardless of which direction the market goes in, below I highlight one stock likely to be in demand and another that could see further downside.

Remember though, my time frame is just for the week ahead, June 26-30.

Stock To Buy: Snowflake

I expect Snowflake's (NYSE:SNOW) stock to march higher in the week ahead as the data warehousing specialist hosts its highly anticipated Snowflake Summit 2023 event, at which it is likely to show off its latest innovations in the data cloud, as well as advancements in generative artificial intelligence (AI).

The four-day annual conference kicks off from Las Vegas, Nevada on Monday, June 26, and will end on Thursday, June 29. It will be broadcast live on Snowflake’s website.

The summit is expected to give investors a deeper understanding of Snowflake’s technological breakthroughs, including advancements with generative AI and large language models (LLMs), flexible programmability, application development, and more.

Most of the spotlight will fall on CEO Frank Slootman’s fireside chat with Nvidia (NASDAQ:NVDA) founder and CEO Jensen Huang, scheduled for Monday at 5:00PM PDT/8:00PM EST.

According to the description, Slootman and Huang will discuss how emerging trends and innovations in generative AI and accelerated computing are driving transformation in the tech industry.

Furthermore, other key members of Snowflake’s leadership team are expected to reveal fresh details on the tech company’s new products and features in data collaboration.

Shares of SNOW have rallied after similar events in the past, often resulting in sizable single-day moves. The company has a history of attracting several analyst upgrades in the wake of its summit presentations.

Source: Investing.com

SNOW stock ended at $178.25 on Friday. At current levels, the San Mateo, California-based data-as-a-service company - which counts nearly half of the Fortune 500 companies as clients - has a market cap of $58.1 billion.

Year to date, shares are up 24.2%, however they still stand roughly 60% below their December 2020 record high of $428.68.

Source: Investing.com

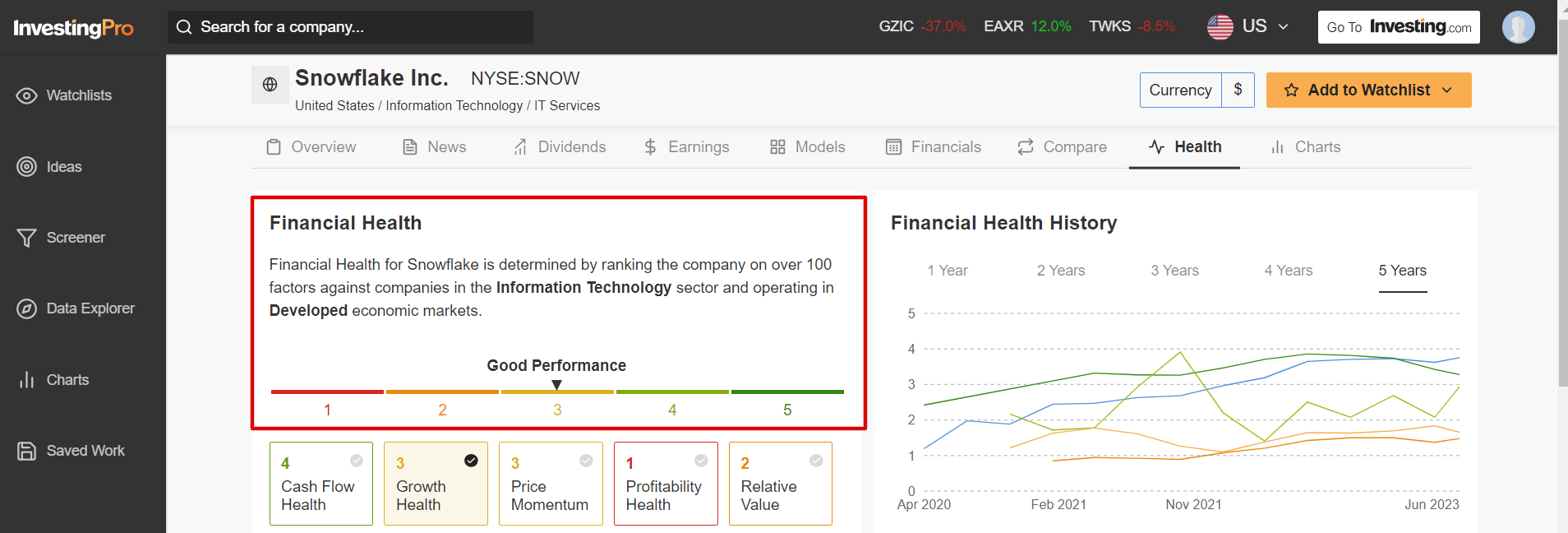

Not surprisingly, Snowflake currently boasts an above-average InvestingPro Financial Health score of 3.0 out of 5.0, a testament to strong execution across the company.

Stock To Sell: Micron Technology

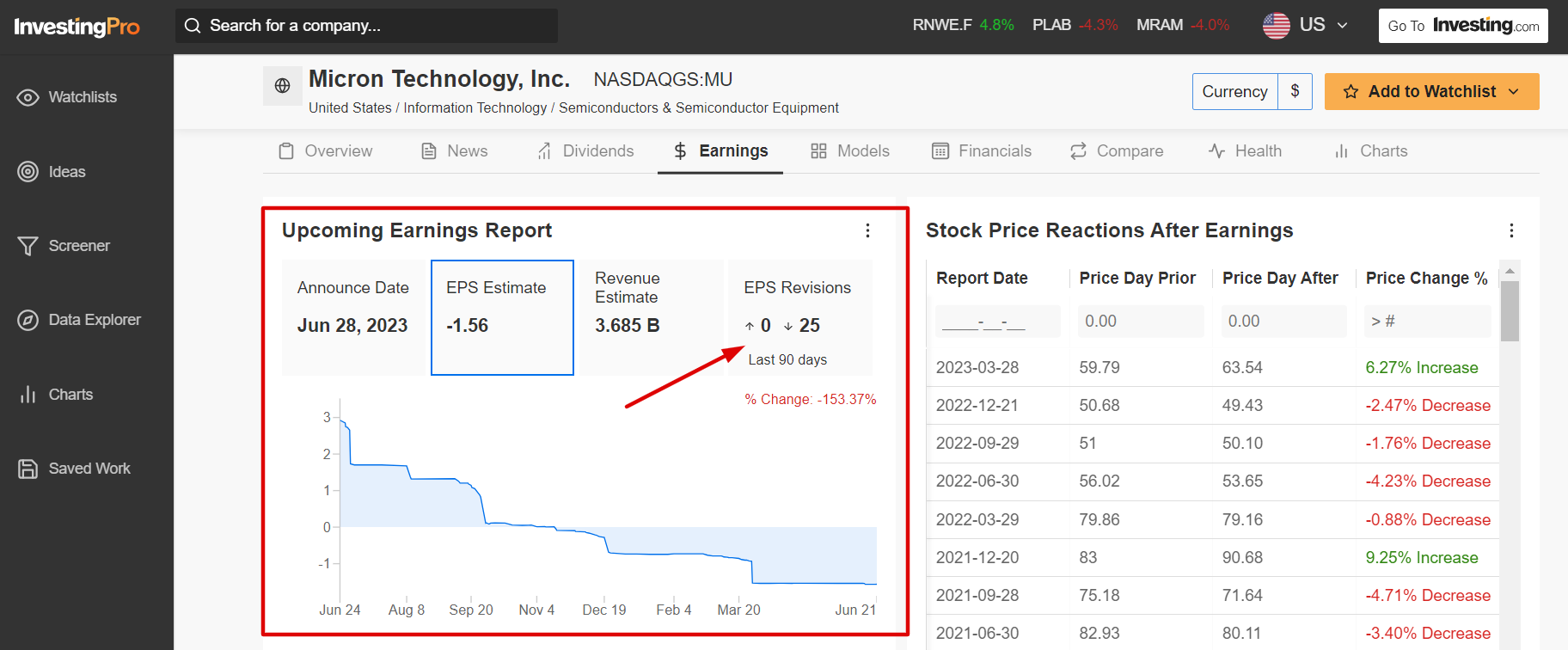

I believe shares of Micron Technology (NASDAQ:MU) will underperform in the coming week, as the struggling memory-and-storage chipmaker will deliver disappointing earnings in my view and provide a weak outlook due to the challenging operating environment.

Micron’s financial results for its fiscal third quarter are due after the closing bell on Wednesday, June 28, and are likely to reveal another quarterly loss as well as slowing sales growth.

Market participants expect a sizable swing in MU stock following the update, with a possible implied move of roughly 7% in either direction, according to the options market.

Ahead of the report, analysts have slashed their EPS estimates a whopping 25 times in the last 90 days, compared to zero upward revisions, as per an InvestingPro survey.

Source: InvestingPro

Wall Street sees the chip manufacturer losing $1.56 per share, worsening significantly from a profit of $2.59/share in the year-ago period.

If that does in fact materialize, it will mark Micron’s third straight quarterly loss due to the negative impact of rising operating expenses and weakening enterprise demand for its DRAM and NAND chips.

Meanwhile, revenue is forecast to shrink 57.3% year over year to $3.68B - which would be the lowest top line since Q4 2015 - amid numerous headwinds, including ongoing inventory and supply-chain issues.

That leads me to believe that there is a growing downside risk that Micron could cut its sales guidance for the rest of the year to reflect reduced spending on memory and storage chips amid a cyclical downturn in demand.

MU stock ended Friday’s session at $65.28, earning the Boise, Idaho-based semiconductor company a valuation of $71.4 billion. Year to date, Micron has seen its stock jump 30.6%.

Source: Investing.com

Micron’s stock appears to be overvalued heading into the earnings print, according to a number of valuation models on InvestingPro: the average fair value for MU stands at $62.19, a potential downside of 4.7% from the current market value.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, the Summer Sale won't last forever!

Disclosure: At the time of writing, I am short on the Dow, S&P 500, and Russell 2000 via the ProShares UltraPro Short Dow 30 ETF (SDOW), ProShares Short S&P 500 ETF (SH) and ProShares Short Russell 2000 ETF (RWM).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.