• Fed rate outlook, more retail earnings, Thanksgiving/Black Friday in focus

• Dick’s Sporting Goods is a buy ahead of upbeat earnings

• Nordstrom shares set to struggle amid shrinking Q3 profit, revenue

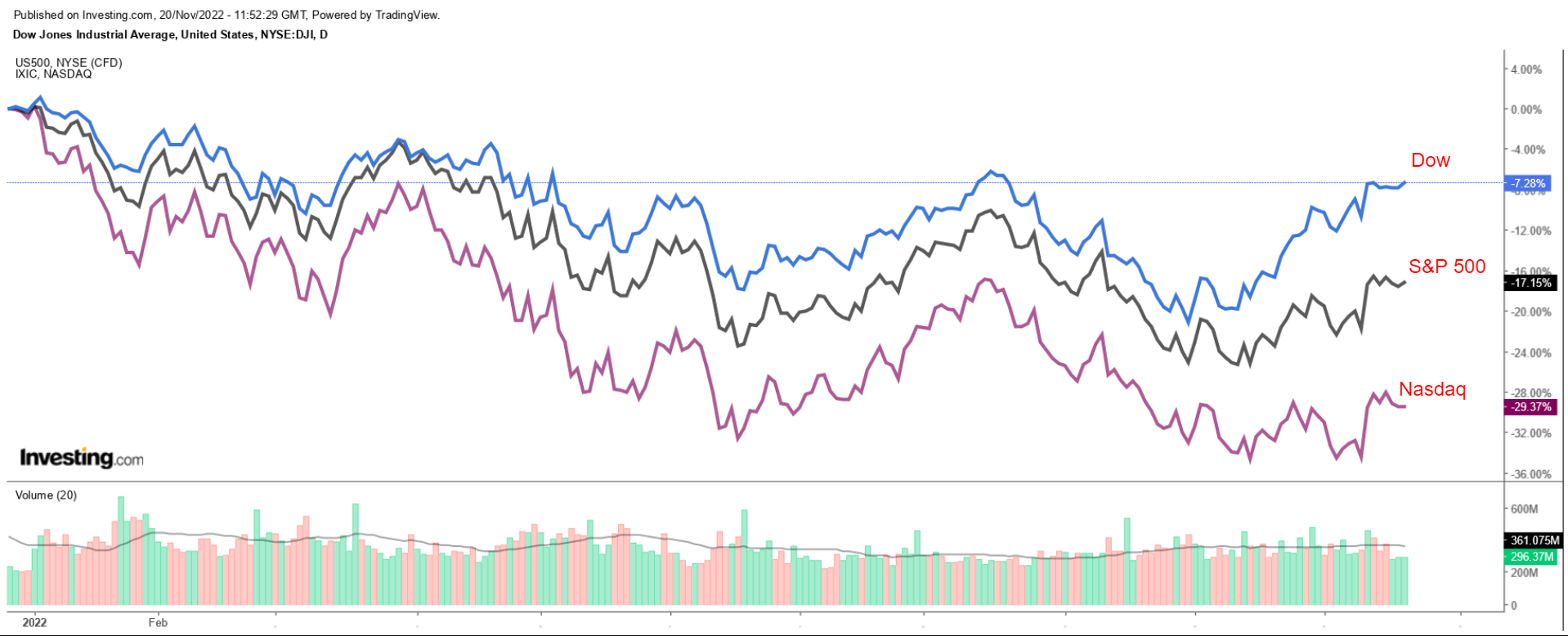

Stocks on Wall Street inched up on Friday, but the major indices still closed the week lower as investors weighed hawkish comments from Federal Reserve officials about interest rate hikes.

For the week, the blue-chip Dow Jones Industrial Average was essentially unchanged, while the benchmark S&P 500 and technology-heavy Nasdaq Composite dipped 0.7% and 1.6% respectively.

Source: Investing.com

With the Thanksgiving holiday just around the corner, Wall Street will have a shortened week of trading ahead. The stock market will remain shut on Thursday, Thanksgiving Day, and will close early at 1:00 PM ET on Friday.

There will, however, be a full slate of earnings reports and data releases coming out in the days prior as investors continue to weigh the Fed’s rate-hike plans for the months ahead.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand in the coming days and another that could see fresh losses.

Remember though, our time frame is just for the week ahead.

Stock To Buy: Dick’s Sporting Goods

I expect shares of Dick’s Sporting Goods Inc (NYSE:DKS) to outperform in the week ahead, with a potential break out to new 2022 highs on the horizon as the athletic-gear retailer is forecast to deliver upbeat financial results ahead of the opening bell on Tuesday, Nov. 22.

As per moves in the options market, traders are pricing in a significant swing of approximately 10% in either direction for DKS stock following the earnings update.

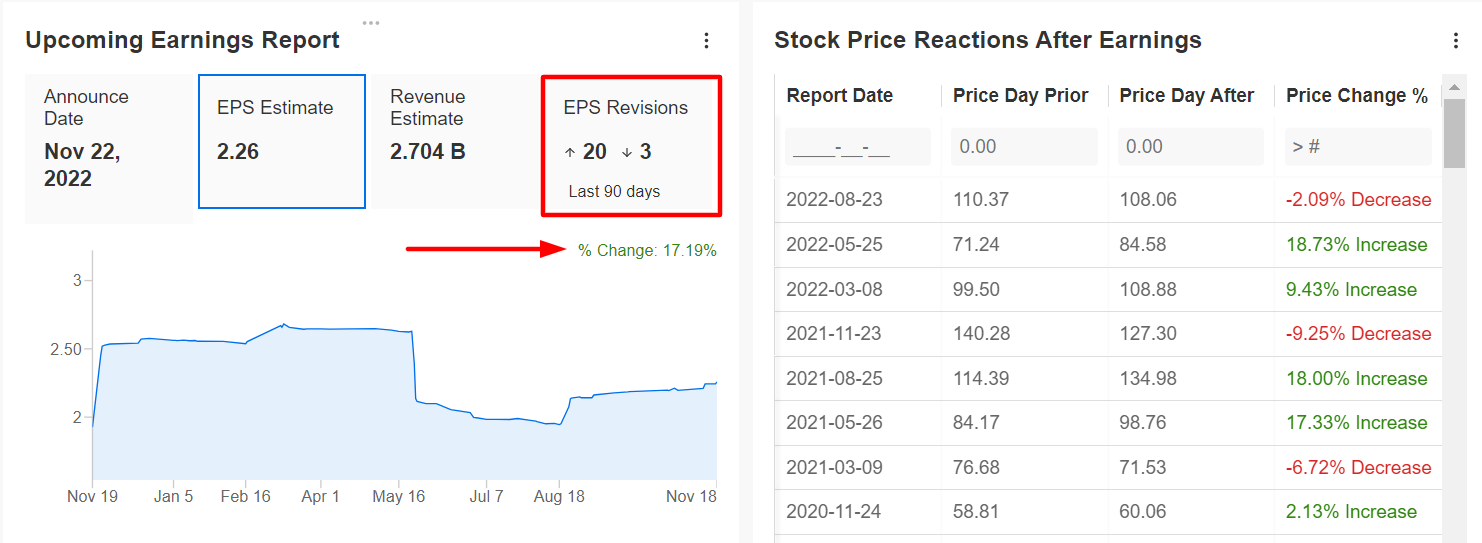

An InvestingPro+ survey of analyst earnings revisions reveals growing optimism ahead of the report, with analysts raising their EPS estimates 20 times in the past 90 days to reflect an increase of over 17% from their initial expectations.

Consensus expectations call for the Coraopolis, Penn.-based sporting goods store chain - which has topped Wall Street estimates for nine consecutive quarters - to post third-quarter earnings per share of $2.26 on revenue of $2.70 billion.

In my opinion, the company’s same-store sales - which track sales at stores open for at least 12 months - could surprise to the upside as it benefits from strong consumer demand across its athletic apparel and footwear product categories amid the current macro backdrop.

As such, Dick’s management will provide an upbeat outlook for the current quarter as it remains well-positioned for the all-important holiday shopping season despite a difficult environment for retailers.

Source: Investing.com

DKS stock closed at $109.09 on Friday, within sight of its 2022 peak of $120.56 touched on Jan. 26. At current levels, the sporting goods retail chain has a market cap of around $8.6 billion.

Dick’s Sporting Goods - which operates over 800 retail locations across the U.S. - has outperformed most of its peers in the retail space this year as it benefits from favorable consumer trends and customer demand for sports and recreation clothing and equipment.

Year to date, DKS stock is off 5.1%, much better than the 28.1% decline suffered by the Retail Select Sector SPDR Fund (NYSE:XRT), which tracks a broad-based, equal-weighted index of U.S. retail companies in the S&P 500.

Stock To Dump: Nordstrom

Sticking with retailers, I anticipate Nordstrom's (NYSE:JWN) stock will suffer a challenging week ahead as the luxury department store chain’s latest financial results are expected to reveal a substantial slowdown in profit and sales growth.

Market players expect a large swing in JWN shares following the results, according to the options market, with a possible implied move of 17.5% in either direction.

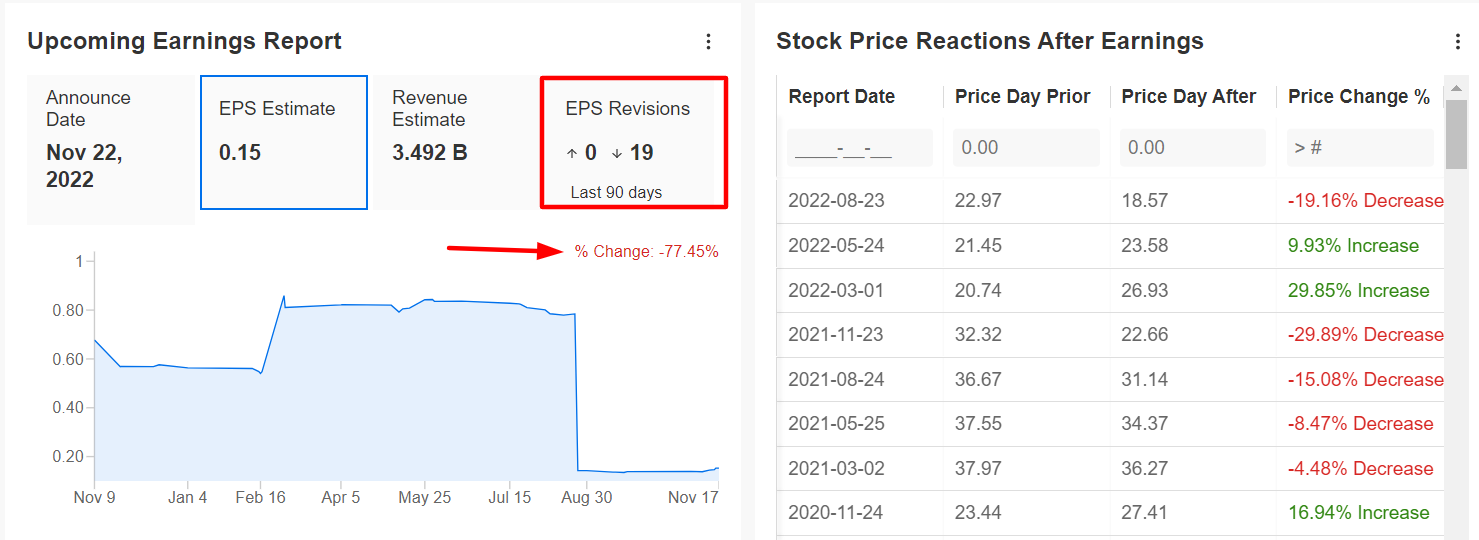

Wall Street consensus estimates have fallen sharply in recent months, according to data from InvestingPro+. Consensus EPS expectations for the upcoming quarterly report have been cut 19 times in the past 90 days, with analysts reducing estimates by a whopping 77.5%.

Nordstrom is forecast to deliver a profit of $0.15 a share when it releases Q3 numbers after the market close on Tuesday, Nov. 22. If confirmed, that would be down 61.5% from earnings per share of $0.39 in the year-ago period, amid the negative impact of rising operating expenses, and higher transportation costs on its business.

Revenue is projected to fall 4.1% year over year to $3.49 billion due to a combination of various macro and fundamental headwinds, such as rising interest rates, mounting inflationary pressures, slowing growth, and lingering inventory and supply chain woes.

The dismal results will likely lead Nordstrom’s management to trim its full-year profit and sales outlook to reflect higher cost pressures and declining operating margins as shoppers cut back spending on luxury fashion items amid the rise in inflation, which is causing disposable income to shrink.

Source: Investing.com

JWN stock ended Friday’s session at $21.45, earning the Seattle, Wash.-based retailer a valuation of $3.4 billion. Shares, which have bounced off their recent 52-week lows along with the major stock indexes, are down 5.1% year to date.

Disclosure: At the time of writing, Jesse is long on the Dow Jones Industrial Average and the S&P 500 via the SPDR Dow ETF (NYSE:DIA) and the SPDR S&P 500 ETF (NYSE:SPY). He is also long on the Energy Select Sector SPDR ETF (NYSE:XLE).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »