The Federal Reserve cut interest rates for the first time in more than a decade last month, lowering its Fed funds target range by 25 basis points, citing worries over “global developments” such as the U.S.-China trade war.

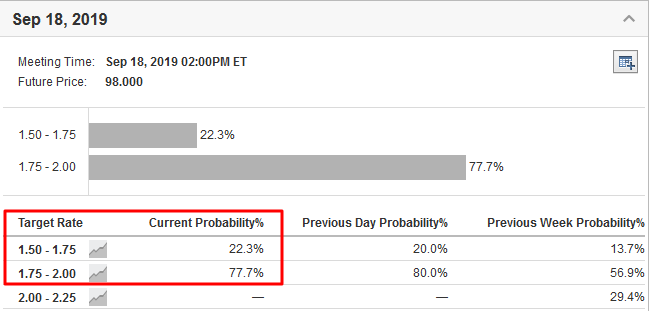

The U.S. central bank may not be done lowering interest rates, either. Futures traders are betting on another quarter-point cut being put in place in September.

As the Fed eases, these three stocks have the potential to provide some of the best returns in the market.

1. AT&T: Rich Dividend Yield

AT&T (NYSE:T) doesn’t need an introduction. Shares of the world's largest telecommunications corporation are up nearly 19% this year. The stock closed at $33.96 on Tuesday, within sight of a 52-week high of $34.64 touched on July 30, giving it a market cap of almost $247 billion.

Good quality blue-chip dividend stocks tend to perform well in an environment of low or falling interest rates. The telecom and media giant announced a quarterly dividend of $0.51 per share, which implies an annualized dividend of $2.04 per share. AT&T stock’s dividend yield is currently 5.97%, almost triple the implied yield for the S&P 500, which is 2.04%.

The Dallas, Texas-based giant posted upbeat second quarter results on July 24. AT&T reported earnings per share (EPS) of $0.89, matching expectations. Sales in the quarter were $44.96 billion, up 15% from the same period a year earlier, and just ahead of expectations for revenue of $44.89 billion.

AT&T now expects to generate $28 billion in free cash flow, $2 billion more than its previous guidance of $26 billion.

The company, which has been focused on reducing its debt load after its $85 million purchase of media and entertainment conglomerate Time Warner in June last year, spent $6.8 billion on paying off debt in the second quarter. It added that it was on track to cut its net debt load to about $150 billion by the end of the year.

“The debt we have will be at a very reasonable place as we exit this year, (and) I fully expect that we’ll be buying some stocks back as we go on this year and (expect) cash flows to continue,” Chief Executive Randall Stephenson said.

2. Duke Energy: Attractive Dividend-Oriented Utility

As interest rates fall, Duke Energy (NYSE:DUK)—one of the largest electric and natural gas utilities in the U.S.—is the second big name to watch. Utility stocks tend to outperform in low interest rate environments due to their attractive dividend yield.

Shares of the Charlotte, North Carolina-based corporation ended at $88.92 last night, not far from their recent 52-week high of $90.27 reached on July 9, giving it a market cap of $64.7 billion.

In July, Duke Energy declared that it was increasing its quarterly cash dividend by almost 2% to $0.945 per share. This represents an annualized dividend of $3.78 and a yield of 4.29%, one of the highest in the utilities sector.

The company beat estimates on both the top and bottom lines when it released second quarter earnings on Tuesday. Earnings per share totaled $1.12, surpassing expectations for EPS of $0.98 and up from $0.93 in the same period a year earlier. Revenue climbed to $5.8 billion, above forecasts of $5.77 billion and compared to sales of $5.61 billion a year earlier.

“So far this year, we’ve grown earnings and increased our dividend. We remain on track to meet our commitments and have reaffirmed our 2019 earnings guidance range and our long-term 4 to 6 percent earnings growth rate,” chairman and CEO Lynn Good said in a statement.

3. Eldorado Gold: Explosive QoQ Growth

The final name to consider buying as the Fed cuts interest rates hails from the gold mining sector. Expectations of monetary stimulus and lower interest rates tend to benefit gold, which is currently trading at its highest level since May 2013.

Eldorado Gold (NYSE:EGO), headquartered in Vancouver, British Columbia, Canada, has seen its shares outperform its peers in recent weeks, with the stock surging 175% since late May. It settled at $8.57 yesterday, after touching a fresh 52-week high of $8.99 earlier in the session.

The gold miner reported second quarter revenue of $173.7 million when it released its latest quarterly results on August 1, which represented explosive quarter-over-quarter (QoQ) revenue growth of 117%.

The company has benefitted from both a sharp increase in gold prices as well as higher sales volumes. Eldorado’s Q2 gold sales increased 21% year-over-year (YoY) to 113,685 ounces, while average realized gold prices rose 2.6% from the year-ago period to $1,321 per ounce.

Looking ahead, Eldorado reiterated its full-year 2019 production target of 390,000-420,000 ounces of gold at all-in sustaining cost (AISC) of $900-1000 per ounce sold.

Eldorado Gold’s robust performance looks set to continue as long as gold prices keep appreciating.