(Bloomberg) -- Anyone who lived through the 2020 bull market knows: investors, especially of the retail ilk, can stomach a lot of pain. However dark is the here and now, light beckons at the end of the tunnel.

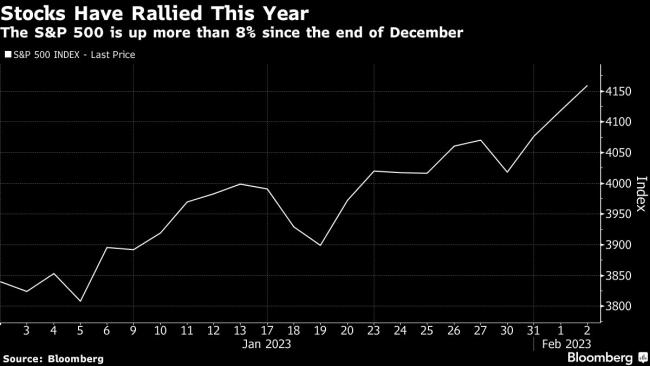

It worked in the pandemic, when equities spiked in the middle of a brutal recession and stay-at-home speculators looked like geniuses when the economy bounced back. Now, with Jerome Powell’s Federal Reserve giving hints of confidence the inflation war is winnable, the same spirit seems to be informing a rally that has pushed up the S&P 500 almost 17% in four months.

Another episode of crowd-sourced prescience? Perhaps. Gains are starting to snowball, with the Nasdaq 100 poised for its fifth straight up week and the S&P 500 breaking though a key chart level. Another possibility is that memories of one lucky episode are informing risky bets in another, despite 2022’s radically different backdrop. Whatever the cause, a rush to the melt-up is on.

“This is a FOMO day,” Kim Forrest, founder and chief investment officer at Bokeh Capital Partners, said in an interview. “People are just piling in going, ‘Crap, I missed it. I thought it was going to go down another 15%.’ We were overly pessimistic.”

It’s a 180-degree shift in sentiment from just five weeks ago, when virtually all of Wall Street anticipated a rough start to the year before a second-half rebound. Retail trades made popular in 2021’s meme frenzy were all but left for dead, while professional speculators had cut equity positioning to the bone. Bonds, sought for their resilience in times of economic duress, were the only thing anyone wanted.

Instead, it’s been speculative stocks that have paced the gains so far. Day traders have come back in droves. By at least one measure, they are trying their hands at the market more than ever before. Retail trading orders in stocks and exchange-traded funds accounted for 23% of the market’s total volume in late January, above the previous high reached during the 2021 meme frenzy, according to JPMorgan (NYSE:JPM) data.

The speed of the rally can’t help but give pause, not least because every attempt at a sustained equity advance in the past year has foundered. The Federal Reserve raised rates Wednesday for an eighth straight meeting and Powell said a “couple more” hikes are in the offing. Inflation remains high, economic growth is slowing and hiring is cooling at some of the country’s biggest companies. A predicted earnings recession is underway. About halfway through the fourth-quarter reporting season, profits at S&P 500 companies have contracted by more than 2%, according to data compiled by Bloomberg.

And for all the damage done to stock portfolios last year, valuations still looked elevated relative to history when 2023 started. They’ve only gotten more bloated, with the Nasdaq 100 now trading at 27 times profit.

The near-term doesn’t look that promising, either. Growth in gross domestic product is forecast to be sub-1% in 2023 before rebounding to 1.2% next year. Current estimates by equity analysts put profit growth in the S&P 500 this year also below 1% — and many think that’s still too high. Sell-side expectations for where the S&P 500 will end 2023 are the most pessimistic in over two decades.

“The danger here is that equities get too far out in front of earnings multiples and aren’t supportive of levels higher than here,” said George Catrambone, head of Americas Trading at DWS. “Investors should remember the Fed is still hiking rates.”

And yet, investors who premised decisions on that gloomy outlook have had to watch as the market shot higher. A Goldman Sachs (NYSE:GS) basket of the most shorted stocks has risen over 32% in 2023, handily beating the S&P 500’s nearly 9% rise.

There is also some evidence that bullish options are also supercharging the rally, according to George Pearkes, global macro strategist at Bespoke Investment Group. He noted an increase in call volume is reminiscent of the meme-stock heyday when retail investors used derivatives to amplify returns.

“In any given move, you’re going to see options use higher than pre-pandemic because there’s a bit of muscle memory in place,” he said. “Over the past six months, we’ve seen a general increase in risk appetite. The sort of move you’re seeing in a name like COIN or WE or OPEN today is just the risk appetite building up.”

Read more: Wall Street Is Making Same Fed Bet That’s Burned It Repeatedly

That’s not to say there’s no fundamental explanation for the equity rebound. As is often the case, analysts get more optimistic the further out you go in time. For 2024, income is expected to rebound by 11%. That’s the view equity bulls are presumably putting their faith in.

At the top of bulls’ minds is also the fact that the Fed did acknowledge on Wednesday progress in its fight against inflation, notably omitting prior references to higher food and energy prices in its latest statement. Additionally, the swaps market is now pricing a half-percentage point cut to interest rates later in the year, the dollar is weakening, and two-year Treasury yields hit their lowest level since October. pricing in

In just a few weeks, the idea of a soft landing has moved from an impossibility to a potential outcome for some on Wall Street. Big Tech firms that grew bloated during the pandemic rally have been cutting positions and promising to improve profit margins. At the same time, the latest labor-market data show continued resiliency, particularly in the services sector.

Meta Platforms Inc (NASDAQ:META). bolstered optimism that the biggest companies can avoid getting crushed by the Fed’s throttling of the economy. Shares in the Facebook parent soared roughly 25% after the company said it will become leaner even after it delivered sales growth that topped estimates. Apple Inc (NASDAQ:AAPL)., Alphabet (NASDAQ:GOOGL) Inc. and Amazon.com Inc (NASDAQ:AMZN). report after the close Thursday.

The recent rally can be attributed to “better-than-feared earnings, inflation inputs coming down faster than anticipated and the potential for the Fed to feel they’ve been restrictive long enough by the time the fourth quarter rolls around — if the path of inflation continues apace,” Art Hogan, chief market strategist at B. Riley, said by phone.