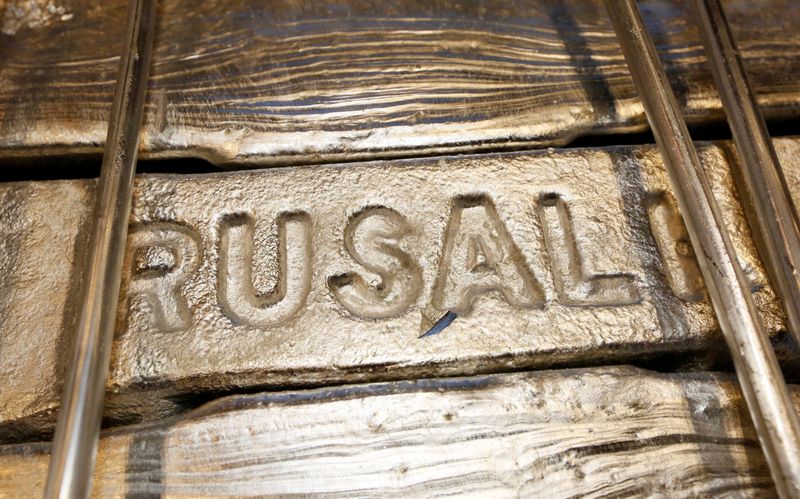

MOSCOW (Reuters) -Rusal said on Monday it had filed a lawsuit in London alleging that Vladimir Potanin, CEO of Nornickel, is in breach of a decade-old deal, renewing a row between two of Russia's largest metals companies.

Rusal said that the lawsuit filed in London's High Court of Justice on Oct. 21 against Potanin and his affiliate Whiteleave Holdings Ltd is aimed at protecting the interests of Nornickel's shareholders, adding that no hearing date had been set.

A spokesman for Potanin's holding company Interros, which owns 36% of Nornickel, said his team was reviewing the information in the lawsuit and declined further comment.

Nornickel declined to comment.

The dispute centres on an agreement brokered by Moscow in 2012 between Nornickel's two largest shareholders, Potanin and Rusal, which protected its dividend payouts. Rusal was at the time controlled by Oleg Deripaska.

The feud between two of Russia's most powerful businessmen over the country's prized metal assets dates back to 2008 when Rusal bought its stake in Nornickel and Potanin opposed attempts by Deripaska to merge the two companies.

Disputes over dividends have been the main reason for on-and-off rows between shareholders at Nornickel and Rusal over the past 14 years. One of the parties to the deal is billionaire Roman Abramovich, who helped cool the dispute a decade ago.

The 2012 deal, which is due to expire at the end of this year, resolved a disagreement over how much profit should be returned to investors and how much should be invested in Nornickel. Interros owns 36% of Nornickel and Rusal holds 26.2%.

"This is a new page in the multivolume Rusal-Potanin relationship, a move in the battle for future dividends, for a new dividend policy, and possibly, for a new shareholder agreement," BCS analyst Kirill Chuiko told Reuters.

SEEKING COMPENSATION

The London lawsuit comes as Moscow faces Western sanctions over what it calls a "special military operation" in Ukraine. While Nornickel has not been directly targeted by Western sanctions, Potanin was sanctioned by Britain in June.

Rusal said it had filed the suit after efforts to enter into "constructive dialogue" on an out-of-court settlement failed.

"Under the management of Mr Potanin, Norilsk Nickel lost a number of assets that played a key role in (the) group's activities. This resulted in Norilsk Nickel and its shareholders suffering significant losses," Rusal said.

Rusal said it was seeking compensation and other remedies but did not give details on the value and said this should be determined in court.

Potanin has been chief executive of Nornickel for the duration of the agreement and Rusal said in its statement that it now required a "professional independent executive" as CEO.

Rusal is using law firm PCB Byrne LLP to represent it, the court filing shows.

In July, Potanin in July floated the idea of a $60 billion merger of Nornickel with Rusal as a means of mitigating possible sanctions risks, but last month said this had been postponed.

He also said the deal now at the centre of the lawsuit was on track to expire at the end of 2022. Sources had told Reuters there were no talks to renew the deal.