(Bloomberg) -- Some European Central Bank officials preferred lifting borrowing costs by 50 basis points in September, according to an account of their most-recent policy meeting in September.

The summary, released Thursday -- three weeks before the ECB next sets interest rates -- showed that decision makers ultimately joined a consensus on the three-quarter-point hike they announced amid “broad” agreement that rates were still accommodative.

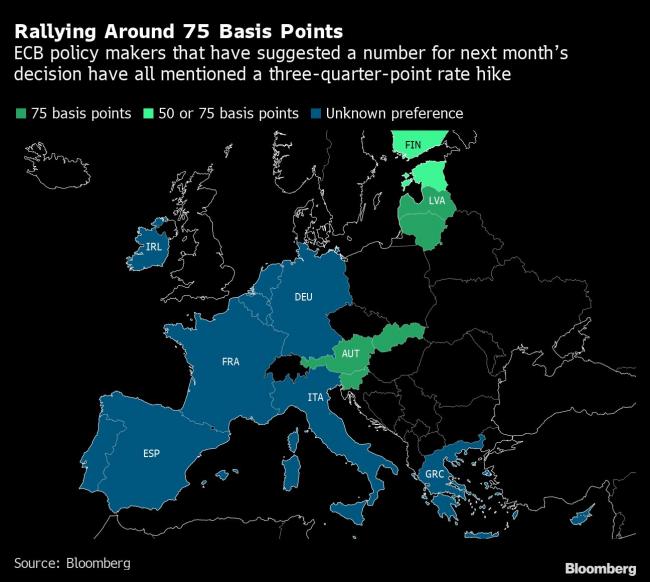

Momentum is building for a repeat of the three-quarter-point rate hike officials delivered last month, with hawks publicly advocating such a step and money markets betting on it. But while that would go some way to tackling record inflation, which is nearing 10% in the 19-member euro zone, it risks worsening a looming downturn in the currency bloc’s economy.

The ECB’s full account can be found here. Below are extracts on some of the key policy areas.

- On monetary policy

- “Some members expressed a preference for increasing the key ECB interest rates by 50 basis points” and it was argued that “would be large enough to signal determination in proceeding with the interest rate normalization”

- “At the end of the discussion, all members joined a consensus to raise the three key ECB interest rates by 75 basis points”

- They affirmed the step “should not signal that the Governing Council intended to agree on interest rate increases of a similar magnitude at its future meetings”

- “There was broad consensus that, even after the current decision, the key policy rates would remain significantly below the neutral rate”

- “It was also argued that growth concerns should, in any case, not prevent a needed forceful increase in interest rates”

- “It was seen as essential to communicate prudently on the way forward and to counter the risk of increased volatility in the bond market by referring to a frontloading of interest rate normalization”

- On the euro

- “The recent depreciation of the euro had added to the build-up of inflationary pressures”

- On inflation

- “Lane stressed that price pressures were extraordinarily high and likely to persist for an extended period”

- “In the context of a global monetary policy tightening cycle, members saw differences between the economic situation in the US and in the euro area”

- “Demand-side factors had become an important driver of underlying inflation” in the euro area, however “it was also argued that inflation was still largely driven by the pass-through of supply shocks”

- “Inflation had started to become self-reinforcing, to the point that even a projected marked weakening in growth was not sufficient to bring inflation back to target” yet it was also argued that “a recession was becoming increasingly likely and would mitigate inflationary pressures”

©2022 Bloomberg L.P.