By Daniel Leussink and Leika Kihara

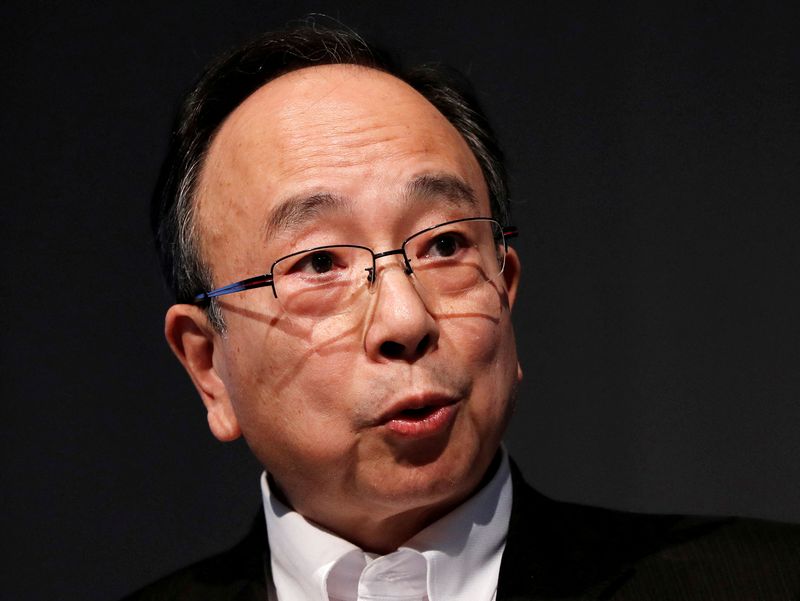

TOKYO (Reuters) -Japan's government has sounded out Bank of Japan (BOJ) Deputy Governor Masayoshi Amamiya to succeed incumbent Haruhiko Kuroda as central bank governor, the Nikkei newspaper reported on Monday, citing anonymous government and ruling party sources.

Prime Minister Fumio Kishida told reporters later on Monday he would continue to consider the best candidate for the job, suggesting that no final decision had been made.

The next governor will face the delicate task of normalising the BOJ's ultra-loose monetary policy, which is drawing increasing public criticism for distorting market function.

A career central banker who has drafted many of the BOJ's monetary easing tools, Amamiya has been seen by markets as a top contender to take over as next governor.

Many analysts see him as a pragmatic policymaker who will prefer tip-toeing toward any exit, rather than make sudden changes to a stimulus programme he helped create.

Stefan Angrick, senior economist at Moody's (NYSE:MCO) Analytics, said that if Amamiya were appointed governor it would signal policy continuity.

"A BOJ under his leadership would not rush towards tightening," Angrick said. "Yield-curve control would be dialed back, but a true liftoff in rates would remain contingent on stronger wage growth and demand."

The government's nomination will likely be presented to parliament next week and take effect upon both houses granting approval, which is effectively a done deal since the ruling coalition has a solid majority.

The Nikkei report did not say whether Amamiya had accepted the offer. Amamiya declined to comment, when asked by reporters whether he had been sounded out, according to Jiji news agency.

Deputy Chief Cabinet Secretary Yoshihiko Isozaki told a news conference there was no truth to the report that the government had sounded out Amamiya for the top BOJ job.

Kishida's choice of a successor to Kuroda, whose five-year term will end on April 8, will likely affect how soon the central bank could phase out its massive stimulus.

Deputy governors Amamiya and Masazumi Wakatabe will also see their five-year terms end on March 19.

The dollar rose as high as 132.60 yen after the Nikkei report, topping the 132-level for the first time since Jan. 12. It gave up some gains after the remarks by Kishida and Isozaki and was last up 0.5% at 131.84 yen.

FLEXIBLE ON POLICY

The BOJ's leadership transition comes at a time Kuroda's radical stimulus programme is being put to test by creeping inflation and rising global interest rates.

Inflation hit 4% in December, double the BOJ's 2% target, pushing up bond yields and challenging its resolve to defend a policy that sets a 0.5% cap on the 10-year bond yield.

With markets creeking under the BOJ's heavy-handed intervention, many investors are betting the bank will start hiking interest rates under the successor of dovish Kuroda.

Amamiya is considered by markets as more dovish than other contenders like former deputy governors Hiroshi Nakaso and Hirohide Yamaguchi.

Dubbed "Mr. BOJ" for masterminding many of the bank's unconventional monetary tools, he played a key role in drafting Kuroda's asset-buying programme in 2013.

But people who know him well describe Amamiya as someone who can adapt policy flexibly, including by reading which way the political wind is blowing.

While consistently calling for keeping ultra-low rates, Amamiya said in July the BOJ must "always" think about the means of exiting ultra-loose monetary policy.

"I think Mr. Amamiya knows well the need to phase out stimulus at some point, albeit very carefully," one of the people told Reuters.