By Padraic Halpin

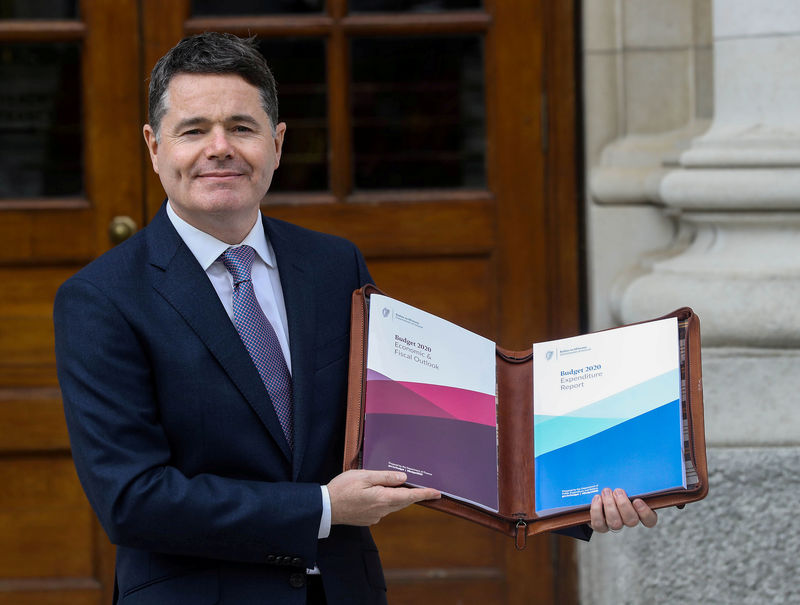

DUBLIN (Reuters) - Ireland expects to run a better-than-expected budget surplus of 0.4% of gross domestic product this year following another surge in corporate tax receipts, Finance Minister Paschal Donohoe said on Tuesday.

Corporate tax receipts have more than doubled since 2012, mainly boosted by Ireland's large cluster of multinational firms, and last year hit a record high of 10.4 billion euros ($11.5 billion).

Until recently, Donohoe's department expected them to decline in 2019. Instead, they have almost hit a fresh annual high with a month to spare - receipts were 10 billion euros at the end of November, 16% or 1.4 billion euros ahead of the full-target.

November is the largest collection month when around a quarter of all corporate tax returns are made.

Donohoe expects corporate tax receipts to top 11 billion euros this year and rise again in 2020 before plateauing and at some point falling as new global rules under consideration are introduced on how and where big internet companies pay tax.

The minister also set a number of medium-term targets to build up Ireland's fiscal buffers, seeking to achieve surpluses of at least 1% of GDP by 2022 and to reduce the state's debt as a percentage of national income to 85% by 2025, assuming a disorderly Brexit does not derail Ireland's booming economy.

If Britain does not leave the European Union with a deal to smooth its exit, Donohoe said the debt reduction target would be increased to 90-95% of national income or debt-to-GNI*, a measure unique to Ireland to gauge its economy.

He warned that a disorderly Brexit remained a distinct possibility even if British leader Boris Johnson ratifies his divorce deal after next week's UK election, given the risk of Britain not having a new trade deal in place or seeking an extension when the transition period ends in late 2020.

Ireland's debt pile will not immediately be cut by this year's projected 1.4 billion euro surplus - only the country's second budget surplus in a decade - as the cash will likely be used to help refinance existing debt, Donohoe said.

The debt pile will only begin to fall after a number of years if the government runs surpluses over a sustained period, he added. He challenged other political parties to either match his debt and surplus commitments or outline their own approach ahead of a general election due next year.

The debt-to-GNI* ratio, which strips out some globalized activities that skew more traditional measures of economic activity, currently stands at around 100% and has been falling, mainly due to Ireland's economy outperforming every other EU member state for the last six years.