By Jonathan Spicer

The Federal Reserve will likely meet its U.S. inflation and employment goals soon and should consider that quicker interest rate rises over time could stave off risks to the economy such as rising commercial real estate prices, a top Fed policymaker said on Wednesday in China.

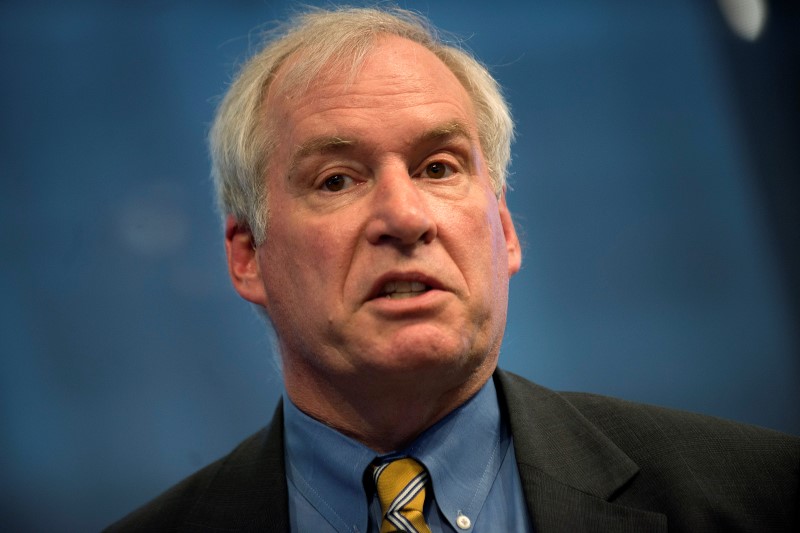

In another hint from the U.S. central bank that a policy tightening is on the horizon, Boston Fed President Eric Rosengren said rate hikes should depend in part on risks to financial stability. He noted that as unemployment has fallen amid record low interest rates, asset prices like commercial real estate "have risen quite dramatically."

With the economy at or near full employment and inflation "edging closer" to a 2 percent target, he said, the Fed's so-called dual mandate "is likely to be achieved relatively soon."

"A somewhat faster move to rate normalization may defer somewhat how quickly we achieve the dual mandate goals of full employment and price stability, but could reduce the risk of a larger divergence from the dual mandate in the next downturn," Rosengren, a voter on policy this year, said in prepared remarks to be delivered in Beijing.

Addressing a closed-to-the-press conference hosted by the Shanghai Advanced Institute of Finance alongside Chicago Fed President Charles Evans, Rosengren, who is considered a relatively dovish policymaker, said there are risks to low rates for extended periods.

He did not mention whether he expects a rate hike before year end, and he reiterated that the Fed aims for a slow and gradual monetary tightening that supports U.S. economic growth.

Yet the message appeared to fall in line with that of Fed Chair Janet Yellen who said on Friday that the case was "strengthening" to raise rates.

The Fed lifted rates from near zero last December - the first rate hike in nearly a decade - but has since stood pat given an economic slump at home and volatile markets overseas.

While the Fed focuses on inflation and employment, Rosengren warned that rising commercial real estate prices - a risk he has cited in the past - suggest banks, investors and households may be taking "excessive" risk.

While occupancy rates are rising alongside foreign investment from China and elsewhere, net income on properties relative to prices paid have fallen to record lows across the United States, especially on the East and West coasts.

"Should the U.S. economy experience a large negative shock, this could pose a problem for the stability of the U.S. economy," Rosengren said in the prepared remarks.