By Bharat Gautam

(Reuters) - Gold and palladium on Wednesday hit the brakes on a blistering rally as riskier assets attempted a comeback, with analysts predicting another run higher for precious metals in case of a further escalation in the Ukraine crisis.

Spot gold fell 1.9% to $2,013.79 per ounce, as of 1047 GMT, snapping a four-session rally that took it to within reach of the August 2020 all-time high. U.S. gold futures fell 1.1% to $2,021.20.

"What we may be seeing now is just a small correction after such a large move over a prolonged period of time (in gold and palladium)," said Craig Erlam, senior market analyst at OANDA.

Key equity indices rebounded as investors picked up beaten-down stocks following a recent rout sparked by fears about growing Western sanctions on Russia for its invasion of Ukraine. (EU)

Crude oil prices, strength in which has driven fears of inflation and burnished gold's appeal as a hedge against rising costs, also retreated. [O/R]

Strong resistance in gold prices can be expected at near these high levels and a pullback to near $1,930 is likely, with some consolidation between $1,930 and $2,075, said Michael McCarthy, chief strategy officer at Tiger Brokers, Australia.

"But if the current instability in geopolitical terms continues, it's very likely we will seek fresh all time highs for precious metals," McCarthy added.

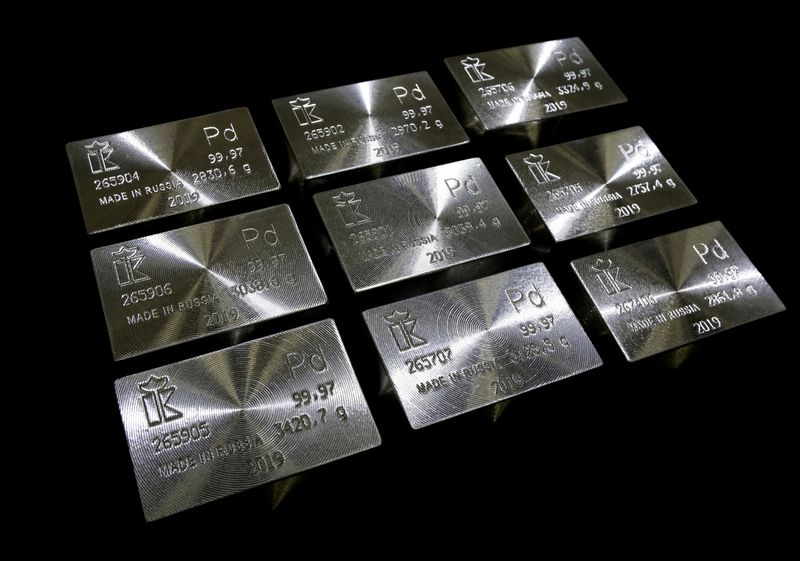

Palladium, used by automakers in catalytic converters to curb emissions, fell 3.7% to $3,063.19 per ounce after hitting a record high of $3,440.76 on Monday, driven by fears of disruptions to supply of the metal from top producer Russia.

Recent volatility in precious metals can be seen as normal as commodities aren't following fundamentals or industrial demand anymore, said Natixis analyst Bernard Dahdah.

Spot silver dropped 1% to $26.13 per ounce, after touching a near nine-month high on Tuesday. Platinum dipped 3.5% to $1,113.43.